Stock market experiences dull week amid economic concerns

Investor participation remains thin as index decreases 322 points in outgoing week

Investor participation remains thin as index decreases 322 points in outgoing week.

PHOTO: FILE

Investors remained on the sidelines as concerns over macroeconomic issues were yet to be addressed. The twin deficits continued to build pressure while depleting foreign exchange reserves added to the investor apprehension.

Even though the current account deficit for August 2018 was low, it failed to entice the market. Participants also awaited clarity on a potential bailout package from the International Monetary Policy (IMF) to revive the economy.

Trading kicked off on a negative note on Monday as selling pressure in index-heavy cement and steel stocks kept the market bearish. Although the following session saw the index finish positive, gains remained minimal and the overall mood was dull.

On the global economic front, the US imposed 10% tariff on $200 billion worth of Chinese goods’ imports - the tariffs came into effect on September 24, 2018. Reacting to this, China also announced imposition of tariffs on $60 billion of US goods. The index retreated once again on Wednesday and maintained the losing streak on Thursday as anticipation over the upcoming monetary policy announcement kept the players sidelined.

The Asian Development Bank’s outlook update on Pakistan’s economy also dented sentiments as it slashed the economic growth forecast for Pakistan to only 4.8%. Despite another volatile session on Friday, the index managed a decent recovery as investors resorted to stock-picking at attractive valuations.

Activity was dull during the week with average daily volumes decreasing 21% to 124 million shares while the average daily traded value was down 18% to $41 million. Sector-wise activity was led by commercial banks (up 113 points) amid expectations of interest rate hike, oil and gas exploration companies (91 points) due to higher crude oil prices, tobacco (31 points) and food and personal care (27 points).

On the other hand, laggards during the week were oil and gas marketing companies (down 106 points), automobile assemblers (104 points) due to indecisiveness on the non-filer status for vehicle purchase, fertiliser companies (77 points) as pricing power wanes off, cement (71 points) and power generation (43 points).

As expected, SBP raises key interest rate by 100bps to 8.5%

The decline in automobile sector was witnessed despite relaxation of the ban on non-filers for the purchase of new cars and properties valued above Rs4 million. There were fears that the Senate may not approve the relaxation for the non-filers.

After intense criticism from the public in response to the proposed removal of the ban, Finance Minister Asad Umar announced that the government would reconsider the proposal of lifting the ban.

Scrip-wise, HBL (up 2.71%), BAFL (up 0.81%), BAHL (up 1.52%) and UBL (up 0.02%) were major movers of the banking sector. The cement sector witnessed mixed sentiments where LUCK (up 0.98%) and PIOC (up 1.19%) closed positive, but DGKC (down 0.82%), MLCF (down 1.85%), KOHC (down 0.03%) and FCCL (down 1.76%) closed in the red. INDU (-2.48%) and HCAR (-4.33%) were major losers of the auto sector.

Market watch: KSE-100 falls as investors wait for clear economic policy

Foreign selling continued this week standing at $9.4 million compared to net selling of $12.6 million last week. Selling was witnessed in exploration and production ($7.8 million) and commercial banks ($3.9 million).

On the domestic front, major buying was reported by insurance companies ($8.6 million) and mutual funds ($4 million).

Among major highlights of the week were the SBP warning of fiscal and external risks threatening stability in H2CY18, Pakistan’s economy going to slow down to 5.2%, SBP increasing the interest rate by 100 basis points to 8.5% and ECC putting off a planned power tariff hike.

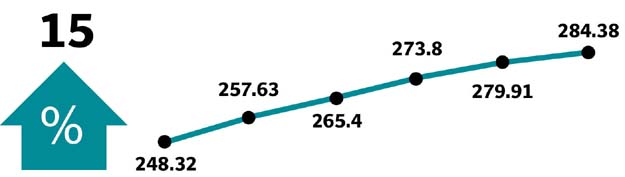

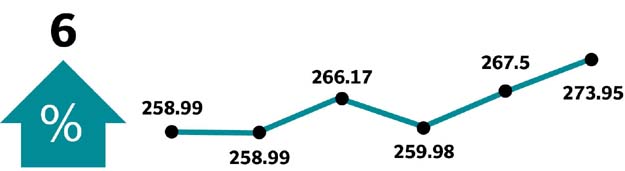

Winners of the week

Pak International Container Terminal

Pakistan International Container Terminal operates a container shipping facility in Karachi, Pakistan.

Shifa International Hospitals

Shifa International Hospitals Limited establishes and runs medical centres and hospitals in Pakistan. The company’s clinical services include medicines, paediatrics, surgical, obstetrics and gynaecology, dentistry, rehabilitation services and ophthalmology.

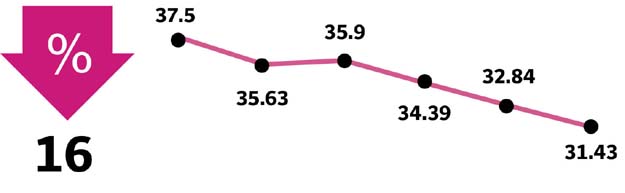

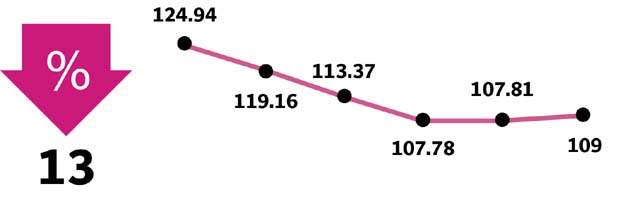

Losers of the week

Unity Foods

Unity Foods Ltd is an agri-business company, with principal activities that entails the entire value chain from the procurement and crushing of multiple oil seeds.

EFU General Insurance

EFU General Insurance Limited is an insurance provider. The group supplies a number of lines of coverage, including fire, marine, aviation, transport, motor and miscellaneous.

Published in The Express Tribune, September 30th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ