Equity market: How the rich got richer in 2016

Return at PSX continues to outshine other assets, positives remain intact

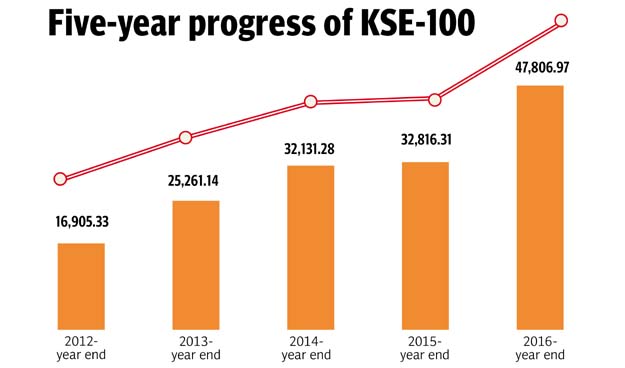

After a rather forgetful year in 2015, when global markets traded directionless, equities adopted the upward trend that makes trading and investing so attractive. The Pakistan Stock Exchange (PSX) was no different.

Europe to be largest market for Pakistan’s textiles

These numbers should put things into perspective: the PSX was the top-performing market in Asia. It was ranked fifth in the entire world, exceeding all MSCI Developed, Emerging and Frontier Markets. Only Brazil, Peru, Kazakhstan and Russia performed better, according to Arif Habib Limited. The benchmark-100 index rose by over 45%, outperforming other assets by a long margin. It reached a record level of 47,806.97 on December 30 - the last trading day of 2016.

Assets under management of the mutual funds industry grew by over 25% during the year, injecting some of the liquidity that is now absorbing foreign selling. Barring one, managers of all equity-based funds gave a return of over 30% to their unit holders. The pace at PSX was so much to keep up to that only four equity-based funds out of 20 were able to outperform the KSE-100 Index.

Chinese consortium wins bid for 40% stake in Pakistan Stock Exchange

Volumes increased to 281.5 million shares exchanging hands every day, opposed to 247.4 million in 2015, according to Arif Habib Limited. More money for brokerage houses in terms of commission.

If this information is technical, just understand this. If one invested Rs100,000 in the stock market on January 1, that amount should have gone over Rs145,000 by December 30, if one were to be an “average” investor.

Stakeholders believe there is still more upside.

Shahbaz Ashraf, head of research at Arif Habib Limited, says a 17 to 21% increase is in the offing in 2017.

He argues that market capitalisation is still nowhere near the levels it once was. Market capitalisation is the total value of all shares listed on the stock exchange.

“The market capitalisation is still 23% of GDP right now. It used to be a lot higher than this in 2006,” says Ashraf, whose bullish sentiment is shared by many other fund managers, traders, stock brokers and international institutions.

The MSCI’s decision to reclassify Pakistan as an emerging market, increased economic activity under the flagship CPEC project, increased GDP growth that is tipped to go beyond 5%, and higher earnings growth are said to be the main catalysts, according to Ashraf.

The only real concern remains foreign selling.

“There has been a bit of that, but one has to understand it in the context of Pakistan’s reclassification. We could see inflows from passive foreign funds before May 2017, which is the official reclassification month. Inflows from actively managed funds will come from May onwards.”

There are still a few worries. Any kind of political instability or security concerns, along with any threats to CPEC projects or missing deadlines, could add to the worries investors always have with the stock market.

Published in The Express Tribune, January 1st, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ