Pressure on reserves: Pakistan’s trade deficit swells 28.7%, now stands at $17.4b

Exports in the first seven months are less than half of the annual target

The latest trade figures released by the Pakistan Bureau of Statistics on Thursday revealed that the country has breached its trade deficit limits and booked a $17.42-billion deficit during the July-January period, equivalent to 85% of the annual target already.

Exports in the seven-month period were less than half of the annual target, while imports were about two-thirds of the annual projections, suggesting that the country will have a larger than $4.5-billion anticipated annual current account deficit.

The State Bank of Pakistan has already warned about the high current account deficit, the gap between external payments and receipts.

Imports/exports

The gap between exports and imports, known as the trade deficit, during the July-January period stood at $17.42 billion, reported the PBS. The trade deficit was $3.9 billion or 28.7% more than the previous year’s comparative period.

CREATIVE COMMONS

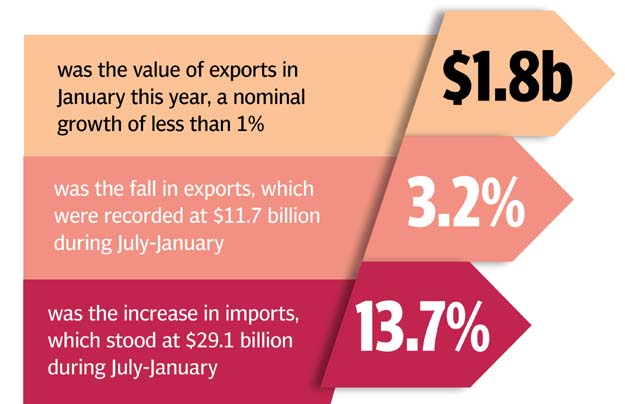

Exports plunged 3.2% to total $11.7 billion during July-January, $388 million less than the exports made in the comparative period of the previous year. In comparison, imports increased 13.7% to over $29.1 billion in the same period. In absolute terms, the import bill was $3.5 billion more than the previous year.

A major reason behind the surge in import bill is the import of machinery under the China-Pakistan Economic Corridor. During the first half of the fiscal year, Pakistan imported $5.7 billion worth of machinery, 40.8% higher than the previous year.

However, imports of petroleum group have also started picking up pace after a gradual increase in the price of crude oil in the international market. During the first half, Pakistan imported $5 billion petroleum products, up by 11.2%.

For fiscal year 2016-17, the government projected that exports would grow to $24.75 billion and the import bill may remain at $45.2 billion. It had projected a $20.5-billion trade deficit for the whole fiscal year. However, results for the first seven months show that the deficit might touch $25 billon by the end of the fiscal year.

The higher-than-projected trade deficit has increased the government’s reliance on foreign borrowings to meet its external account requirements. The country’s foreign financing requirements for this fiscal year are projected to be in the range of $12 billion to $15 billion, depending upon the projections of exports and imports.

It has already started tapping unconventional source of foreign borrowings amid growing debt repayments.

The government closed the last fiscal year 2015-16 at an eight-year low level of exports, which dropped to $20.8 billion despite preferential access to European markets. The exports have been declining since the current government took over, falling from $24.5 billion in 2012-13.

January

The trade deficit was alarmingly 75% more than the comparative period. The trade deficit increased to about $3 billion in January, which was 75.2% or $1.3 billion more than the deficit recorded in January 2016.

Exports in January this year stood at $1.8 billion, showing a very nominal growth of less than 1% when compared with last year, according to the PBS. In absolute terms, exports were up by $13 million.

However, growth in imports jumped to 37.1%, as the bill grew to $4.7 billion in January this year. The import bill was $1.3 billion more than last January’s imports.

Even on a month-on-month basis, the trade deficit widened to 7% in January over December. In absolute terms, the trade deficit was roughly $3 billion. The exports were up by 3% while imports grew at 5.6% rate.

Published in The Express Tribune, February 10th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ