Weekly review: KSE-100 continues ascent despite uneventful budget

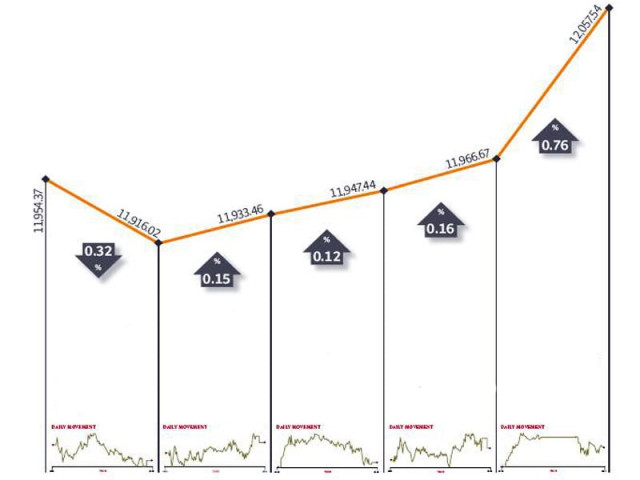

The benchmark index gained 1.2% as activity in blue-chips picks up.

The market maintained its pre-budget upward momentum and managed to make decent gains, despite the uneventful budget announcement last Saturday. The benchmark KSE-100 index rose 1.2 per cent (141 points) to close at 12,378 points during the week ended June 10.

The budget turned into a non-event for the stock market as almost none of the expected changes were made in the document. Investors had expected both positive and negative developments, however, with no major changes being made; the budget’s effect was minimal on the market.

The biggest and most relevant change that had been expected was the cancellation of the much-maligned Capital Gains Tax on market transactions. The KSE board had met with the Federal Board of Revenue in the weeks leading up to the budget, to iron out a deal which had resulted in increased activity at the country’s bourses.

However, it is believed that the modalities of the CGT withdrawal could not be finalised by the time of the budget announcement and thus the tax is tentatively going to continue for another year. Yet, despite this setback, investors had something to cheer about as many of the proposed taxation measures were not implemented in the budget as well.

Absent from the budget announcement was any mention of the Value Added Tax (VAT) or the Reformed General Sales Tax (RGST). In fact, the government reduced the current General Sales Tax rate from 17 per cent to 16 per cent, with the aim of bringing more people into the taxation bracket.

The budget also provided a boost to the cement sector as the government announced a phased withdrawal of the Federal Excise Duty. The cancellation of the flood tax surcharge and no mention of increased corporate taxation on the banking sectors also provided further impetus to the market.

Overall, the impact of the budget was neutral on the market, but the continuation of the CGT is likely to continue as a dampener to increased activity in the coming year. The market’s gains for the week were thus largely attributable to the fundamental developments during the week.

The discovery of oil and gas supplied in the Domail block by Pakistan Oilfields Limited resulted in interest in the Energy and Power sector and activity in the sector picked up. As a result, a lot of activity was witnessed in E&P blue-chips which resulted in much improved trading values.

Rumors also started to circulate that the Fauji Fertilizer Company is set to further increase its urea prices and consequently was subject to attention in the market. However, Engro Corporation remained under pressure throughout the week on reports of production issues due to gas supply disruptions at its new plant.

Volumes remained largely unaffected and increased by 9.1 per cent to 112 million shares traded per day. This activity, however, was focused towards blue-chip companies and resultantly, average traded value also jumped by 62 per cent and stood at Rs4.71 billion per day. The KSE’s market capitalisation also rose 0.9 per cent and stood at Rs3.28 trillion at the end of the week.

What to expect?

With the budget failing to impact the market in any significant way, investors will now shift their focus towards other indicators to gauge the direction of the market. The results season for the fiscal year 2011 is not due for at least a month, while no immediate developments on the CGT issue are expected.

Hence, foreign inflows (negative $7.1 million in the current week) and sector-wise developments can be expected to determine the direction of the stock market in the coming weeks.

Monday, June 6

The first stock market session after the budget recorded selling as the announcement had nothing for the capital market. The decline was much less than initial expectations as analysts had expected the market to fall at least 100 points.

Tuesday, June 7

Equities started off on a slow note but witnessed a burst of activity to close above the 12,300 points level after a four-month gap. The rally was led by Pakistan Oilfields that closed at its upper circuit and generated impressive volumes on the back of news of discovery at Domial well, Ikhlas block.

Wednesday, June 8

The stock market managed to close in the black after late profit taking was covered by rise in index heavyweight Oil and Gas Development Company. The benchmark successfully avoided any major decline as participants were active in sector swapping, said an analyst.

Thursday, June 9

The stock market fell after spending most of the day on the neutral line as investors opted to book profits at higher levels. Attock Refinery led the fall with the stock plummeting to its lower limit as rumours about removal of deemed duty led to panic selling.

Friday, June 10

The stock market ended the day up led by rumours of Pakistan Petroleum expected to announce special dividend in the extraordinary general meeting. The stock closed with clipped gains as no such announcement was made by the company. Increase in international oil prices also helped local oil production companies to remain in the green.

Published in The Express Tribune, June 12th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ