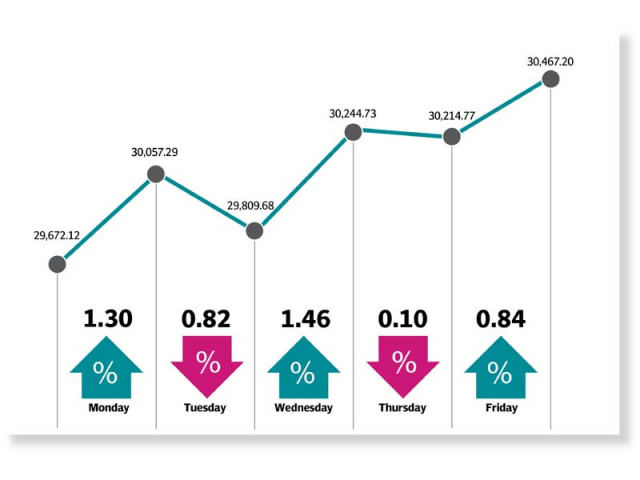

KSE-100 endures mixed week

Benchmark index jumps 795 points or 2.7% to settle at 30,467.2

Trading kicked off on a positive note as investors reacted with euphoria to the host of measures approved by the Securities and Exchange Commission of Pakistan over the weekend. The SECP announced major reforms to rejuvenate the capital market and promote ease of doing business. Moreover, expectations of a lower inflation reading and issuance of the presidential ordinance to waive over Rs300 billion GIDC dues also kept the mood upbeat on the first trading day of the week.

However, the trend could not be sustained and the index tumbled into the red zone as participants succumbed to profit-taking. The persistent selling pressure dragged the index to fall below the 30,000 barriers. The tables turned on Wednesday as the market reversed gears on the back of lower-than-expected inflation reading, which provided a boost to sentiments.

The following two sessions witnessed mixed trend as the KSE-100 retreated on Thursday and recovered on the last trading day of the week. Overall, activity was marred by a lack of positive triggers and the prevailing uncertainty, particularly due to issues on the eastern border. Among some positive developments, news of the PM’s meeting with businessmen to facilitate economic activity also emboldened investors, whereas ECC’s decision to offer a simplified tax regime to non-resident companies to attract foreign exchange flows also enticed market players.

Market activity slowed, as average daily volumes for the outgoing week were down by 25% to 93 million shares, likewise, value traded decreased by 23% to $22.3 million.

Contribution to the upside was led by oil and gas exploration companies (up 299 points) amid rising international oil prices, commercial banks (152 points), power generation and distribution (103 points), oil and gas marketing companies (75 points), and fertiliser (49 points).

Scrip-wise, major gainers were HBL (up 127 points), OGDC (126 points), PPL (118 points), HUBC (87 points), and POL (41 points). On the other hand, MEBL (down 32 points), THALL (19 points), and HASCOL (12 points) dragged the index lower.

Foreigner’s offloaded stocks worth $5.32 million compared to a net buy of $0.97 million last week. Major selling was witnessed in commercial banks ($3.05 million) and cement ($2.44 million). On the local front, buying was reported by individuals ($6.15 million) followed by other organisations ($4.10 million).

Other major news of the week included; ADB expected to lend $10 billion in next five years, economy now capable of absorbing shocks: SBP chief, consumer inflation marginally increase to 10.5% in August, controversial GIDC ordinance withdrawn, and SBP’s foreign exchange reserves inch up $9 million to $8.28 billion.

Published in The Express Tribune, September 8th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ