Weekly review: KSE-100 rises 1,108 points as bulls take control

Ceasefire and low inflation figure highlights of the week.

Ceasefire and low inflation figure highlights of the week.

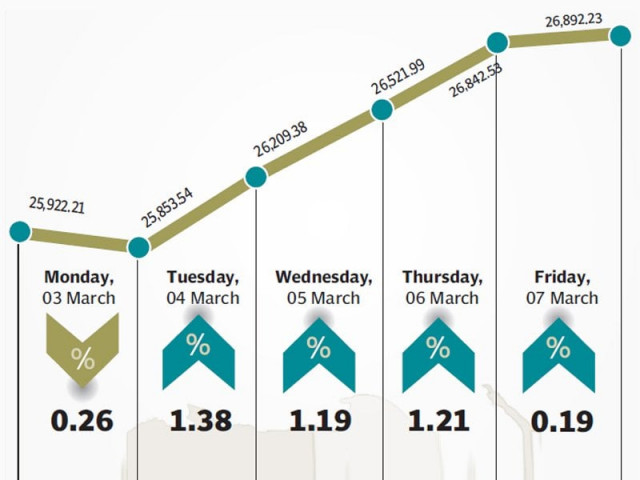

The bulls staged a dominant comeback and took firm control of the stock market as the benchmark KSE-100 index rose 1,108 points (4.3%) during the week ended March 7.

The declaration of a ceasefire and lower-than-expected inflation numbers were the highlights as the index closed in the green in all five trading sessions of the week.

The index’s gain helped in recuperating most of its losses stemming from a bearish spell in the previous month. The index ended the week just shy of the 27,000-point barrier after closing at 26,892 on Friday.

The KSE-100 index posted a small gain on Monday before posting an increase of 300 points in each of the next three trading sessions and ending the week with clipped gains on Friday, as some profit-taking was witnessed.

Inflation numbers for the month of February provided further impetus to investors after clocking in at 7.93%, taking the full-year inflation to 8.65%. As a result, it is highly unlikely that the State Bank of Pakistan (SBP) will announce a discount rate hike in its monetary policy announcement later this month.

The country’s macroeconomic position also continued to improve as the country’s foreign exchange reserves stood at $8.9 billion, according to latest figures from the SBP. The central bank’s reserves stood at $3.9 billion, according to the figures.

The government also sent a bill of $1.6 billion during the week to the United States to be charged under the Coalition Support Fund. The Finance Ministry hopes to receive a fast-track payment for this bill to help it shore up reserves further.

As a result, the Pakistani rupee continued to climb against the greenback and stood at Rs103.25 by the end of the week.

International politics also played their part as the Crimean crisis created concerns about energy supply. Resultantly, Pakistan Petroleum, Pakistan Oilfields and the Oil and Gas Development Company posted strong gains during the week and were significant contributors to the KSE-100’s gains.

There were, however, losers during the week and the National Bank of Pakistan led the way following its disappointing full-year earnings of Rs2.49 per share, a decline of 66% year-on-year. The bank’s share price tanked 8% during the week.

Average trading volumes fell slightly by 2.9% and stood at 210.9 million shares traded per day. However, average daily values shot up by 37.2% and stood at Rs9.18 billion traded per day. The market capitalisation of the KSE stood at Rs6.49 trillion at the end of the week.

Winners of the week

Shell Pakistan

Shell Pakistan Limited markets petroleum and petrochemical products. The company also blends and markets different types of lubricating oils.

Murree Brewery

Murree Brewery Company specialises in the manufacture of beer and Pakistan made foreign liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the group’s bottles and jars.

Habib Bank Limited

Habib Bank Ltd operates as a commercial bank in Pakistan. The Bank offers commercial, corporate, investment, retail and International Group Banking.

Losers of the week

National Bank of Pakistan

National Bank of Pakistan is a government owned bank which provides a wide range of banking and financial services to corporate, institutional, commercial, agricultural, industrial, and individual customers throughout Pakistan.

Nestle Pakistan

Nestle Pakistan Limited manufactures, imports and sells dairy products, confectioneries, culinary products and fruit juices. The Group’s products include milk, butter, cream, noodles, coffees, and dietary and infant products.

Ghani Glass

Ghani Glass manufactures and sells glass containers. The company manufactures glass containers for pharma, food and beverage industries. Ghani Glass also manufactures float glass variations for commercial, domestic and industrial use.

Published in The Express Tribune, March 9th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ