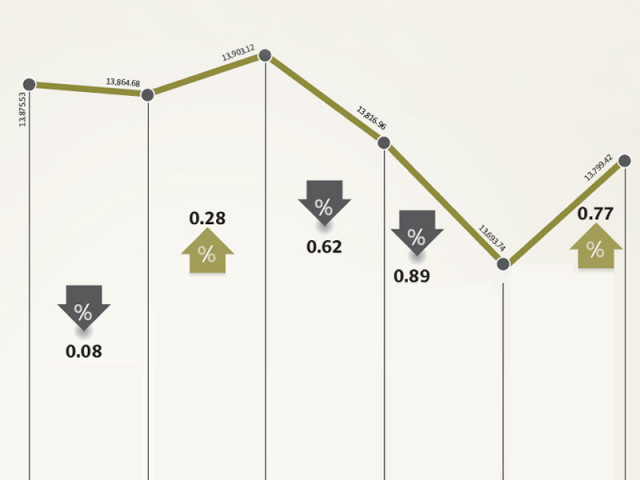

Weekly review: KSE-100 sheds 0.5% as uncertainty prevails

No news regarding the revised CGT regime keeps investors worried.

A lack of any new information regarding the revised Capital Gains Tax (CGT) regime resulted in a range-bound week at the stock market; the benchmark KSE-100 index closed on Friday at 13,799 points – down 0.5% (76 points) over the previous week.

Two weeks have passed since the original date of implementation of the revised CGT regime, but the Securities and Exchange Commission of Pakistan (SECP) or the finance ministry have yet to give an official indication regarding the finalisation and implementation of the new regime.

The possibility of an amnesty, first announced by the Finance Minister in January this year, had breathed new life into an otherwise dead stock market; volumes picked up and market capitalisation of the Karachi Stock Exchange increased by more than Rs500 billion.

Investors are now anxious for a Statutory Regulatory Order or a presidential order whereby the regime will go into force. However, both the SECP and the Finance Ministry have remained mum about the issue. Some investors fear that there will be no ordinance in the near future, and that the revised regime will be part of the budget for fiscal year 2012-13, meaning it will be delayed till June.

The lack of any other significant trigger meant that the index remained range bound and oscillated between the 13,600 and 14,000 point levels. The index breached the 14,000 point barrier briefly on Friday, after a strong rally was witnessed in the Oil and Gas sector. However, these gains were clipped by the end of the session.

Other noteworthy news during the week was sector specific, as well as macroeconomic, but failed to have a lasting impact on the market. In the headlines was news that the government is going to restore Nato’s supply network through Pakistan, and in return payments to the Coalition Support Fund will be restored – bringing in some much needed foreign currency in the country.

In sector news, Oil and Gas came alive during the week after the lowered BTU Gas Pricing Policy was approved in a meeting of the Economic Coordination Committee. Pakistan Petroleum led the way with gains of 4.5% during the week, while OGDC and Pakistan Oilfields also witnessed late rallies.

Pakistan Telecommunications Limited (PTCL) was also in the news after the government asked Etisalat to pay up the remaining $800 million from PTCL’s privatisation. As a result, PTCL gained 5% during the week.

Volumes remained steady at 374 million shares traded per day, down 3%, while average daily values dropped 7% to Rs7.17 billion per day.

Monday, April 09

The stock market closed slightly lower and with this decline, fell further away from the 14,000-point barrier.

Weak international markets and uncertainty on the political front led investors to book profits at inflated levels.

Tuesday, April 10

The stock market continued to flirt with the 14,000 points psychological barrier, but closed shy after posting modest overall gains during trading.

Trading volumes were lower during the day, as investors chose to remain cautious before any solid development on the capital gains tax amnesty.

Wednesday, April 11

The stock exchange closed red, as investors grew restless and chose to book profits after failing to obtain any official signal related to a relaxation on the Capital Gains Tax (CGT) regime. Rumours are now circulating in the market that the CGT amnesty will not be implemented before the budget.

Thursday, April 12

Disappointed of the unyielding stance of the finance ministry on news regarding the Capital Gains Tax (CGT) amnesty, investors opted to book profits on Thursday – in continuation with a downward trend in the market triggered first on Wednesday.

Friday, April 13

The stock exchange staged a recovery, amidst profit-selling in lower-priced stocks and renewed interest in the energy and power (E&P) sector. Trading started on a strong note and breached the 14,000 point psychological barrier early in the second half of trading, but all was downhill from that point on.

Published in The Express Tribune, April 15th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ