Word of advice: Let the people judge, PM advises budget critics

Urges banks to participate in Youth Business Loan Scheme.

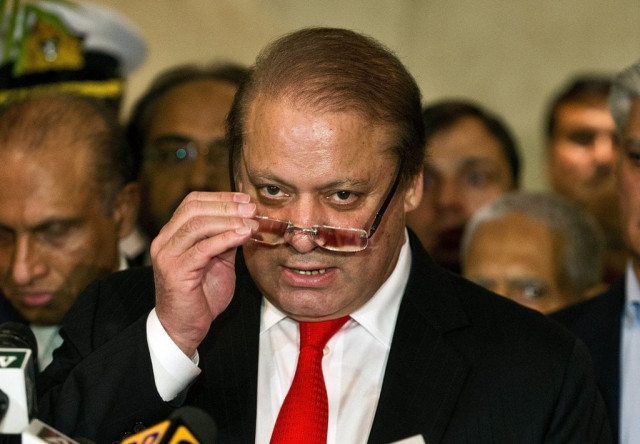

Prime Minister Nawaz Sharif. PHOTO: AFP

A day after his government presented its second budget, the prime minister had some words of advice for critics: let the voters do the talking.

“We should not indulge in unnecessary criticism and deceit,” he said while addressing a ceremony for the second balloting of the Prime Minister’s Youth Business Loan Scheme. “The people of Pakistan have shown their confidence in us during the 2013 elections and they will decide once more in 2018, based on our performance.”

Although the prime minister did not name his critics, it can be surmised that he was referring to the Pakistan Tehreek-e-Insaf (PTI), a party that has been vocal in its dissatisfaction with the government.

Nawaz described the federal budget as ‘pro-poor’, adding that the government has been able to achieve 16.4% revenues against a target of 21% which, he termed ‘almost 90% success’. He said a livestock insurance scheme has been included in the 2014-15 budget to provide security to small-scale farmers.

He emphasised that the government’s top priority remained power supply and 21,000MW power projects for the next 8-10 years have been planned to address the power shortage.

“I see great potential in the youth of Pakistan, and it can bring about an economic revolution and development in the country through its energies and dynamism,” the premier said on the occasion. He said the middle and lower-middle classes have contributed to the development of nations like Germany and Japan, and therefore, he “holds great expectations from the youth of these classes in Pakistan”.

Emphasising the role of women in the development of Pakistan, the prime minister said the government is providing equal opportunities to women in all sectors and the Youth Business Loan Scheme reserves a fifty per cent quota for female applicants.

The premier directed the State Bank governor to engage private banks to participate in these schemes. “Previously banks only entertained the affluent class while the poor were not allowed to even enter the premises,” he said, “But our government provided opportunities to the marginalised population to gain economic independence.”

Published in The Express Tribune, June 5th, 2014.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ