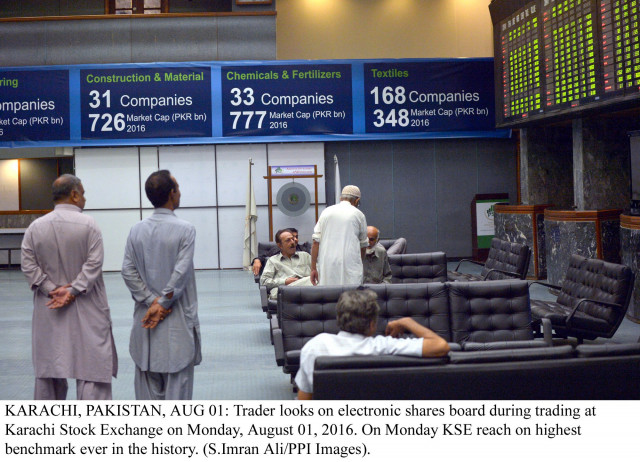

Market watch: Week starts off on bullish note

Benchmark KSE 100-share Index rises 438.81 points

Benchmark KSE 100-share Index rises 438.81 points. PHOTO: ONLINE

At close on Monday, the Pakistan Stock Exchange’s benchmark index recorded a rise of 1.10% or 438.81 points to end at 40,220.76.

According to Elixir Securities analyst Ali Raza equities surged sharply to close Monday positive as retail investors along with select institutional investors went on buying spree.

“Market started on the front foot and benchmark index steadily increased during the day as participants downplayed recent geopolitical concerns related to India-Pakistan and resumed aggressive buying primarily in second and third tier names.

“Moreover, select main-board plays also had a field day on reports of select institutional investors’ interest as index names such as United Bank (UBL +2.2%), Engro Corp (+2.8%), Fauji Fertilizers (FFC +1.6%), Nishat Mills (NML +5%), Hub Power (HUBC +1%) and DG Khan Cement (DGKC +2%) led day’s gains and cumulatively contributed more than 30% points to KSE-100 index.

“Expect market to carry momentum and retest previous highs with index names generating better activity going forward, while second and third tier names will continue to remain in the limelight.”

Meanwhile, JS Global analyst Nabeel Haroon thinks that investor interest was seen in textile sector, as NML, Nishat Chunian (NCL) and Gul Ahmed (GATM) gained to close on their respective upper circuits.

“UBL (+2.55%) and MCB (+0.62%) led the gains in the banking sector, as the sector gained to close (+0.89%) higher from its previous day close.

Dewan Cement closed on its upper circuit for second consecutive day, as the company in its material information, disseminated in the market, announced that it has allowed strategic Chinese investor to carry out due diligence process of the company.

Mughal Iron and Steel (-1.3%) lost value to close in the red zone, as the steel manufacturer declared its result for FY16. In its result announcement company posted earnings per share of Rs7.10 along with final cash dividend of Rs3 per share. Moving forward we recommend investor to accumulate value stocks on dips.”

Trade volumes fell to 484 million shares compared with Friday’s tally of 506 million.

Shares of 438 companies were traded. At the end of the day, 317 stocks closed higher, 102 declined while 19 remained unchanged. The value of shares traded during the day was Rs11.8 billion.

Bank of Punjab was the volume leader with 37.4 million shares, gaining Rs1 to finish at Rs12.41. It was followed by Pace (Pak) with 37.2 million shares, gaining Rs0.53 to close at Rs11.67 and WorldCall Telecom with 35.2 million shares, gaining Rs0.24 to close at Rs3.09.

Published in The Express Tribune, September 27th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ