K-P unveils Rs404.805b budget

The budget size is 18% higher than that of the previous year.

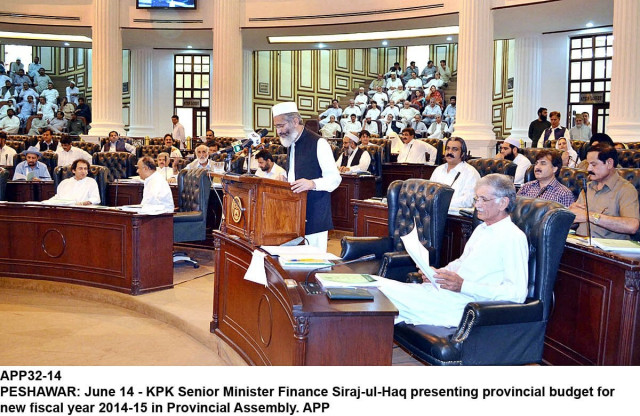

Khyber-Pakhtunkhwa finance minister Sirajul Haq presenting the provincial budget on Saturday as K-P Chief Minister Pervez Khattak reviews the budget document. PHOTO: APP

Khyber Pakhtunkhwa (K-P) Senior Minister for Finance Sirajul Haq on Saturday unveiled a Rs404.805 billion budget for the fiscal year 2014-15.

Sirajul Haq told the house that the budget size was 18% higher as compared to that of the previous year. The government expenditure estimates also show a total outlay of allocations at Rs404.80 billon.

Although the budget claims to introduce no new taxes, a nominal change has been made in the existing taxes.

Estimates for the revenue receipts show that province is set to get Rs227.121 billion from its share in federal taxes. It is also poised to get Rs27.290 billion in lieu of 1% of the federal divisible pool for the war on terror.

The K-P will get Rs29.263 billion in direct transfer from the federal government.

The province will generate about Rs13.930 billion from its own tax and non-tax receipts, Rs12 billion from net profit for hydel power generation, a likely income of Rs32.272 billion from net hydel profit arrears, Rs2.875 billion from own hydel power generation and Rs477 million from population welfare programme.

The K-P is slated to get Rs270 million from recoveries of loans and advances. However, it also envisages operational shortfall of Rs12 billion for the next financial year.

The expenditure estimates show allocation of Rs73.280 billion for general public service, Rs62 million for civil defence, Rs35.428 billion for public order and safety affairs, Rs19.340 billion for economic affairs, Rs37.048 million for environmental protection and Rs4.770 billion for housing and community amenities.

Rs20. 985 billion have been allocated for health, Rs87.632 billion for education and services, Rs4.975 billion for foreign debt servicing while Rs9.375 billion has been set aside for domestic debt servicing.

Annual Development Programme

The budget envisages the ADP of Rs139.805 billion for the year. Provincial government will contribute Rs100 billion, while Rs39.75 billion will be generated from foreign project assistance (FPA).

The provincial development programme comprises about 1,251 development projects, of which 711 are ongoing and 540 are new.

Salaries, pensions and cost cuttings

Siraj also announced a 10% salary raise for government employees, while medical allowance of grade 1 to 15 employees was increased by 20% and conveyance allowance by 5%.

Grade 1 to 4 employees will also get a premature increment, while pensioners will also get 10 % raise.

The provincial government has also increased the minimum pension from Rs5,000 to Rs6,000. Government will also face an additional burden of Rs10 billion annually.

Siraj also announced complete ban on foreign medical treatment for governor, chief minister, ministers and lawmakers. However, in case of unavailability of treatment of any particular illness, individual cases of all, including ordinary citizens, will be considered from provincial funds.

He also announced a ban on public representatives’ and government officials’ foreign visits to attend workshops, seminars and trainings. “A ban has also been imposed on purchasing vehicles for development projects and reduction in POL, electricity,” he added.

The minister said free stay at all rest houses, lodges and dak bungalows by all except members of the provincial assembly has been disallowed.

“For all new appointments, an NOC will be required from establishment department, while new houses for public representatives and government officials will not be constructed on more than 10 marlas,” he said.

Taxes

The finance bill envisages tax on agriculture income of more than Rs400,000. Five percent tax will be levied on an income of Rs450,000 to Rs5,50,000; while in case of an income of Rs550,000 to Rs750,000, a tax Rs7,500 will be charged – including 7.5% tax on income in excess of Rs550,000.

Those earning Rs750,000 to Rs950,000 will have to pay Rs22,500 including 10% on income over Rs750,000. On an income of Rs950,000 to Rs1.15million, Rs42,500 tax will be applicable which includes 17.5% tax on income over Rs9,50,000.

Land tax on property of 5-12 acre land has been set at Rs225 and Rs340 for over 12 acres. Rs900 tax has been imposed on orchards.

Those in the bracket of Rs10,000 to Rs20,000 will pay professional tax of Rs330, people earning Rs20,000 to Rs50,000 will pay Rs435, those earning Rs50,000 to Rs100,000 will pay Rs600, people earning Rs100,000 to Rs200,000 will pay Rs800 while those earning Rs200,000 to Rs500,000 will have to pay Rs1,000.

Government employees of grade 5-12 have to pay Rs100, from grade 13-16, Rs200, of grade 17, Rs300, of grade 18, Rs500, of grade 19, Rs1,000 and of grade 20 and above Rs2,000 as professional tax.

In addition to these, taxes on naswar dealer, jewelers, cable operators, money changers, transport companies, property dealers, doctors, marriage halls, catering, guest houses, restaurants, travelling and clearing agents have been reviewed in the budget.

Siraj also presented supplementary budget of Rs29.885 billion, of which Rs16.361 billion were incurred on current expenditure and Rs12.726 billion for development projects.

Towards the end of the session, opposition members tried to disrupt Siraj’s speech, they tore budget copies and staged walkout from the house. The session was later adjourned till Tuesday.

Published in The Express Tribune, June 15th, 2014.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ