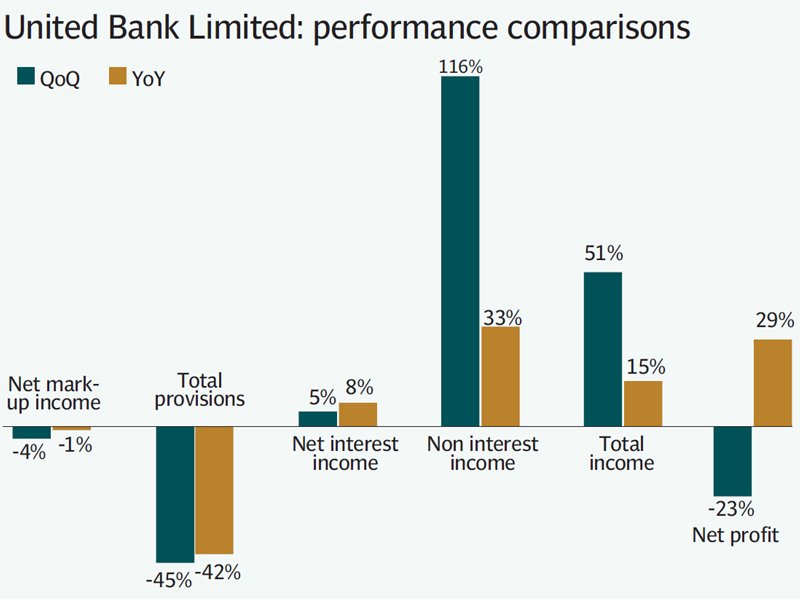

United Bank Limited (UBL) has announced its results for calendar year 2012 (CY12), which are up a healthy 29% year-on-year. The company has announced a consolidated net profit of Rs19.03 billion for the year, which translates into earnings per share of Rs15.71. It has also decided to give a final cash dividend of Rs3.5 per share, taking the full-year payout to Rs8.5 per share.

The highlights of UBL’s result statement include largely unchanged net interest income (1% YoY fall on account of tighter margins); a 46% fall in long-term liability provisions; healthy 30% growth YoY in non-interest income driven by higher fees, capital gains and income from derivatives; and a 20% YoY increase in non-interest expenses. The bank earned Rs2.4 billion in its share of profits earned by its associates this year, as compared to a loss in this segment last year, said analysts.

On a quarter-on-quarter (QoQ) basis, however, UBL posted a decline in earnings of 23% primarily due to narrower net interest margins – the difference between how much banks borrow at, and at how much they lend – and lower non-interest income. The lower non-interest income QoQ is explained by a one-off derivatives gain recorded in the preceding quarter, explains a research note issued by Shajar Capital.

Interest margins

A lower interest rate environment (the benchmark discount rate was lowered by 250 basis points (bps) in the last 13 months) has yielded a 116 bps YoY decline (down 33bps month-on-month) in weighted average banking sector spreads in January 2013, says a note issued by Shajar Capital’s Research division. In this regard, weighted average banking sector spreads have clocked in at 6.21% in January 2013 compared with 7.37% in January 2012. Lower banking sector spreads in January are primarily due to lower lending rates (down 165 bps YoY) coupled with an enhanced minimum savings deposit rate (was increased by 100 bps to 6% in April 2012).

“We believe banking sector spreads are close to bottoming out and may start reversing in the second half of 2013,” the note continues. “At the same time, there may be positives on the asset quality front – a relatively lower interest rate environment may lead to stronger balance sheets and improved cash flow position while unrealised capital gains on government papers also provide an upside. In this regard, while growth in net interest income has visibly slowed down, winners should be able to control provisioning and sustain earnings growth going forward, in our view.”

Published in The Express Tribune, February 26th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

1732020599-0/BeFunky-collage-(73)1732020599-0-165x106.webp)

1731926127-0/zayn-(1)1731926127-0-165x106.webp)

1732018399-0/BeFunky-collage-(72)1732018399-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ