Taking an easy route, the Sindh government will continue to generate more receipts from indirect taxes (like general sales tax on services, stamp duty, etc) compared to direct taxes (like agriculture income tax, property tax, etc).

When a sector starts booming, more taxes are slapped on it

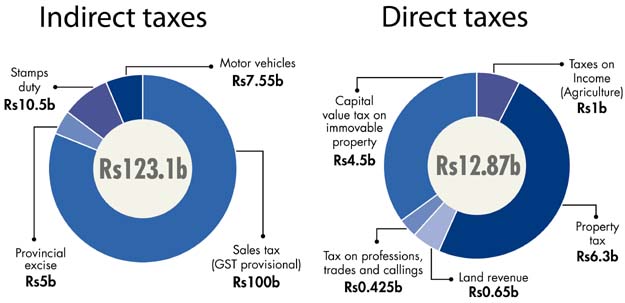

Cumulatively, the provincial government, in its budget for FY18 announced on Monday, has targeted to generate Rs186 billion in taxes in the upcoming fiscal year.

Again, the lion’s share will come from indirect taxes with collections of Rs173 billion, up 26.2% compared to the outgoing fiscal year FY17.

Indirect taxes

Sales tax tops the list in the indirect tax category. The government has fixed the sales tax revenue target at Rs100 billion for the Sindh Revenue Board in FY18.

This target is 28.2% higher than the target of Rs78 billion that the revenue board met in the outgoing fiscal year.

Other than sales tax, the government also expects to collect Rs5 billion in provincial excise duty, Rs10.5 billion in stamp duty and Rs7.55 billion in motor vehicle tax in FY18.

Direct taxes

The provincial government estimates collection of Rs12.87 billion in direct taxes, up 24% compared to the outgoing year.

Property tax leads in the direct tax category. In the upcoming fiscal year, the government expects to collect Rs6.3 billion on this account.

It also expects to receive Rs4.5 billion in capital value tax on immovable property, Rs650 million in land revenue and Rs425 million from tax on professions, trades and callings.

Similar to its past shortcomings, the provincial government is targeting to collect only Rs1 billion this year in agriculture income tax compared to just Rs650 million in the outgoing year. Sindh Chief Minister Syed Murad Ali Shah has time and again committed to improving the mechanism of agriculture income tax, but there has been no improvement so far.

Sindh - the second largest province in terms of economy and population - had been the worst performer in FY16 among four provinces in the collection of agriculture income tax as a percentage of total tax receipts.

Except for Sindh, the other three provinces either improved or maintained their share in tax on income (agriculture) in FY16.

Sindh’s tax on income (agriculture) in FY16 dropped further to just 0.3% compared to 0.5% in FY15, according to the SBP’s Annual Report on the State of Economy 2015-16.

Opposition protests proposed hike in water taxes

Experts say lack of political will is the main reason why the Sindh government has not been able to increase income tax collection from the agriculture sector. What is disappointing is that the Sindh government’s agriculture income tax has never exceeded 1% of total tax collection since FY10 when it was 0.9% - the highest ratio in the past seven years.

Analysts point out that due to embarrassingly low tax collection from agriculture income, the Sindh government heavily banks on tax collection from the salaried class and foreign assistance that are insufficient to meet growing infrastructure needs of the province.

Published in The Express Tribune, June 6th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1672385156-0/Andrew-Tate-(1)1672385156-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ