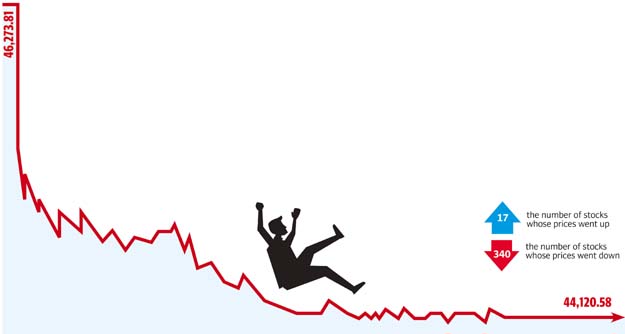

Market watch: Stocks get a hammering as KSE-100 ends 2,153 points lower

Benchmark-100 index falls 4.65% to end at 44,120.58 amid political uncertainty

Over 4 per cent shaved off benchmark-100 share index amid political uncertainty. PHOTO: EXPRESS

The free-fall started from the start of the day with stocks continuously trading in the red zone. Monday’s calm due to adjournment of the Panama verdict till next week soon vanished as the vulnerability of the current political setup was realised by major players.

By close of trading, the benchmark KSE 100-share Index finished with a decrease of 2,153.23 points or 4.65%, largest in terms of percentage since Feb 2009, ending at 44,120.58.

Pakistan upgraded to MSCI Emerging Markets Index

Elixir Securities, in its report, stated Pakistan equities witnessed a bloodbath as political noise reached a new decibel.

“The benchmark KSE-100 Index plunged by as much as 4.65%, down most since February 2009 when interestingly Sharif brothers were declared ineligible by Supreme Court to contest elections or hold public offices.

“ The market opened gap down and traded deep in red throughout the day as investors, after digesting the details overnight of investigators’ report submitted to Supreme Court yesterday in the case against PM Nawaz Sharif and his family, became sceptical of the stability of the current political setup,” the report stated.

“Just two stocks on the benchmark KSE-100 Index ended positive, five remained unchanged while 92 names closed in red out of which 62 closed at their respective lower price limits.” Interestingly, no major change was witnessed on the currency market with rupee steady against USD while yields also didn’t see any sharp moves today.

“We see value buyers to remain very cautious with choppy trading in days ahead as the Supreme Court hears the case against First family on Monday July 17. Local smart money will be critical in leading value hunting at lows while news flow on domestic politics to guide the market till at least this weekend,” the report added.

JS Global analyst Arhum Ghous said the market ‘splashed red ink everywhere’ from the very start of the day, opening almost thousand points negative.

“By the end of the session, the index had lost 2,153 points to close at 44,121. The extreme decline in the market came from political jitters where uncertainties related to future of the incumbent PM Nawaz Sharif, post JIT report, escalated,” he stated.

Moreover, conviction of SECP chairman on matters of record tampering under political influence also added fuel to the fire. Selling pressure remained persistent throughout the day and across the board.

Commercial bank heavyweights such as HBL (-5.0%), UBL (-5.0%), MCB (-4.9%), ABL (-5.0%) and NBP (-5.0%) closed near their lower circuits, cumulatively contributing 403pts decline to the benchmark index.

Stocks bloodbath as Pakistan upgraded to MSCI Emerging Markets

Apart from this, other notable decliners during the day were MARI (-5.0%), INDU (-3.9%), MTL (-4.7%) and HCAR (-5.0%) cumulatively contributing 102pts fall to the benchmark KSE-100 index.

Overall participation also remained weak where average volumes clocked-in at 185 million, as compared to 235 million in the last trading session. KEL (-5.7%) from the power generation sector led the volume with 17 million shares changing hands.

“We expect volatility in the market to persist until clarity emerges on the fate of Sharif family. That said, a cautious approach is advised to avoid headwinds,” Ghous added.

Overall, trading volumes fell to 185 million shares compared with Monday’s tally of 235 million.

Shares of 367 companies were traded. At the end of the day, value of 17 stocks closed higher, 340 declined while 10 remained unchanged. The value of shares traded during the day was Rs9.89 billion.

K-Electric was the volume leader with 17.4 million shares, losing Rs0.39 to close at Rs6.44. It was followed by TRG Pakistan with 9.68 million shares, losing Rs1.88 to close at Rs35.84 and Aisha Steel Mill with 9.3 million shares, losing Rs1.02 to close at Rs19.49.

Foreign institutional investors were net buyers of Rs1.026 billion during the trading session, according to data compiled by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, July 12th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ