Softening stance: Opposition demands at least a 5% cut in GST

PPP leader asks the finance ministry to withdraw regulatory duty on furnace oil while boycott continues.

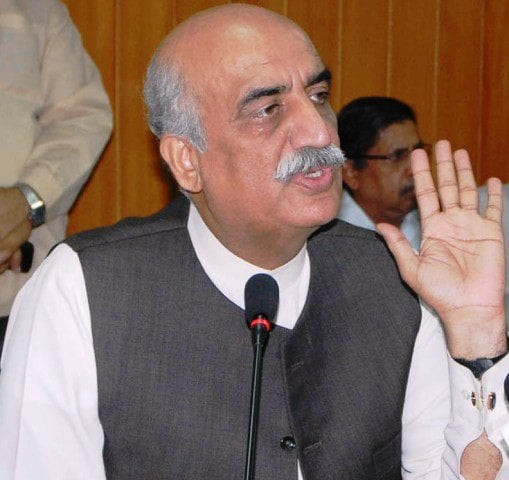

Leader of Opposition in the National Assembly Khursheed Shah. PHOTO: PID

Finance Minister Ishaq Dar has failed to paper over differences with the opposition’s lawmakers on the government’s recent revenue measures. Gaps in perception remained even though the opposition softened its stance on Thursday after signalling willingness to accept a majority of tax measures, providing the government withdraws regulatory duty on furnace oil and lowers sales tax on petroleum products to 22%.

However, indifference on the part of the government led Leader of the Opposition in the National Assembly Khursheed Shah to resume boycott of the proceedings. The boycott ended when the finance minister appeared to plead his case.

The opposition leader ‘certified’ that the finance minister knows the art of juggling economic figures but refused to accept his justification for newly imposed unbudgeted taxes.

“At least an announcement of 5% reduction in the GST, from 27% to 22%, should come from you today, otherwise, we are going for a boycott,” Shah said.

He said that furnace oil was not a ‘luxury item’ on which regulatory duty was imposed and that it was hitting the poor directly. “Regulatory duty is not something to be levied to cover the budget deficit,” he added.

While recalling Dar’s budget speech and the claim of ending the tradition of issuing SROs, he said, “You [Dar] had made a commitment but today you are quoting the example of the PPP.” “If we made a mistake, we are in the opposition now.”

Talking about the revenue targets of Rs2.8 trillion, he cautioned the government that it was difficult to achieve. “You can overcome the deficit by some other means and by reducing your expenditures,” he added.

Naveed Qamar said, “If you have to do everything through SROs then there is no need to present a budget in this house.” Qamar turned his fury on the government, saying it has no respect for “sovereignty of this house”.

Earlier, the finance minister said that the steps were badly needed to meet the shortfall in revenue collection. He said that the new levies would only generate Rs46 billion against projected loss of Rs196 billion in it due to certain reasons.

Dar said that the prices of petroleum products in Pakistan were lowest [in the region] and relief was passed on to people. He argued that the new levies would create an impact of Rs46 billion, while pointing out that the country was still facing a Rs119 billion loss in revenue that led to the scaling down of revenue collection targets from Rs2,810 billion to Rs2,691 billion.

Published in The Express Tribune, February 13th, 2015.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ