Regulatory frame-d work: Topic of Benami transactions gives rise to conflict

Authorities provide different responses to accountability

Authorities provide different responses to accountability. CREATIVE COMMONS

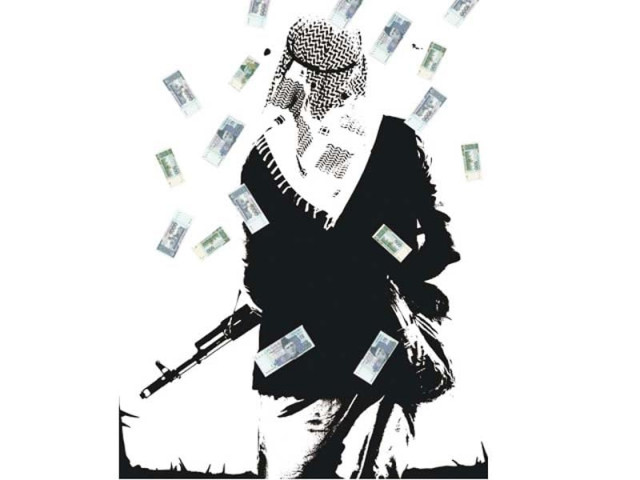

Benami transactions – the buying and maintaining of assets through frontmen – have been a curse that has prompted Pakistan’s public stakeholders to question conclusive steps being taken to counter it.

However, there have been two conflicting responses from federal institutions to the same question.

These assets, which are taken through illegally-earned money, can be used for evasion of material amounts of taxes or something more serious, financing terrorism.

The answers reveal how easily the state functionaries are prevented from tapping the actual wealth of a tax-evading superclass in Pakistan.

Two shades of statements

The Securities and Exchange Commission of Pakistan (SECP) spokesman emailed the following answer, “The proposed legislation for regulation of the Benami transactions was initiated in 2008 under auspices of the Ministry of Finance. However, after enactment of the 18th Amendment in the constitution and abolition of Concurrent Legislative List, the subject was devolved to the provinces and it no longer falls within the jurisdiction of the federation; hence the proposed legislation could not materialise.”

FBR Spokesman Shahid Hussain Asad had a completely opposite answer to the query. He said the Benami transaction prohibition regulations are being processed at the FBR – a federal authority. “I cannot divulge the details of an exercise which is already under way to create such regulations,” he said.

These conflicting statements induce an impression that a serious initiative taken by the FBR in coordination with the SECP in 2008 came to nothing. My discussions with relevant officials on this issue had been extensive. There was a realisation on the part of these officials that the Benami Transactions (Prohibition) Act 1988 was in full operation in India, while Pakistan was two decades late on the issue.

At that time, the Havala, Benami and other illegal transactions were thought to be used for suppression of details about the holdings and assets of tax-evaders and terror-financing operators. But serious initiatives to regulate both transactions were being discouraged at each point of the process.

My effort was in view of two scenarios: the much orchestrated FBR campaign for broadening the tax base in Pakistan to enhance the revenues beyond 9% to 10% of the GDP, and questions being raised in the print and electronic media about the financing of terrorist groups now facing military action.

It is being suggested that the terrorist groups continue to be resilient and in some aspects appear to be stronger than before in the absence of documentation for illegal sources of financing.

The efforts of the FBR for broadening the tax base and increasing the net revenues were explained to The Express Tribune by FBR Member Rehmatullah Wazir, who said his office was striving to intricately implement Section 122C of the Income Tax Ordinance 2001.

The crux of his explanation was that the electricity bills showing consumption of Rs15,000 and Rs20,000 attract a lump-sum tax at 5% and 7.5% respectively, while the users of electricity of Rs50,000 per month and above are being taxed at the normal GST rate of 17%.

Notices are being served on the holders of assets such as land and vehicles that do not file tax returns. They are being forced to pay up tax on the prices thereof, or face punitive action against which there is no provision of appeal whatsoever.

Such seriousness on one hand, and neglect of the urgently needed regulations of the Benami transaction documentation — no official is ready to face queries in this regard.

Such regulations can help detect almost each and every asset being concealed and dangerously used in Pakistan. It would be pertinent to point out that the FBR exercise to implement Section 122C cannot stop the Benami practices, even if the front holders of assets are brought to the book.

The actual men behind the front-men would stay untouched. And those who are brought to the book by the on-going tax-broadening exercise would always be able to help their controllers buy and maintain Benami assets. It is obvious that such assets are way bigger than those which are being detected by the FBR.

Falling on deaf ears

No official in Islamabad could answer the following question: Who is stopping the initiative to just take a look at the Indian Benami Transactions (Prohibition) Act, 1988, and implementing the aspects that are applicable in the Pakistani situation? The anti-Benami regulations might be enforced without further delay and can be improved in the process, the same way other regulations are improved.

However, some of the officials pointed out that a Benami prevention law cannot be created and implemented ‘as long as a mafia enjoying exemptions from the existing laws and protection of authority operates in Pakistan.’

THE WRITER HAS WORKED WITH MAJOR NEWSPAPERS AND SPECIALISES IN ANALYSIS OF PUBLIC FINANCE AND GEO-ECONOMICS OF TERRORISM

Published in The Express Tribune, May 25th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ