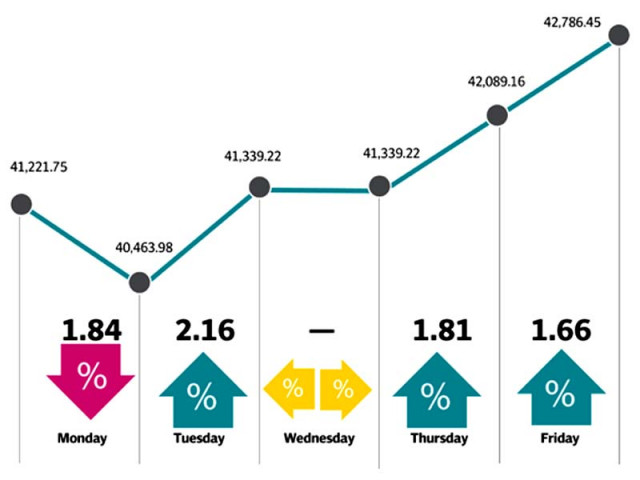

Weekly review: Bulls lead the way as KSE-100 gains 1,565 points

Clarity on political front boosts sentiment; fear of hung parliament dismissed

Weekly review: Bulls lead the way as KSE-100 gains 1,565 points

The successful completion of the general elections, held on Wednesday, helped the index to a four-month high week-on-week rally, according to AHL Research.

Pakistan needs $1.2b annually to feed job market

The week kicked off on a negative note, however, the sour mood did not last as the index gained on Tuesday with investors rejoicing news of timely elections. Although investors remained jittery on fears of a hung parliament, attractive valuations kept participants interested.

With the election results showing a resounding victory for Pakistan Tehreek-e-Insaf (PTI), sentiments became bullish as the KSE-100 index continued its winning streak. Following Imran Khan’s speech, where he shared a glimpse of his economic and foreign policy, sentiments were further buoyed as the index gained another 697 points on Friday.

Market activity also continued to improve with average daily traded volume increasing 7% to 235 million, while average daily traded value grew by 6% to $70 million.

Market watch: Stocks extend winning run, KSE-100 adds another 697 points

Sector-wise positive contributions came from commercial banks (up 368 points), cements (up 294 points) given expectations of robust housing scheme under PTI, fertilisers (up 213 points) amid recent price hike of urea, oil and gas exploration companies (up 184 points), and oil and gas marketing companies (up 133 points).

Scrip-wise, HBL (up 138 points), LUCK (up 115 points), UBL (up 91 points), POL (up 82 points) and DAWH (up 76 points) contributed positively to the index.

Despite successful general elections, foreign investors continued their selling spree with another net sale of $0.36 million, recorded during the week. However, overall selling remained lower than last week, where outflows were recorded at $21 million. Selling was witnessed in exploration and production sector ($6.9 million) and commercial banks ($2.2 million). On the local front, individuals were net buyers amounting to $19 million, while mutual funds were net sellers amounting to $18.4 million.

Post-election session: KSE-100 ends with 750-point gain

Among major highlights of the week were; urea sales for the month of June 2018 clocked in at 608,000 tons (up 23% on monthly basis), plans to increase duties to curb imports materialised, oil and gas discovery made by POL in Khaur, connection of new 1,320-megawatt (MW) power plant transferred by HUBCO to national grid, textile exports increased 9% year-on-year to $13.53 billion in FY18 and $2 billion to be sought from AIIB, Swiss banks for building dams.

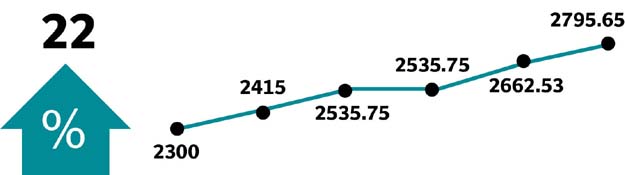

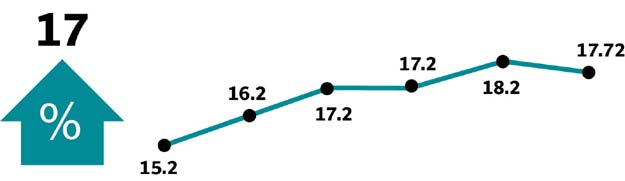

Winners of the week

Philip Morris (Pakistan)

Philip Morris Pakistan Limited manufactures and sells tobacco and cigarettes.

Jahangir Siddiqui & Company

Jahangir Siddiqui and Company is an investment company, offering share brokerage, money market and advisory.

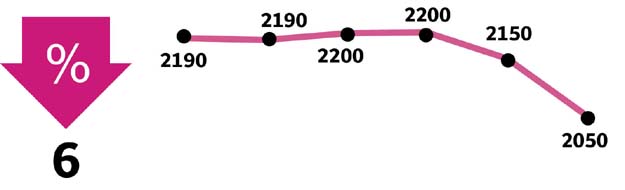

Losers of the week

Colgate Palmolive (Pakistan)

Colgate-Palmolive Pakistan Limited manufactures and sells detergents, personal hygiene and a variety of other products.

Pak Tobacco

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Published in The Express Tribune, July 29th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ