Weekly Review: KSE-100 closes flat despite eventful week

Simmering political and religious tensions kept the index from hitting all-time high.

The stock market witnessed a mixed week, as ongoing political and religious tensions kept the benchmark KSE-100 index on a leash.

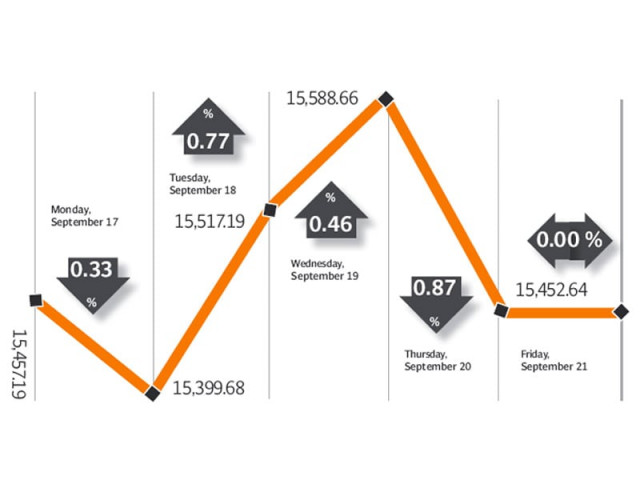

The index closed flat at 15,452 points during the week ended September 20. Investor participation also dropped as volumes dwindled by 21% during the week.

The week started on a positive note as the Attock Group announced impressive results for both Pakistan Oilfields and Attock Refinery Limited, beating market expectations and announcing better-than-expected payouts. However, with the Supreme Court’s ruling on the National Reconciliation Ordinance (NRO) implementation case due, investors chose to book profits and the index closed in the red on the opening day of the week.

The following day, the ruling was announced and was viewed as lenient by investors, which led to a rally at the bourse. The oil sector dominated proceedings, with Attock Group companies leading the way. Wednesday was a similar story, as the index gained another 71 points, with the oil companies leading the way.

However, the law and order situation deteriorated across the country on Thursday as protests against an anti-Islam film turned violent and resulted in profit-taking by investors. The index shed 136 points and closed at 15,452 points, as compared to last week’s closing of 15,449 points.

Friday was declared a national holiday by the government.

Foreigners were net buyers of $3.9 million worth of equity as investment in the oil sector grew. Macroeconomic statistics for August revealed a surplus in the current account of $1.2 billion, as compared to a deficit of $321 million in July. The improvement was largely due to the release of $1.18 billion from the Coalition Support Fund (CSF) by the United States.

Average daily volumes stood at 129 million shares, down 21% over the previous week. Average daily value, however, rose 3.2% to Rs4.46 billion, reflecting higher investments in oil companies and similar blue-chip stocks. The market capitalisation dropped 0.4% to Rs3.91 trillion by the end of the week.

What to expect?

The violence witnessed across the country on Friday is sure to play a part in investor’s decisions in the coming week. The government-judiciary tussle will also be monitored closely by investors as the Supreme Court gave a deadline of September 25 to the prime minister for implementation of its decisions.

Winners of the week

IGI Insurance

IGI Insurance was incorporated in 1953, and is a flagship organisation of the Packages Group. The company underwrites all types of property and casualty insurance: fire, marine, motor, travel, health, home and miscellaneous.

Packages Limited

Packages Limited, together with its subsidiaries, engages in the manufacture and sale of paper, paperboard, packaging materials, and tissue products in Pakistan, Sri Lanka, and internationally.

Dawood Hercules Corporation

The principal activity of the company is production, purchase and sale of fertiliser. The company has an annual production capacity of 345,000 metric tons. It recently announced plans to sell its fertiliser business to Pakarab Fertilizers.

Losers of the week

Grays of Cambridge

Grays of Cambridge (Pakistan) Limited is primarily engaged in manufacturing sport goods including hockey sticks. It has a cricket ball manufacturing unit which produces balls with famous brand names like Duke & Sons and Gray-Nicolls.

Media Times

Media Times Limited is engaged in printing and publishing daily English and Urdu newspapers and the production, promotion, advertisement, distribution and broadcasting of television programmes through satellite channels.

KESC

Karachi Electric Supply Company (KESC) is engaged in the generation, transmission and distribution of electricity to industrial, commercial, agricultural and residential consumers. It covers an area of 6,000 square kilometres.

Published in The Express Tribune, September 23rd, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ