Corporate result: Maple Leaf Cement’s earnings fall slightly to Rs4.7b

Company declares Rs1.75 per share cash dividend for 4th quarter

PHOTO: WEBSITE

Earnings per share (EPS) stood at Rs9.05 in FY17 compared to Rs9.18 in the previous year.

Along with the results, the company also announced a cash dividend of Rs1.75 per share for the fourth quarter (April-June) of FY17, taking cumulative pay-out to Rs3.75 per share for the entire year.

Maple Leaf’s stock price closed at Rs87.54, up 0.86% at the PSX on Wednesday. The benchmark KSE 100-share Index ended the day at 42,310 points, up 1,030 points or 2.5%.

Maple Leaf to raise Rs4.28b in right issue

Last month, Maple Leaf Cement had decided to raise Rs4.28 billion through the PSX to partially finance the cost of a new dry process clinker production line.

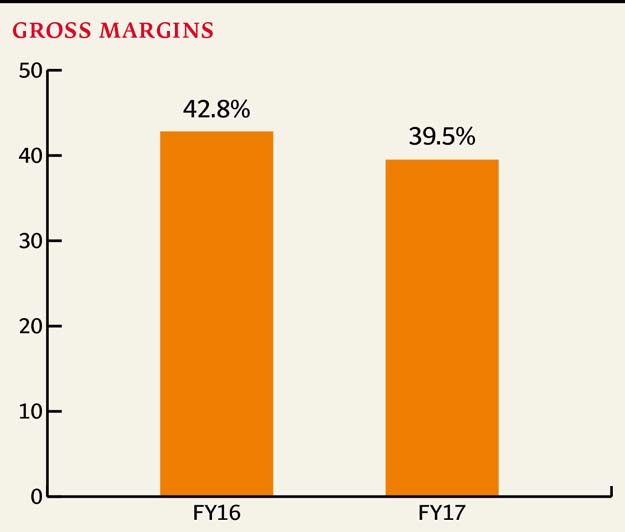

Gross margins came in at 39.5% in FY17 compared to 42.8% in the previous year, mainly because of a rise in international coal prices, according to Taurus Securities.

Sales revenue for the fourth quarter stood at Rs5.69 billion compared with Rs6.32 billion in the third quarter of FY17, down 10% quarter-on-quarter on the back of a decline in volumes in the last quarter.

Company’s sales volume went down 11% quarter-on-quarter in the fourth quarter of FY17.

The effective tax rate in the quarter was 38.2% because of super tax provision, translating into an effective tax rate of 30.5% for FY17.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ