tax

More News

-

Govt may increase tax on dividend income to 20%

Also likely to levy income tax on companies suffering gross losses.

-

Crackdown looms for India's super-rich tax avoiders

Lamborghini rolled out its new supercar onto the streets, local millionaires could hit a bump thanks to the 'taxman'

-

Govt likely to double WHT on cash withdrawals

FBR wants to collect an additional Rs3b through this proposal

-

Retailers: Turnover tax termed discriminatory

Retailers: Turnover tax termed discriminatory

-

Flat tax: rethinking the debate

It is transparent, fair, inclusive and could fix the tax system.

-

FBR looking to milk more taxes

The move is estimated to increase the price of packaged milk by at least Rs8 per litre

-

Pursuing digital dividends with high tax rates

Pakistan needs to find balance to realise IT sector’s potential .

-

Furore over closure of tax haven

The aftermath of the federal government’s decision to extend the Customs Act of 1969 to Pata has been a heated one

-

South Africans sweet on sugary drinks despite fat tax

South Africa ranked as one of the most obese nations on the continent

-

Revision: PBA wants income tax rate to be brought down to 32%

Banks’ association wants same tax rates as those on corporate sector

-

Tax authorities begin probes into some people named in Panama Papers leak

The documents are at the centre of an investigation published by International Consortium of Investigative Journalists

-

Panama vows to cooperate if legal fallout from 'Panama Papers' leak

In wake of "Panama Paper" leak, legal probe may be launched against the govt

-

Action: College sealed for defaulting on tax

The team also confiscated marble tiles and equipment from a marble factory for encroaching upon the road

-

Jewellers across gold-loving India strike over tax

Indian finance minister Arun Jaitley on Monday proposed to reintroduce a 1%t levy on some jewellery transactions

-

Pay tax? No thanks

Only 128 traders have so far availed the ‘tax amnesty scheme’

-

Widening the tax net: Voluntarily scheme being taken to traders

Akhtar directed VTCS teams to educate traders about the benefits of the scheme

-

Corporate results : PPL’s earnings amount to Rs11.78b in Jul-Dec

Six-month profit down 47%, company announces Rs2.25 per share dividend

-

Afghan Taliban flex muscles with new telecom 'tax'

At a secret meeting near Quetta, Taliban's central leadership formally demanded tax from four cellular companies

-

Money bill: Tax concessions for services sector come under fire

Senate panel chairman says minimum tax is against the law

-

Govt walks on tight rope as deficit widens to Rs490b

IMF-permitted limit is Rs625b for first six months of ongoing fiscal year

-

Institutional shortcomings behind mini-budget

Bringing money into tax net requires proper restructuring of tax machinery

-

Government mulls ‘asset regularisation scheme’

Negotiating with traders in attempt to bring them into tax net

-

Japan seeks abolition of tax on reserves, turnover

Pakistan outlines unfavourable conditions for textile exports

-

Bureaucracy blocks vital reforms in FBR

Reforms committee not yet functional as issuance of notification delayed

-

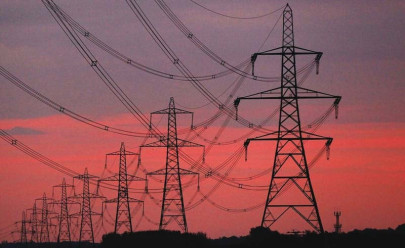

IMF to weigh in as Pakistan mulls single-stage sales tax

Taxation and energy remain top concerns; reforms will be discussed

-

Services tax: ‘PRA not imposing new taxes’

Sales tax on services was earlier collected by the FBR

-

Govt agrees to key demands of traders

Finance minister rejects proposal for tax amnesty scheme .

-

Tax-free transaction threshold raised to Rs100,000

Govt, traders agree to lower rate to 0.2% for interim period; no signs of a concession on tax amnesty scheme

-

Protest: Cantt traders refuse to pay tax to Punjab govt

They said professional tax should be collected from service providers and government contractors

-

Govt reconstitutes body to resolve transparency issues

Replaces members with conflict of interest; will listen to service providers

-

Taxman recovers Rs2.8m from Arsalan Iftikhar

The RTO team, taking action on the directives of the RTO-I Commissioner froze Arsalan’s personal bank account

-

The dead capital

Lack of information on income prevents governments from collecting taxes and acting for the public welfare

-

Pakistan’s creaking tax structure

Only a systematic reform agenda pursued with sincerity and transparency can increase tax collection

-

More people on airplanes right now than taxpayers in Pakistan

Report argues better tax collection will pay for itself; fiscal fragility will worsen if tax crisis not addressed

-

Services sector: Companies raise voice against 8% minimum tax

Newly formed action group threatens to discontinue services

-

Telecom market: Dar opposes parallel competition framework

Points out CCP is already working with powers to perform such functions.

-

Salaried class: Deadline for tax returns is Aug 31

Official said July figure was 6% higher compared to the same month of previous year when Rs133 billion was collected

-

Why are we so tax averse?

The country’s tax machinery has been unable to enforce tax laws, enabling businesses and citizens to hide

-

Trying to unite: Group forms ‘mega union’ to protest

Wants govt to take back withholding tax on banking transactions.

-

Covering for the corrupt and the incompetent

Dar pushed these sweeping changes in taxation of energy sector without presenting them to parliament

-

Lacking transparency: Fraudulent taxpayers, collectors and auditors

Over 100 companies make billions in tax credit claims on GST, 65% businessmen delinquent

-

Increased cost of doing business: No progress in talks with textile industry

APTMA’s strike call for August 7 stands, govt refuses to accept demands

-

The withholding tax saga

It seems that as long as you have links with the right people in the right places, you can get away with anything

-

Dar introduces new taxes to compensate for FBR failures

Taxmen fall short of July revenue target by nearly Rs8 billion; new taxes hit oil products, electricity

-

Gaping loophole: Over half of cabinet members, MPs do not pay income tax

Speakers call for making tax evasion criminal offence

-

Contrary to traders' claims: WHT has not affected bank deposits, says SBP governor

Govt’s meeting with traders ends in deadlock, main representatives not present

-

The withholding tax controversy

The government has a promise to keep to the IMF. It has to show that it has taken measures to reform the tax system

-

On revenue: Services sector bashes 8% tax measure

Says culture of start-ups needs to be promoted.

-

All banking transactions for non-filers: The withholding tax saga continues

Traders back out of agreement, reject 0.3% levy as well; talks with govt bear no result

-

Disguise: Cash-only transactions and the need to lessen them

They help tax evasion; promotion of plastic money necessary.