The year when new cars got back in the game

2016 concluded with many positives, mainly entry announcement of three new players

The year when new cars got back in the game

After years of idle capacity, several out-of-business players saw it as an opportunity. The existing players weren’t too happy, but were content with high sales figures that were spurred by lower cost of financing, cheaper oil and higher purchasing power.

It was reflected in the stock prices of all three players - Indus Motor Company, Pak Suzuki and Honda Atlas - that rallied to record levels as the KSE-100 Index itself shattered its own boundaries.

The industry itself remained optimistic to double auto sales in the next five years.

History

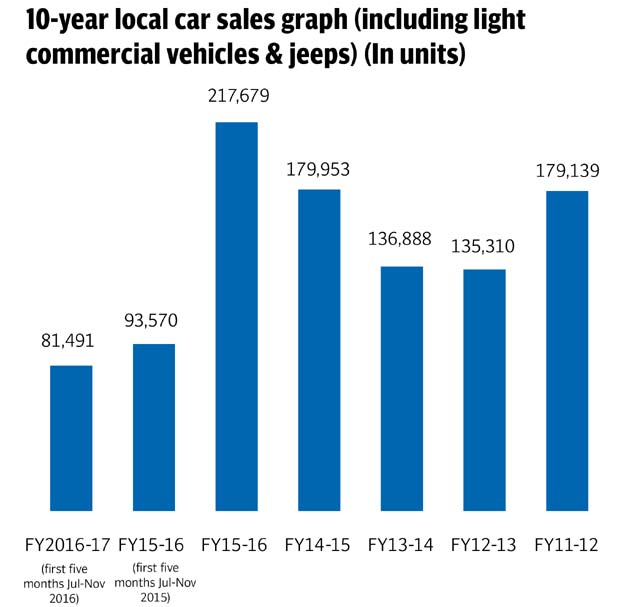

Pakistan’s first auto-policy was introduced for 2007-2012 with the objective to produce 500,000 cars a year. Now even after 10 years, the country is just producing only half the targeted units. That’s why auto industry calls it a ‘lost decade’.

“The future looks very promising, unless some policy issue comes in and smashes the industry’s positive sentiments,” Pakistan Association of Automotive Parts and Accessories Manufacturers (Paapam) former chairman Aamir Allawala said. “The industry is all set to recover what it lost in the last decade.”

Due to untapped potential and subdued demand in the last decade, Paapam officials believe the auto industry could attract up to $4-5 billion in new investments over the next three to four years.

From June 2012 until March 2016, the local auto industry was completely directionless. The last auto policy, which expired on June 30, 2012, had already failed to achieve its targets. The current government took over office in mid-2013, but shockingly enough took over two-and-a-half years in announcing the new policy that further weakened the already dampened investment atmosphere.

Fast forward to 2017, industry players are targeting to produce 500,000 units annually. Some optimistic players say it’s better late than never.

Their confidence is not unfounded. The industry now has a direction and the stage has already been set by continuous improvement in auto sales in the last four years.

Analysts say strong macroeconomic indicators and 42-year low interest rates that boosted auto car financing will continue to remain the dominant factors helping the local auto sales.

In fact, the market recovered the losses it made in the last decade due to uncertain government policies and below average economic growth. For instance, auto sales in fiscal year 2016 have touched 217,679 units, an all-time high figure compared with previous best figures of 204,212 units in 2006-07 due to robust GDP growth rate and unprecedented auto financing from banks in Musharraf’s era.

Entry of new players

The government’s bet on new auto players finally paid off. In September 2016, Dewan Farooque Motors Limited (DFML) became the first company to announce its reentry in the local market in collaboration with Kolao Group based in Laos and South Korea.

DFML assembled Hyundai Santro and Hyundai Shehzore for over 10 years before the giant business group collapsed due to defaults on loan repayments. The company has plans to launch different variants of Shehzore truck along with a 1,600cc engine capacity sport utility vehicle (SUV) in collaboration with Ssangyong China in 2017.

Board of Investment (BoI) in November revealed that the French automobile manufacturer Renault has decided to enter Pakistan and it will start assembling cars by 2018. Although, there is no official word from Renault, BoI Chairman Miftah Ismail had said the company will invest $100 million to expand the capacity of Ghandara plant to assemble vehicles.

In December 2016, the next announcement surprisingly came from Lucky Cement - the second largest cement maker in Pakistan - which announced to enter in auto industry in collaboration with South Korean automobile giant Kia Motor with an investment of Rs12 billion.

Stock market performance

Among the top 10 sectors of Pakistan Stock Exchange (PSX) in terms of market capitalisation, autos remained top performing sector posting market cap gains of about 70%, according to a Topline Securities report.

Last year, the sector remained the second best with an overall return of 13%.

Pakistan has one of the lowest cars per 1,000 (13 cars per thousand) consumption as compared to regional peers. Analysts expect this to gradually increase to 20 cars per 1000 people by the end of 2021.

Auto sector remained a key beneficiary of rising sales led by increased consumer demand, low oil prices and inflation, and improving economic growth. Most of these positives are likely to support the industry in 2017.

Published in The Express Tribune, January 1st, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ