Leave services to us, Sindh tells FBR

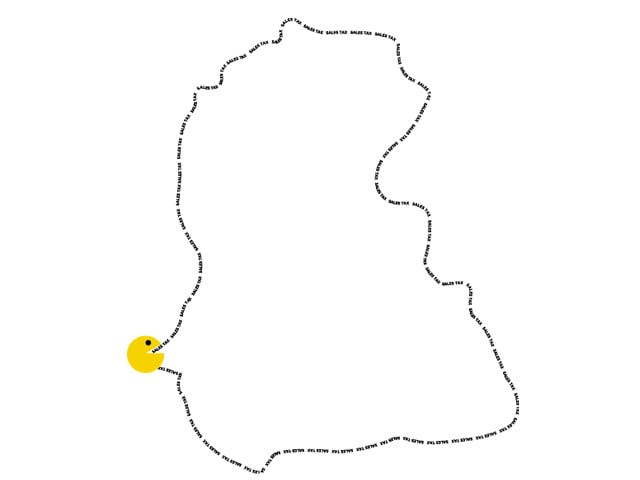

Sindh government decides to withdraw authority given to Federal Board of Revenue to collect sales tax on services.

According to the letter, the province is authorized to impose and collect sales tax under the 18th amendment and the provincial government is going to charge sales tax on services on its own now. The Sindh Sales Tax on Services Ordinance 2000, which authorized the FBR to collect sales tax on services, is also being repealed, the letter further said. With the annulment of this ordinance, the provincial government is imposing taxes on all the services that were listed in this ordinance. The federation had been receiving excise duty on these services.

The letter added that the provincial government is imposing a tax on all but advertising agencies, financial services, banking and insurance companies, construction services and franchises.

The letter asks for FBR’s help by providing tax data from fiscal year 2009-10. It further requests the FBR to provide Sindh government with sales tax forms, notices, returns and formats of receipts for tax payments. Copies of rules, circulars and orders introduced by the FBR for the receipt of sales tax are also requested by the province.

Sindh government has asked to be informed about the prospective problems the provincial government may have to face from taxpayers, the number of tax dues and refund claims that will have to be handled once the ordinance is repealed and the arrangements that should be made in this regard. The province also demanded the data of current registered taxpayers, registered input refund claims worth more than Rs2500 and input adjustment claims.

The letter further demands the disclosure of data regarding taxpayers who file their returns in the services sector and data on tax returns, broken up category-wise. The government has also requested information on the number of people who submit returns through e-filing facilities. Input and output adjustment information regarding standalone services was also requested.

Sindh government hopes that sales tax and Pakistan Revenue Automation Limited officers will visit the revenue service office set up in Karachi to brief provincial authorities about the issues associated with sales tax on services.

Published in The Express Tribune, November 9th, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ