Pakistan's current account deficit shrinks massive 73% in July

Contraction comes on back of drop in imports, increase in exports

Pakistan's current account deficit shrinks massive 73% in July

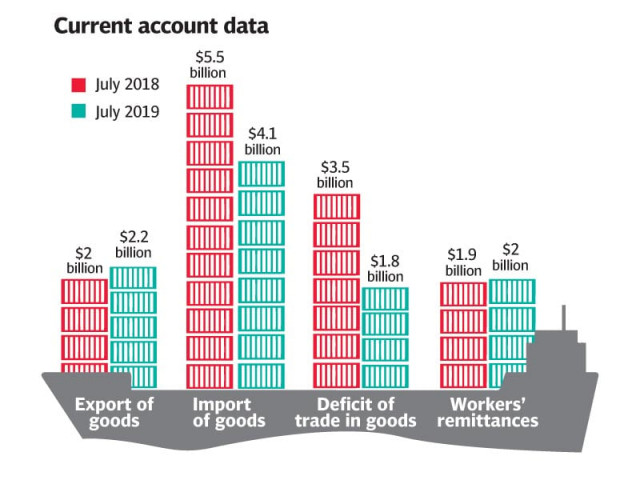

The current account deficit stood at $2.13 billion in the same month of last year, the State Bank of Pakistan (SBP) reported on Tuesday.

“The colossal contraction in the deficit came on the back of…26% drop in imports and 11% improvement in exports,” Arif Habib Limited Head of Research Samiullah Tariq told The Express Tribune.

The desired improvement in the two major heads - imports and exports - was partly achieved after the government implemented reforms under the 39-month IMF loan programme, which started in July. The loan programme binds the government to undertake structural reforms. These included increase in the key interest rate which stood at an eight-year high of 13.25% in July, depreciation of the rupee, which fell 32% to Rs160 to the US dollar in FY19, upward revision in power and gas tariffs and an ambitious tax-collection target of Rs5.55 trillion for the current fiscal year among other tough conditions for steering the economy out of the crisis.

Imports fell significantly in July 2019 after the government made it mandatory to collect the copy of Computerised National Identity Cards (CNICs) at wholesale and retail levels with the objective of increasing the number of tax return filers.

“Implementation of the (tax) policy has significantly impacted imports,” Tariq remarked. “Hike in key interest rate also helped slash imports,” he said.

“Government crackdown on smuggling will help it achieve the tax collection target (of Rs5.55 trillion),” he said. On the other hand, “exports surged after the authorities let the rupee depreciate significantly.”

Besides, the grant of incentives to exporters like provision of subsidised electricity and gas, tax rebate on export growth of up to 6% and a notable increase in food exports also played an important role in increasing shipments from the country, he said.

Moreover, the remittances sent home by overseas Pakistanis came in at $2.03 billion in July compared to $1.98 billion in the same month of last year due to Eidul Azha. The inflows played a very important role in financing the trade deficit and making a foreign debt repayment.

The government has targeted to contain the fiscal year 2019-20 current account deficit at $6.5 billion, as agreed with the IMF, compared to $13.5 billion worth of deficit in the preceding fiscal year.

“The significant drop in the current account deficit in July seems sustainable,” he said, adding that the implementation of the CNIC condition at wholesale and retail levels and a crackdown on smuggling would further improve import and export numbers, he said.

The IMF programme has, however, resulted in a slowdown of the economy to a nine-year low of 3.3% in the fiscal year that ended on June 30, 2019, and pushed inflation into double digits - 10.3% - in July after a gap of 68 months.

SBP Governor Reza Baqir, while addressing Pakistan’s Independence Day gathering on August 14, claimed that the country had taken right decisions for reviving the slowing economy as their implementation had started bearing fruit.

The projects that the economic team of Pakistan was implementing were bringing stability to the country. “If we continue our journey with consistency in the direction we have taken, then we will definitely achieve the destiny of progress and prosperity,” he said.

“Consistency in our policies is our biggest challenge. If there is continuity in policies, I have no doubt that our future is bright,” the SBP governor remarked.

Published in The Express Tribune, August 21st, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ