LSE to open think tank to assist in policymaking

Think tank, named Lahore Financial Centre, will also promote investment.

"I believe that coming days will be good for the economy as we expect the incoming govt to privatise some state owned enterprises," LSE MD Aftab Ahmad

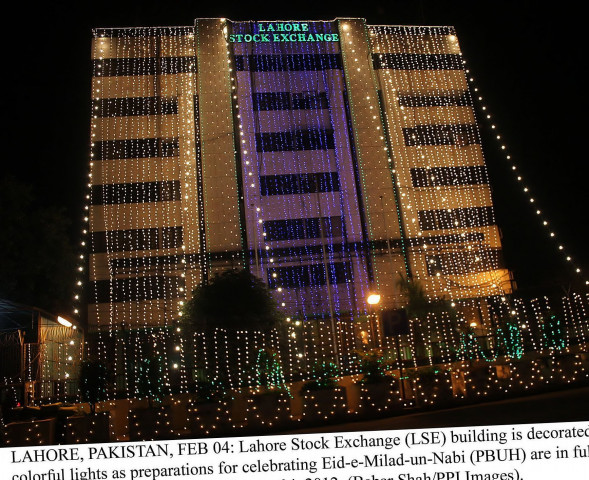

Chaudhry. PHOTO: PPI

As the new government is about to take over, hopes of business community, particularly of Punjab, are flying high. Revival of economy, reining in the energy crisis, investment by domestic and foreign investors and job creation are what they expect to see in coming months or years.

Leading business groups and associations have made plans to share ideas with the government. Some of them, including the Lahore Stock Exchange, are focusing on introducing modern trading trends in the country, which they believe will provide huge opportunities for large and small businesses as well as state-owned corporations, banks and financial institutions.

One of the key initiatives LSE management is hoping for is the opening of the Lahore Financial Centre. This centre, which is likely to start operating in July, will work as a think tank and will assist the government and private businesses in policymaking and enhancing expertise to grow businesses and turn this part of the region into a business hub, especially when prospects of opening up trade with India are bright.

The centre will work with government departments, banks, financial institutions and other businesses to also promote investments, both local and foreign.

“I believe that coming days will be good for the country’s economy as we expect the incoming government to privatise some state-owned enterprises. With this, responsibilities of LSE will likely increase and we are preparing ourselves for this,” says Aftab Ahmad Chaudhry, Managing Director of LSE, in an interview to The Express Tribune.

Commodity and power exchanges

Apart from the financial centre, Chaudhry aims to launch two more projects – a spot commodity exchange and a power exchange.

“Punjab contributes 80% to the agricultural economy of the country, almost every company and business, one way or the other, is associated with agriculture, our strength is agriculture, so why not we regulate this sector properly,” he asks while referring to the plan to open a spot commodity exchange.

However, this project will take a long time before coming on stream as a majority of stakeholders, like farmers, are uneducated. Linking all wheat markets of Punjab to set a uniform price, providing farmers with an opportunity to trade in futures contracts along with storage facility at accredited warehouses and much more will be the features of the commodity exchange.

“We kicked off this project two years ago, but were forced to stop work, people are yet to understand the system, they don’t know how it will revolutionise their life. We will restart the project soon,” Chaudhry says.

Talking about the power exchange, he believes that privatisation of power distribution companies will stabilise the sector as is the case with Karachi Electric Supply Company (KESC), which is now on its way towards stabilisation.

In India, around 20% of power production is traded on three power exchanges which are giving fruitful results, why not in Pakistan, he asks.

When power companies will be offered for privatisation, industrial areas may purchase shares in respected distribution companies to ensure uninterrupted electricity supply to them.

Share float

Talking about the stock market boom, he says the domestic bourse is still lower compared to other exchanges in the region as foreign investors consider share prices in Pakistan to be standing around 2005 levels due to depreciation in the value of rupee.

“This is the most appropriate time for the government to raise money from stock exchanges by floating at least 10% shares in state-owned enterprises,” he says. “Indian market regulator did this last year and generated revenue of $2.5 billion. Pakistan may use its revenue for curtailing circular debt or for development projects.”

Published in The Express Tribune, June 5th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ