Weekly review: Index rises 232 pts on improved macroeconomic data

Forex reserves rise to $9.4 billion as rupee appreciates 5 per cent.

Forex reserves rise to $9.4 billion as rupee appreciates 5 per cent.

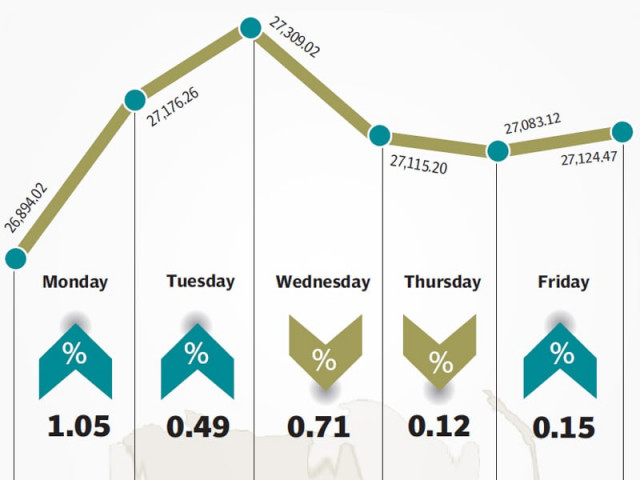

The bulls prevailed at the stock market for the third week in succession as strong improvement in macroeconomic figures helped the benchmark KSE-100 index climb 232 points (0.9%) during the week ended March 14.

An improvement in the country’s foreign exchange reserves, along with a reduction in the trade deficit, were the highlights of the week and resulted in the Pakistani rupee appreciating by 5% against the US dollar.

The improved macroeconomic situation also created speculation at the bourse that the State Bank of Pakistan (SBP) may consider reducing the discount rate in its upcoming monetary policy announcement on Saturday.

The week started on a solid note with the KSE-100 index climbing 284 points (1.1%) to shatter past the 27,000 barrier as the index heavyweight oil and gas sector dominated proceedings at the bourse.

The index hit an all-time high when it closed at 27,309 on Tuesday after climbing further by 132 points (0.5%) before profit-taking in the next two days clipped its gains. The index closed in the green again on Friday as speculation about a discount rate cut made rounds at the bourse.

The sudden improvement in the country’s foreign exchange reserves came about after a “friendly nation” deposited $750 million at the State Bank, bringing the total inflow to $1.5 billion in the past couple of weeks. The country’s foreign exchange reserves stood at $9.4 billion as per the latest figures from the SBP.

The high availability of dollars resulted in the PKR-USD exchange rate nose-diving and falling by 5% in three days to trade at Rs98 per US Dollar. The greenback did make a recovery later on in the week and the exchange rate hovered at the Rs100 mark at the end of trading on Friday.

Finance Minister Ishaq Dar also announced that he expects forex reserves to jump to $10 billion by the end of the month and $16 billion by the end of the current fiscal year. The announcement of a firm date for the 3G/4G spectrum auction on April 23 will also help that cause.

The dollar’s depreciation also raised hopes that electricity prices will fall (as they are pegged to the USD for IPPs).

The market’s gain came despite foreigners being net sellers of $4 million worth of equity during the week.

Average trading volumes showed strong improvement and stood at 283 million shares traded per day, up 12.4% over the previous week. Average daily values also improved 6.8% and stood at Rs11.86 billion traded per day. The market capitalisation of the KSE stood at Rs6.55 trillion at the end of the week.

Winners of the week

Pak Suzuki Motors

Pak Suzuki Motor Company Limited manufactures, assembles and markets Suzuki cars, pickups, vans and 4 X 4 vehicles.

Javedan Corporation

Javedan Corporation Ltd manufactures Portland cement, blast furnace slag cement and sulphate resisting cement.

Shell Pakistan

Shell Pakistan Limited markets petroleum and petrochemical products. The company also blends and markets different types of lubricating oils.

Losers of the week

Nishat Chunian Limited

Nishat Chunian Limited manufactures and sells yarn and fabric. The company operates spinning, weaving, dyeing, and finishing units.

Murree Brewery

Murree Brewery Company specialises in the manufacture of beer and Pakistan Made Foreign Liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the group’s bottles and jars.

National Foods

National Foods Limited is a diversified food manufacturer. The Group’s products include recipe blends, dehydrated vegetables, pickles, salts, snack foods, desserts, and a number of kinds of health foods.

Published in The Express Tribune, March 16th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ