Budget2014

More News

-

Speakers urge government to take steps for disabled

Demand equal rights for special persons.

-

Win-win: Move will benefit industry and government, says analysts

Government proposes to replace FED collection system.

-

‘Abolition of 10% FED only on local cars unfair move’

Dealers’ association complains govt favouring local assemblers.

-

Spiralling: Steel prices to rise after budgetary measures

Will go up Rs6,000 due to increase in taxes.

-

Number crunching: Finance Bill 2014 reveals budget as unfriendly

Telecom sector laments ‘high taxation rates’, to meet Dar soon.

-

Raise rebuke: Police arrest over 100 clerks at D-Chowk

Batons, rubber bullets used to disperse protest; they were demanding 50% increments.

-

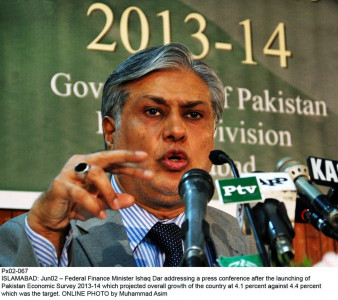

Dar downplays ‘pro-business’ tilt

Says influential segment has been brought under tax net for the first time.

-

Green light: FCCI terms budget business-friendly

Budget will help in streamlining the national economy in a permanent and sustained manner.

-

Right direction: Despite reservations, OICCI terms budget ‘commendable’

Incentives mark substantial step towards economic growth.

-

Construction industry hopeful after govt pledge

Plan to revive House Building Finance Company pleases sector.

-

Taxing away: Don’t blow up the proposal in smoke

Industry wants enforcement to discourage illicit trade.

-

Real estate and textile: Lobbies get tax plans changed in their favour

Ministers demand increase in salaries, PM rejects.

-

The mantra of every budget session: 'This budget is not people-friendly'

PPP Senator says budget has been prepared by industrialists for businessmen with no relief for common man.

-

2014-15: Fiscal year brings Rs231b in new taxes

Govt scraps Rs103b tax exemptions to broaden revenue base.

-

For less than 12 months: Proposal put forward to increase Capital Gains Tax to 12.5%

Tax not applicable on sale of stocks after holding period of 2 years.

-

Tax proposed on business class air passengers

Govt proposes 3% advance tax on business and club class air passengers in a bid to widen the tax net.

-

Telecom receives much-needed relief

FED removed, withholding tax reduced by 1%.

-

Outlook: Stitching optimism for the textile sector

Industry players term package a surety for increasing exports.

-

Subsidy pool gets leaner as govt sets aside Rs203b

Energy firms and essential commodities will get cushion.

-

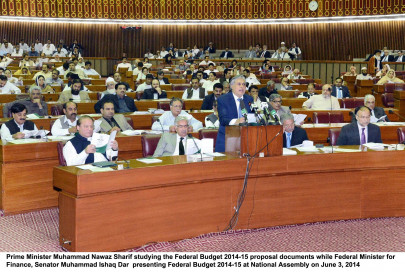

Cabinet approves budget proposals

Prime Minister Nawaz says main objective of new budget was to provide relief to the masses and increase tax base.

-

Budget breakdown: Govt expects to receive $8.6b in foreign loans

Pakistan to receive Rs1b from China, Rs16b under Kerry-Lugar Act; Rs49.5bn from Islamic Development Bank.

-

Austerity measures: PM Office spending slashed for now, but door open for revision

Govt made a cut, at least on paper, in budget of PM’s Office for fiscal year 2014-15, pegging it on Rs779.35...

-

Carving the pie: Provinces’ share in federal taxes swells

FBR ability to achieve Rs2.810tr tax target will determine how much the provinces will receive.

-

Law ministry bags Rs1.2 billion

Islamabad High Court gets a significant chunk for reconstruction.

-

Analysis: Get your numbers straight, minister

Dar artificially inflated the 2013 deficit by transferring a massive chunk of circular debt payments to that year.

-

Preservation of intangible heritage not a priority

Biggest chunk of budget allocated for rebroadcast stations.

-

National Conference on MDGs: Govt allocates Rs12.5 billion to help accelerate progress

Legislators draw up plans to meet targets.

-

Slight increase: Rs64 billion earmarked for education sector in PSDP

National Plan of Action not mentioned.

-

Mixed priorities: Over Rs1b allocated for health projects

Five new projects included in PSDP for 2014-15 for Islamabad; major chunk to go to CADD.

-

Twin cities low on development agenda

Islamabad and Rawalpindi projects get Rs6.7 billion less in PSDP for 2014-15 against last year’s Rs28.85 billion.

-

Budgeting for 2014-15—more of the same

We are a nation that spends vast amounts on weapons when a large proportion of our population is illiterate.

-

Provinces share in federal taxes increases to Rs1.720tr

Allocation will depend on FBR’s ability to meet Rs2.810tr tax target

-

Budget 2014-15: Real-time analysis

In-depth analysis of the budget for fiscal year 2014-15.

-

Budget 2014-15: Giving relief to the telecom sector

Govt withdraws FED on telecom services from provinces that have imposed GST.

-

Budget 2014-15: PM House spending

In 2011-12 and 2012-13, the budget of the PM office was increased at whopping rate of 56 and 58 per cent respectively.

-

Budget 2014: Govt announces 700bn defence budget

Defence expenditure almost doubled in last five years.

-

Dar unveils ambitious budget

Minimum wage rate increased to Rs12,000, President House to get Rs243,253,000.

-

Budget 2014-15: Rs1.325 trillion budgeted for debt servicing in Finance Bill

Debt as a percentage of GDP is projected to go down.

-

Budget 2014-15: 5.2% growth target set for services sector

Government introduces housing and housing finance schemes, seeks to bring the retail sector under the tax net

-

Budget 2014-15: Agriculture sector growth target lower than last year

Budget 2014-15 introduces support packages for farmers, several insurance schemes introduced

-

Budget 2014-15: GDP growth target revised upward

The government will also envisage a fiscal deficit of 4.8% of gross domestic product in the budget for FY15

-

Budget 2014-15: Non-tax revenues

Expected that government will allocate nearly half a billion dollars for leftover spectrum.

-

Budget 2014-15: Broadening the tax net

FBR tax revenue projected at Rs2,810b.

-

Budget 2014-15: Subsidies and circular debt

Power subsidies to be reduced; circular debt not to be cleared.

-

Budget 2014-15: Government optimistic about industrial growth

Growth target for the large scale manufacturing (LSM) sector has been set at 7% for fiscal year 2014-15

-

Budget proposals: AJK urged to allocate more for children

Activists demand budgetary provisions for community midwives, girls’ education.

-

Proposals: Call for budget that addresses issues on ground

Centre, provinces urged to allocate ample funds for health, education, drinking water.

-

Constructing an impressive period

Posts more than targeted growth of 11.3%

-

Economic survey 2013-14: Off target

Dar, however, pledges to increase growth rate by 1% every year taking it to 7% by 2017.

-

Reviving businesses: K-P to set up two industrial estates

Adviser to CM on Industries said that the government is keen to introduce different industrial schemes in the budget.