Studying the costs and benefits of a stable exchange rate

Most developing economies have lowered their exchange rates to remain competitive.

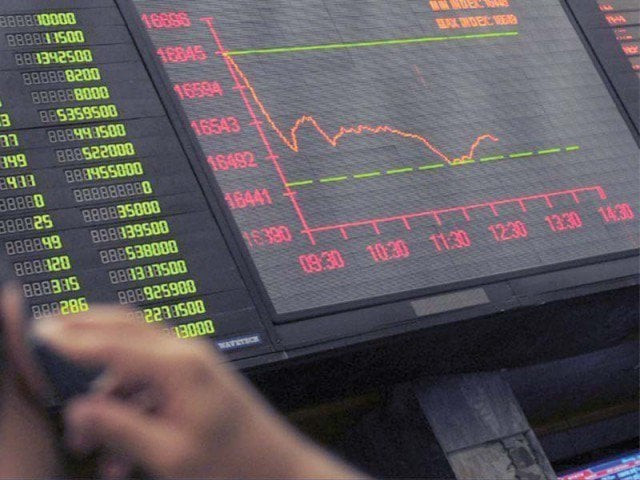

Most developing economies have lowered their exchange rates to remain competitive. PHOTO: EXPRESS/FILE

In the current year budget, the government targeted the level of foreign exchange reserves to be at $30 billion by June 2017. However, the stable exchange rate is eating out the costly foreign exchange; therefore, this target could not be materialised.

There are certain costs associated with the stability of exchange rate.

The hypersensitivity to maintain a stable exchange rate has already affected the performance of merchandise exports in the last couple of years. The hypersensitivity can be judged through defying the foreign exchange market on a number of occasions.

Recently, the exchange rate depreciated in an open market, but it again recovered through an intervention from the State Bank of Pakistan (SBP).

Although the central bank can intervene in the foreign exchange market to tame volatility, this intervention should be carefully crafted. This stability has made the Pakistan rupee overvalued, since most of the developing economies have already lowered their exchange rate to remain competitive in the global economy. In addition, the overvaluation has made imports cheaper and exports dearer, which creates pressure on the external account.

The rupee has been stabilised through dollar denominated borrowing. Apart from borrowing from multilateral institutions and bilateral sources, the government has borrowed $4.5 billion since September 2013 from the international bond markets and around $2.5 billion from international commercial banks.

In the absence of non-debt creating inflows, short term and commercial borrowing became the natural choice of the government. Through this act, the government bolstered the foreign exchange reserves to $23 billion. Out of which $17 billion is with the SBP, covering around four months of merchandise. The absolute number of foreign exchange seems large; however, the situation is slowly deteriorating.

If import cover of official foreign exchange reserves drops below three months, the economy becomes susceptible to Balance of Payment crisis, which has happened on various occasions in the past.

The deterioration of external account increases the chances of speculative attack on currency. People start to hoard dollars as they intend to maintain the store of value of their money. The confidence of the people shakes and the restoration of confidence demands time-therapy.

Benefits

There are certain benefits associated with stable exchange rate. By holding the rupee stable for too long, the government can stabilise imported inflation, which doesn’t even affect the domestic inflation. The fortuitous factor of lower international oil prices acted as a boon for the current government. Hence, the stability of exchange rate and lower international oil prices contributed to lower domestic inflation in the economy.

Similarly, the dollar denominated debt and its payments are not affected if exchange rate remains stable. On the contrary, the depreciation of exchange rate increases the dollar denominated debt. On this basis, the situation of debt seems to be under control at the moment, which would deteriorate in the near future.

By keeping in view the costs and benefits of stable exchange rate, the focus of the government should be on long term goal of capital development. A developing economy requires a managed depreciation to avoid the depletion of foreign exchange reserves and to maintain the competitiveness.

In a nutshell, the political governments try to manage their economies according to the election cycle since they are fearful of the accountability of the people in the upcoming elections.

They manage the economy on a short-term basis. Therefore, the governments normally don’t take long-term goals into account. Last but not the least, this short-term stability of exchange rate has long run repercussions on the capital developing of an economy.

The writer is an Assistant Professor of Economics at SDSB, Lahore University of Management Sciences (LUMS).

Published in The Express Tribune, March 20th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ