An almost 18% rupee depreciation against the US dollar in first nine months (January-September) of calendar year 2018 turned the import of car parts expensive, which prompted the car assembler to jack up vehicle prices.

Accordingly, volumetric sales of the company dropped 10% in the Jul-Sept 2018 quarter compared to the same quarter of last year. It, however, managed to achieve 3% higher sales revenue in rupee terms in the quarter.

A further 8% depreciation in the value of the rupee, which occurred in the current month, suggests a tough time for car manufacturers in last quarter of the current calendar year as they heavily rely on imports.

Cumulatively, the rupee has shed 27% of its value since December 2017, standing at Rs133.91 to the US dollar in the inter-bank market, according to the State Bank of Pakistan.

In line with the currency’s weakness, all the three Japanese carmakers have revised vehicle prices upwards. Pak Suzuki Motor is expected to increase prices once again in order to pass on the impact of the latest round of rupee depreciation. The other two players - Honda and Toyota - have already raised prices.

In addition to the rupee’s free fall, the government’s decision to prevent non-filers of tax returns from buying new cars has also impacted volumetric sales of the carmakers.

Pak Suzuki Motor’s share price hit the lower limit of 5%, or dropped Rs11.87, to close at Rs225.60 with trading in 53,600 shares at the Pakistan Stock Exchange (PSX).

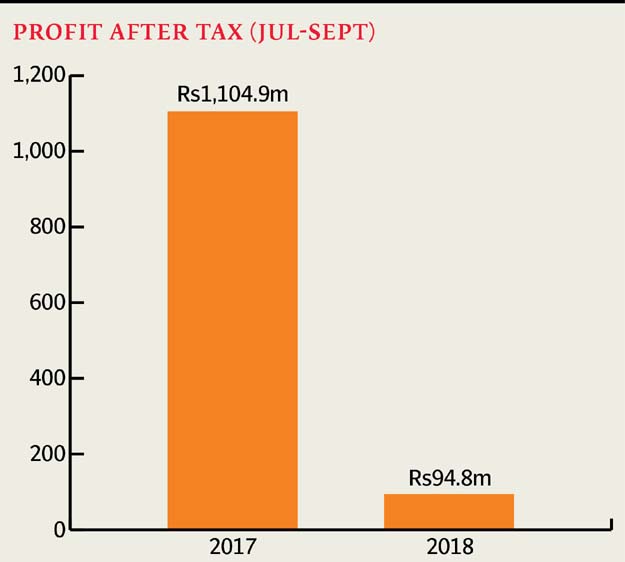

According to the profit or loss account the company sent to the PSX, Pak Suzuki had recorded after-tax profit of Rs1.10 billion in the Jul-Sept quarter last year.

Earnings per share nosedived to Rs1.15 in the Jul-Sept 2018 quarter compared to Rs13.43 in the corresponding quarter last year. It achieved 3% higher sales at Rs26.62 billion compared to Rs25.97 billion last year.

However, a 6.5% increase in the cost of sales at Rs24.93 billion ate up most of the sales revenue. The cost stood at Rs23.40 billion in the same quarter last year.

More importantly, the government charged an exorbitant 78.57% tax on profit in the Jul-Sept quarter compared to 30% tax in the same quarter last year. JS Research analyst Ahmed Lakhani said the drop in profit was steeper than market expectations.

“Earnings nosedived 91% against our expectation of a decline of 66% ... where the major deviation from our expectation was on account of 79% effective tax in the latest quarter compared to 30% in the same quarter last year,” he said.

Net sales improved 3% despite a contraction in volumes “on the back of price increases”, he said.

“Net sales also benefited as the product mix tilted towards higher priced cars. However, gross margins shrank by 353 basis points year-on-year mainly as a result of rupee depreciation…leading to a 34% drop in gross profitability,” he said.

Moreover, other income dropped 59%, which was on account of lower bank deposits in the current quarter.

“The coming quarter does not look attractive from an earnings perspective for the OEM (car makers),”he said.

Published in The Express Tribune, October 24th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1713904359-0/burn-(1)1713904359-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ