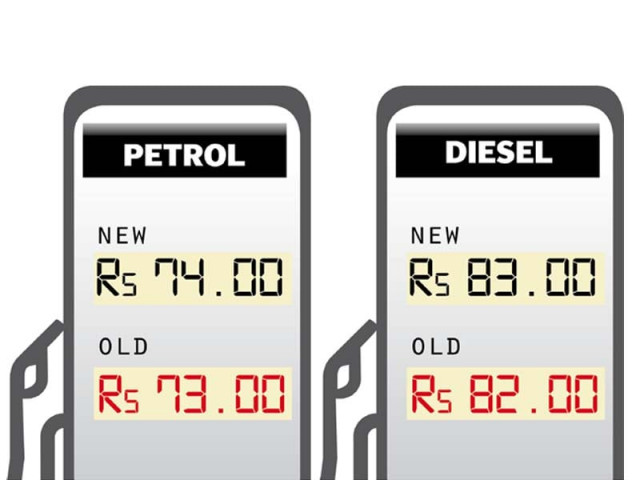

Litre price of petrol, diesel up by Rs1; kerosene unchanged

Light diesel oil rate also remains the same

Light diesel oil rate also remains the same

“The prices of light diesel and kerosene will remain unchanged to provide relief to consumers,” Finance Minister Ishaq Dar said while talking to the media in Dubai.

“The government will provide a subsidy of Rs3 billion on petroleum products,” Dar added.

The government had absorbed the impact of oil prices by making adjustment in taxes which were imposed on consumers following a dip in oil prices in international markets.

The Oil and Gas Regulatory Authority (Ogra) had suggested an increase of up to Rs13 per litre in line with the fluctuation in global oil prices.

Both petrol and diesel are used by the majority of people in the country as diesel is used in the agriculture and transport sectors. Therefore, high prices of diesel directly hit farmers and cause inflation due to increase in the cost of transportation.

In a summary moved to the petroleum ministry on Thursday, the regulatory body had proposed an increase of Rs2.28 per litre for petrol (MS), Rs2.04 for high speed diesel (HSD), Rs13 per litre for kerosene (superior KO) and Rs7.75 per litre for light diesel oil (LDO).

However, the government had decided to make partial increase in the prices of petrol and high speed diesel by Rs1 per litre. The prices of light diesel oil and kerosene were kept unchanged.

By keeping the price of light diesel oil unchanged, the government had provided relief to the industry where it is heavily used.

Kerosene is used by low-income segments of the country’s population where liquefied petroleum gas is not available. But the product is being mixed in diesel by petroleum dealers to mint money from consumers. The oil refineries were also involved in this practice.

The petroleum industry was not only making money by mixing kerosene with diesel to charge higher prices but the government has allowed ‘deemed duty’ – a type of incentive on diesel that directly goes into the pockets of refineries.

So, the decision to keep its price unchanged would not make any difference for the poor, but it would provide an opportunity to the oil industry to mint money from consumers, an official said.

After the increase, the price of petrol will go up to Rs74 per litre from the existing Rs73 per litre, high speed diesel to Rs83 per litre from the current price of Rs82 per litre. However, the prices of kerosene and light diesel oil have been maintained at Rs44 per litre.

Following a dip in oil prices in international markets, the government has burdened consumers with heavy taxes, especially on petrol and high speed diesel.

Due to this, consumers in Pakistan have been paying up to 38% more on oil when compared with the prices prevailing in the international market to make up for the shortfall in revenue.

According to a report prepared by Ogra, consumers had paid GST by up to Rs29.57 per litre on HSD during FY2015-16 in addition to Rs6 per litre petroleum levy.

Moreover, the federal government has reduced sales tax on high speed diesel from 30% to 29.5% from today (April 1) while other POL products would be subjected to sales tax on previous rates with no change.

The Federal Board of Revenue (FBR) has issued SRO 223(1)/2017 on Friday to change the rates of sales tax on POL products.

Under the sales tax regime applicable from April 1, there is no change in the sales tax rate on petrol. The FBR will collect 15.5% sales tax on motor spirit during April. In March, the FBR was charging the same rate of 15.5% sales tax on this POL item.

Published in The Express Tribune, April 1st, 2017.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ