Four strategic investors file bids for PSX stake

Winner of bids will be announced in a couple of days

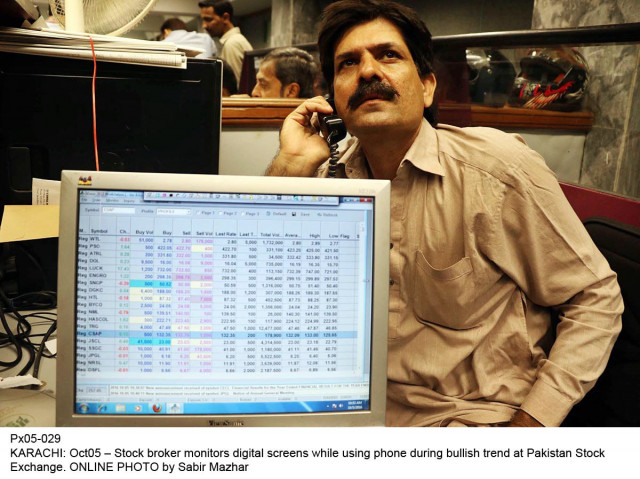

PHOTO: EXPRESS

One of the interested investors was a consortium named Markhor that submitted its bid for the entire 40% stake. It comprised Nasdex, DCE Capital, Kingsway Capital and Blibros Capital, MCB Bank and Faysal Bank.

Shanghai bourse interested in PSX stake

Another was a Chinese consortium of which Habib Bank Limited was also a part. National Bank of Pakistan and Habib Metropolitan Bank placed bids for 5% stake each in their individual capacities.

According to regulations, local financial institutions cannot file bids for more than 5% stake each irrespective of whether they are part of a consortium or not.

“PSX extended the time for bid submission by the Chinese consortium till 10pm, as officials of the consortium had to travel all the way from China to the exchange,” said an official.

Sources, however, said the Chinese consortium had demanded some special incentives with the 40% stake, but the regulator Securities and Exchange Commission of Pakistan was reluctant. It was the favourite consortium, they added. However, the official said, the process was meant to earn money and those who met the set criteria and placed the highest bid would be announced as the winner in a couple of days.

Earlier, 19 strategic investors, including consortia of foreign and local investors, conducted due diligence of the stock exchange.

Bid prices

The official revealed that the PSX divestment committee would announce a date for opening the bids later on Thursday.

Haji Ghani Haji Usman, a former director of PSX, formerly Karachi Stock Exchange board, estimated the bid price in the range of Rs25-35 per share. Accordingly, the 40% stake (320 million shares) will fetch $76-107 million for stockbrokers.

Invest and Finance Securities analyst Danish M Owais put the tentative bid price at Rs26.57 per share, translating into around $81 million for the 40% stake. Insight Securities analyst Zeeshan Afzal evaluated that the bid price would be in the range of Rs45-72 per share, totalling $140-220 million.

All you need to know about the PSX divestment

Under the divestment policy, PSX would offer another 20% (160 million) shares to the general public within six months of the completion of acquisition process by the strategic investors.

Brokers, who are yet owners of the privately run PSX, may opt to sell the rest of their 40% stake or part of the remaining stake with them in the future.

Earlier, in January 2016, three local bourses namely the Karachi Stock Exchange, Islamabad Stock Exchange and Lahore Stock Exchange were integrated into the Pakistan Stock Exchange.

The integration was done to attract strategic investors, as it stood in line with government’s vision of a fair, efficient and transparent market with one national stock exchange conforming to international standards.

Published in The Express Tribune, December 16th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ