Stocks slip as corporate earnings fail to inspire investor confidence

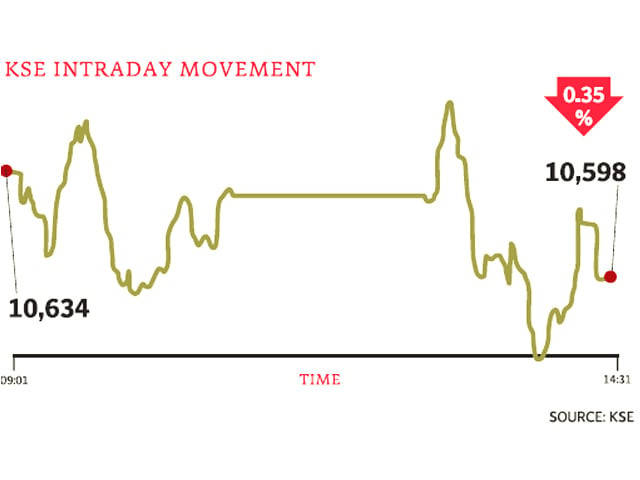

The benchmark KSE 100-index shed 37 points on the last trade session of the week to close at 10,598 points.

Activity in the broader market also lacked enthusiasm as shares of 371 companies were traded. Of these, 196 declined, 153 advanced and 22 remained unchanged. The value of shares traded on Friday stood at Rs2.92 billion.

The benchmark index ended the week down 0.5 per cent compared with the preceding week, although trading activity increased. While 103 million shares changed hands at the bourse on Friday, average daily turnover for the week was recorded at 133 million shares, up nine per cent from the previous week.

Samar Iqbal, a local equity dealer, asserted that foreign selling during the last trading session of the week triggered profit-taking from local participants. “The market took a small correction mainly due to selling in National Bank and MCB Bank,” she added.

“A fall in international oil prices and concerns over rising circular debt in the energy sector affected sentiments negatively,” commented Ahsan Mehanti, director at Arif Habib Investments. He contended that the cement and fertiliser sectors are still attractive for investors but blamed the negative trend during Friday’s trade on limited foreign interest and institutional profit-taking.

“Foreign portfolio investment flows turned negative after a long time as net outflow was recorded at $2.76 million for the week,” highlighted a research report published by BMA Capital.

It also asserted that the end of company earnings announcements will likely shift attention back to political and security crises in the country. It acknowledged that positive triggers are limited in coming days.

“Failing to hold on to new highs, the KSE 100-index is likely to undergo a correction towards 10,400-10,350,” added Nurali Barkatali, a technical analyst. He predicted a nervous start to equity trade for the coming week.

Published in The Express Tribune, October 30th, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ