Weekly review: KSE-100 plummets 1,014 points as global markets crash

Losses were witnessed across the board led by banking and oil sectors

Losses were witnessed across the board led by banking and oil sectors.

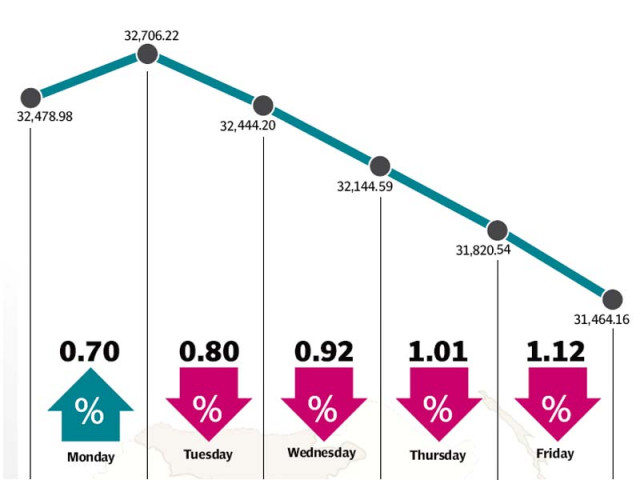

The stock market’s most recent rally came to a crashing halt as financial markets across the world slumped, resulting in the benchmark KSE-100 index falling by 1,014 points (3.1%) during the week ended February 12.

The market was on an 11-day winning streak, which had added more than 1,900 points to the KSE-100 index. However, a global rout in equity markets coupled with another dip in crude oil prices saw the index fall 1,242 points in four days to close 31,464 at the end of trading on Friday.

With profit-taking in the banking sector and negative news flows for the cement and fertiliser sectors, there was little reason for investors to cheer. The only positive of the week was the signing of the LNG deal with Qatar, which will see shipments start in March 2016 and contribute significantly towards the energy security of the country.

After a strong start on Monday, on the back of an impressive performance in the previous week, the market’s momentum fizzled out as oil prices plunged downwards and regional equity markets started witnessing the sell-off. The pattern would continue for the rest of the week, with the KSE-100 shedding losing an average of 300 points (1%) every session to end the week with an overall loss of 1,014 points.

Panic gripped global equity markets over concerns of the health of financial institutions in Europe. With commodity prices having fallen sharply over the last year and a half, the effects are likely to start reflecting on financial institutions in the coming months with bad loans kicking in.

The equity rout started with Asia, spread through Europe and finally gripped the US with the main indices falling sharply throughout the week. As a result, foreign investors began pulling out of their investments in emerging markets which led to stock markets crashing in those markets as well.

Oil prices continued to be extremely volatile and fell to $26.21 per barrel after approaching the mid-30s in the previous week. The sharp decline saw the Oil and Gas sector fall 4.8% during the week. However, a notable exception was Pakistan Oilfields Limited which rose 7.4% during the week after beating expectations with its earnings and dividend payout.

The banking sector suffered from profit-taking and fell 3% during the week while the cement sector (down 4.8%) and the fertiliser sector (down 3.6%) also fell as a result of pricing power erosion for manufacturers in both sectors. Foreign selling continued unabated with foreigners offloading a net of $17.3 million worth of equity during the week. The number was a sharp jump from the $2.2 million net selling witnessed in the prior week.

Average daily volumes fell 2.4% to 140.8 million shares traded per day, while average daily values also fell 6.5% to Rs7.98 billion per day. The Pakistan Stock Exchange’s market capitalisation stood at Rs6.66 trillion ($63.6 billion) at the end of the week.

Winners of the week

Jahangir Siddiqui & Co

Jahangir Siddiqui & Company Limited is an investment company, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

Ghani Glass

Ghani Glass Limited manufactures and sells glass containers. The company manufactures international glass containers for pharma, food and beverage firms. Ghani Glass also manufactures float glass variations for commercial, domestic and industrial use.

Feroze1888

Feroze 1888 Mills Ltd manufactures and sells a wide range of cotton towels and fabrics.

Losers of the week

Kohinoor Textile

Kohinoor Textile Limited manufactures and sells grey cloth.

Ferozsons Laboratories

Ferozsons Laboratories Ltd manufactures and sells pharmaceutical products.

Pak Suzuki Motor

Pak Suzuki Motor Company Limited manufactures, assembles and markets Suzuki cars, pickups, vans and 4 X 4 vehicles.

Published in The Express Tribune, February 14th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ