Now that the elections are over and a newly elected national government is preparing itself to take control of economic affairs of Pakistan, many economists and political scientists are looking forward to the new economic policies to address a number of serious challenges facing the country.

Economic policies adopted by the new government will be crucial for bringing the country out of the malaise the previous government has left her in.

There are a number of challenges the economy faces. Some macroeconomic problems include budget and balance of payments deficits, price instability and foreign exchange deterioration, and unemployment.

In addition to these macroeconomic issues, the country faces at least two serious crises – energy crisis and crisis of security and deterioration of law and order.

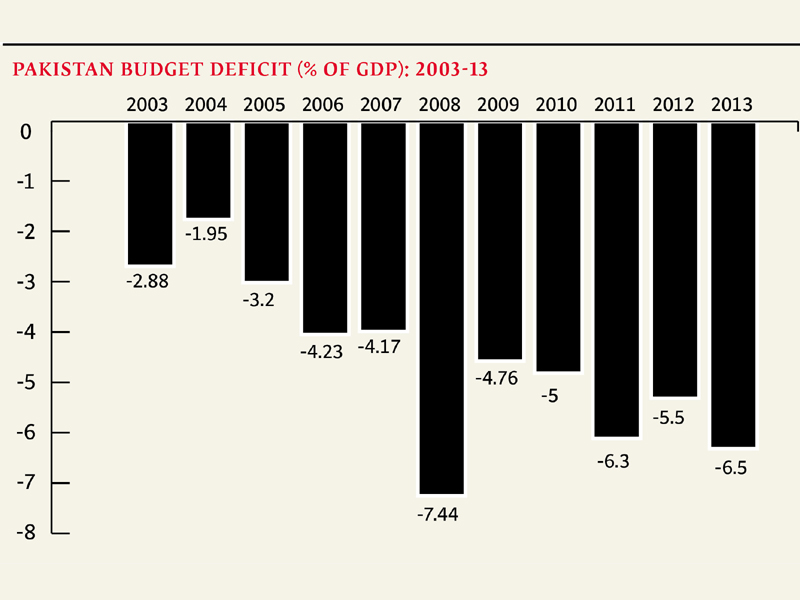

Many economists are predicting that the new budget will increase the budget deficit from 5.5% to about 6.5% of gross domestic product (GDP). They are of the view that this is dangerously high for a country like Pakistan that has for many years experienced stifled growth.

While it will be imprudent to ignore the budgetary situation, it is equally important to understand that austerity measures will not effectively tackle the country’s economic problems. An economic policy based on austerity will further dampen growth, leading the country to acquire an even larger budgetary hole. It is, therefore, important to devise an economic policy that will bring the required investment into the country to spur economic growth. Sufficient economic growth is likely to counter any negative effects of a budget deficit.

In fact, the budget deficit in India has shown similar trends in the last five years as Pakistan with the real difference being that the Indian economy has also grown significantly.

Continued reliance on domestic borrowing will not help, as it will certainly crowd out domestic private investment. The country’s economy is already suffering from a lack of private investment; a failure to incentivise investors will continue this turmoil. Attracting foreign investment remains the only viable option in the present circumstances.

Despite all the wrongdoings of the previous government, and contrary to commonly held perceptions, inflation has improved during their tenure. Therefore, the new government will have to continue with the measures taken by the previous regime to control and contain inflation.

To increase employment in the country, and accounting for the huge budget deficit, the new government must rely on the private sector and initiate a number of infrastructural projects with the help of foreign investors to generate new jobs. Employment, after all, is dependent on economic growth. If the new government can spur growth, it will not have to worry about employment creation separately.

Despite all the promises given by PML-N during its election campaign, it must not come up with expensive schemes (like yellow cab, affordable tractors, etc) to generate employment amongst the masses. This will certainly add to the budget deficit, which will eventually have an adverse effect on prices; if not immediately but certainly towards the end of the five years of the government.

Islamic banking and finance

Using Islamic banking and finance as a tool for attracting foreign investment will serve a number of political and economic purposes. First and foremost, it will attract investment from friendly countries like Saudi Arabia and other countries in the Middle East, Turkey and Malaysia. Secondly, bringing Islamic banking and finance to the policy table will dilute the influence of hardcore Islamist and militant groups who pose a real security threat to the nation. It can also be used as an indicator of government commitment to building a modern Islamic welfare state.

Pakistan can utilise Islamic banking and finance as a tool for bringing economic reforms that are desperately needed to solve a myriad of problems facing the country. The energy crisis and the depressed state of affairs of state-owned corporations like Pakistan International Airlines (PIA), Pakistan Railways and many more present an excellent opportunity for international financial players to invest in Pakistan through the private sector.

Given that Islamic banking and finance is currently in vogue, and that Pakistan has a long history of engagement with Islamic finance, she can benefit immensely if the new government devises an unambiguous national strategy towards the sector.

A key component of the strategy should be the creation of an onshore financial hub that aims to provide a platform for business and financial institutions to develop their outreach into and beyond the country’s borders. The new government should immediately set up the Pakistan International Islamic Financial Centre (PIFC), similar to the Malaysia International Islamic Financial Centre (MIFC).

Pakistan should similarly use Islamic banking and finance to attract investments in its infrastructure projects, without increasing its budget deficit any further.

THE WRITER IS AN ECONOMIST AND A PHD FROM CAMBRIDGE UNIVERSITY

Issuing $5b sovereign sukuk an option

Islamic banks and financial institutions under PIFC can help in solving the energy crisis and shortage of electricity in the country. The expected prime minister, Mian Nawaz Sharif, said on May 20, while addressing a gathering of workers of the PML-N at Lahore, that the government needed Rs500 billion (or roughly about $5 billion) to make payments to different stakeholders in the electricity and power sector.

Issuing a sovereign sukuk of $5 billion to raise funds from the international financial markets can secure this amount. It will cost more to go to the capital markets to raise this amount, and so it may not be a bad idea to borrow from cheaper sources like Asian Development Bank and Islamic Development Bank for other non-developmental expenses.

The proposed sukuk could be structured as a convertible sukuk to give an option to investors to convert their sukuk into equity of some of the public sector corporations in the energy sector. This will allow the government to start privatising some of the larger public sector corporations when the time is right.

Published in The Express Tribune, May 27th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS (4)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

1725096749-0/Untitled-design-(1)1725096749-0-270x192.webp)

The writer of this report is "insane" in making un-realistic proposition of raising $5 billion either by floating sukuk in the international market or borrow from donar agencies. Who will lend such sizable about of funds to Pakistan????? Since the circular debt is in rupees, better raise or create domestic debt to clean-up the process. Raising FCY debt will increase debt-to-GDP ratio in FCY and close all future options to borrow from the international market. PML-N needs to motivate and create confidence in local investors by simply improving the law & order, good governance (with an example of self imposed austerity) and getting out of 'show off' business.

The concept of PIFC if good. I agree with this initiative but in order to attract Foreign investment why do we need to go for sukkuks. Developing countries are mainly going for bonds as the sukkuks most of the time have high returns compared to conventional bonds and that will add pressure to the existing government and the governments to come (if the bond is 10-15years maturity) Looking at the current FDI figures now and 5 years before proves that only if the governance is improved by even 30% then we can raise money on conventional bonds with market based returns. Still the overall article is good in raising the point of privatization of Railway and PIA. I also think that will be one of the best option after looking at the current scenario.

People are optimistic that with the arrival of the new government, the overall economy, local as sell as foreign investments will pour in.

But before the economic revival, the basic issue is to maintain peace in the country. During PPP regime, the law and order situation has gone from bad to worst.

If PLM(N) Government will be able to tackle terrorism in the country by negotiating peace with the TTP, I am sure that economy of the country will grow and people who have taken their investments out of the country will bring it back to Pakistan, which will not only revive the economy, but will also generate employment opportunities.

When employment opportunities will grow in Pakistan, the crime rate will also been decreased gradually and with the passage of time.

During Mian Sahib's tenure, I am looking forward a proporus Pakistan. AMEEN.