Corporate results: MCB Bank earns Rs11.9b in a span of six months

Sale of stake in Unilever Pakistan, reclaimed bad loans absorb drop in core income.

The bank’s management also decided to pay Rs3.5 per share to its shareholders, taking the cumulative payout for the half year to Rs7.

On Friday, MCB Bank – Pakistan’s fourth largest bank by assets – announced its earnings for the half-year period of 2013 where core operations reflected a slowdown, non-core operations saw a boost thanks to Unilever Pakistan’s share buyback and reversals of bad loans made by the bank before.

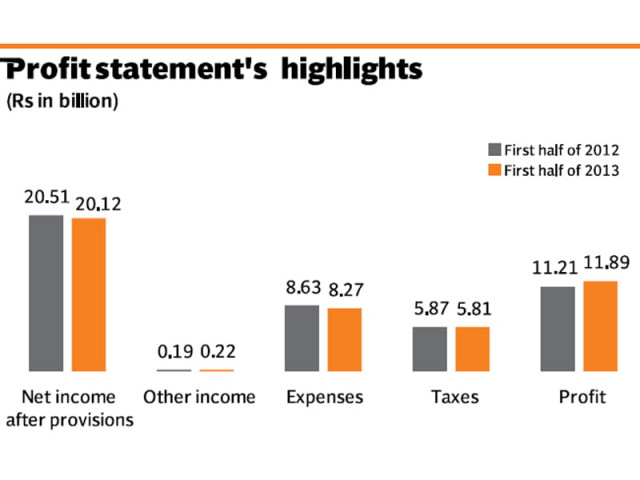

According to a notice sent to the Karachi Stock Exchange, MCB Bank earned Rs11.89 billion during the semi-annual period, 6% higher than what it made in the corresponding period of 2012. The bank’s management also decided to pay Rs3.5 per share to its shareholders, taking the cumulative payout for the half year to Rs7.

Umair Naseem, analyst from Global Securities, attributes the growth in earnings to higher non-core income and provisioning reversals, which negated the effect of declining revenue from core operations of the bank ie lending at higher rates and borrowing cheaply.

The bank’s core-income head suffered a drop – like the whole of the banking sector – to Rs18.81 billion during the period, 10% lower than the Rs20.91 billion it made in the corresponding half-year of 2012, as the State Bank of Pakistan continues its expansionary monetary policy – hiking interest rates keeping in line with rising inflation – which in return shrinks banking spreads.

Reversals in advances the bank made also supported the growth in earnings as provisions against bad loans and investments, totalling Rs1.31 billion, were added to the interest income as the bank was repaid most of the bad loans it made during this and the previous period.

The highlight for the bank was a 12% rise in non-core operations (earnings from fees, dividends and sales of securities) to Rs5.84 billion. The bank managed to boost its earnings from advisory services as the fee, commission and brokerage income rose 9% to Rs3.27 billion.

MCB Bank’s profits from selling shares and bonds in the first half of 2013 doubled to Rs1.55 billion, compared to Rs725 million in the corresponding period of 2012. According to Global Securities’ Naseem, the sharp surge in non-interest income was largely due to realised gains of Rs800 million from the sale of Unilever Pakistan’s shares the bank held – a one-off gain.

Moreover, the bank also managed to contain expenses as they fell 2% to Rs8.27 billion during the period, mainly due to a reduction in administration expenses of the bank.

Published in The Express Tribune, August 17th, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ