Budget2014

More News

-

Post-budget briefing: Sindh wants Centre to withdraw taxes, give more from divisible pool

CM’s adviser fears government will miss its targets in the current budget.

-

A slice of the pie: Health sector gets 10% increase in allocation

Finance minister says Rs8 billion allocated for 67 ongoing and 26 new health projects.

-

K-P unveils Rs404.805b budget

The budget size is 18% higher than that of the previous year.

-

Finance bill: Govt plans tax increase across the board

The government has proposed that service stations and cellular companies’ towers be brought in the tax net.

-

Setting the tone: Over Rs100b allocated for 1,251 development schemes

An additional Rs39.77b has been patched together from foreign grants, loans.

-

Sindh budget: Industrialisation issue remains unattended

The union urged the Sindh government to study the Punjab model of growth.

-

Water schemes: Govt likely to utilise only half of allocated funds

Annual Plan blames poor planning, monitoring and evaluation.

-

Explaining the budget: Yellow cab scheme to provide 50,000 rural jobs

Rs5b subsidy provided for fertiliser, federal govt asked to provide matching amount.

-

Enhancing strength: CM’s Secretariat set to expand

72 new posts to be created in the secretariat.

-

JUI-F MNA questions why minorities could not be PM or president

The budget for 2014-15 does not have anything meaningful for minorities, JUI-F MNA Asiya Nasir also remarks.

-

Figure fudging?: Budget deficit understated by Rs280b

Budget documents reveal gap between national income and expenses is around Rs1.7 trillion.

-

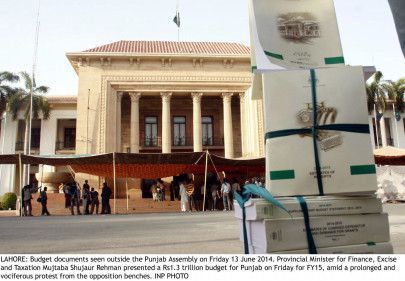

Punjab presents Rs1.044tr budget

Opposition leader Mian Mehmoodul Rashid started the protest as soon as the budget speech commenced.

-

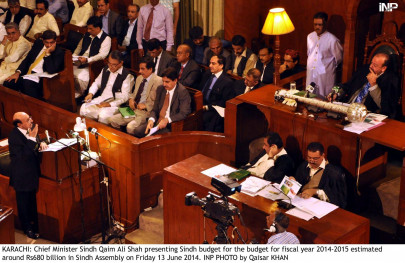

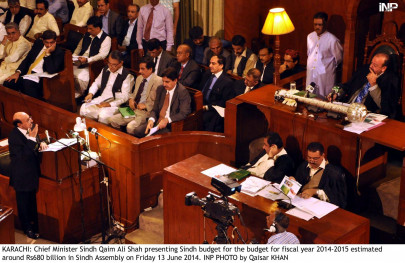

Rs686 billion Sindh budget unveiled

Development outlay slashed; chief minister rails against centre for poor tax collection.

-

Revenue generation: New taxes introduced for big houses

Annual tax on vehicles of 1,300cc and above doubled.

-

Punjab’s budget: Province to pour Rs31b into energy projects

Allocation 52% more than that provided in outgoing year.

-

Achieved: Province meets tax collection target of Rs42b

Experts warn 25% increase may prove to be negligible .

-

Dissatisfaction: Sour Sindh contests GIDC

Provincial CM makes it a point to mention cess in budget speech.

-

With heavy reliance on federal govt, Sindh keeps agriculture tax elusive

In absence of resource mobilisation, province resorts to indirect taxation.

-

Sindh promises better health this year

In an effort to improve primary health care, 84 new initiatives are being introduced.

-

Punjab budget 2014-15: Police, Rescue and Prisons

Rs81.68 billion has been allocated to police while Rs7.36 billion has been fixed for the Punjab prisons.

-

Punjab budget 2014-2015: Auqaf and religious affairs

Govt will be restoring, conserving the Wazir Khan Mosque and Re-constructing the Shrine of Hazrat Madhu Lal Hussain.

-

Punjab budget 2014-2015: Information and culture budget

The allocated amount consists of Rs484 million for the ongoing schemes and Rs123 million for the new schemes.

-

Punjab allocates Rs541 million for labour and human resource

Govt allocates Rs541 million for the sector.

-

Punjab Archaeology budget 2014-15

Of the allocated amount, Rs329 million is for ongoing schemes and Rs52 million for the new schemes.

-

Affirmative steps: Rs320m for human rights protection, minorities

Proposed share in budget Rs105m higher than the allocation in the last fiscal year.

-

Annual Development Programme 2014-2015: Going strong on infrastructure

Utilisation remained low during the outgoing financial year.

-

Parha Likha Punjab: Rs30.9 billion uplift budget for education

Rs18.6b earmarked for school education, Rs11.5b for higher education and Rs800m for special education.

-

The people speak: Simple folk with not-so-simple desires

K-P residents share their qualms regarding today’s ‘pro-poor’ budget .

-

Punjab govt presents Rs1.3 trillion budget amid uproar

Thirty-six percent of total budget has been allocated for the development of southern Punjab

-

Poultry matters: PPA receives support from economists

Asks govt to review taking back zero-rating tax facility.

-

Taxation: A not-so simplified sales tax regime

Retail sector points out flaws in new proposal to collect taxes.

-

Education budget analysis: A for allocation, B for being clueless, govt doesn’t know rest of the alphabets

Only 24% of the allocated amount for development schemes was spent.

-

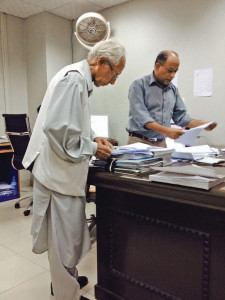

Behind the scenes: Meet the 80-year-old who’s the backbone of Karachi’s city budgets

Masood Ahmed Jafri has been involved in KMC’s finances, writing the official analysis, guiding staff since 1978.

-

Sindh to unveil Rs688b budget

Finance officials say deficit likely to reach Rs10 billion.

-

Sindh to introduce liver transplantation facilities

Govt has already allocated Rs1b to the project in the upcoming budget.

-

Budget allocation: Senators seek guarantees for provincial share

Say allocations should not be made solely on the basis of tax collection targets.

-

Suggestions: PAMA commends budget proposals, wants more

Urges increase in duties on import of used cars.

-

After budget hype dies, reality starts to creeps in

Textile sector disgruntled at GIDC increase, rejects budget package.

-

Over Rs97b allocated for various projects in G-B

An allocation of Rs50 million has been made for another 30MW hydro power project in Ghowari.

-

Necessary: Pay more attention to agriculture, govt told

ICCI president says it is important to boost per acre yield.

-

Industrialists reject property valuation tables

Split on rate of increase tax in proposals sent to province.

-

Turning around

Turning the Pakistan economy around requires courage, vision and innovation, and we hope these are delivered.

-

Voicing criticism: Opposition senators contest budget numbers

Opposition parties in the upper house say figures presented by govt were not only distorted but inconsistent as well.

-

Unhappy: Rice exporters unable to digest budget proposals

The industry is shocked over the government’s attitude of completely ignoring its budget proposals.

-

Cigarettes, garments, leather: Tax increase comes into force before start of year

FBR begins collecting higher taxes to bridge revenue gap in outgoing year.

-

Demonstration: Pensioners protest outside K-P Assembly

Retired government employees protests against the 10% increase in their pensions, terming it inadequate.

-

Budget criticism: K-P businessmen want tax exemptions, relief packages

Appreciate curb on SROs, provision of NTNs for industrial gas connections.

-

Widening tax base: Heavy taxes imposed on transfer of vehicle ownership

New rates equal to charges for registering a new vehicle; move likely to lead to surge in prices of used cars.

-

A lifetime of service: ‘10% increase in pensions is eyewash’

Retired govt employees lash out against meager pension increase in federal budget.

-

Budget 2014-15: Sindh govt targets bikers to widen tax net

Proposal calls for taxes to be levied on owners of 120sq yard plots, petroleum products.