RDA receives $204m in Oct

Investment is significantly higher compared to last six-month average of $187m

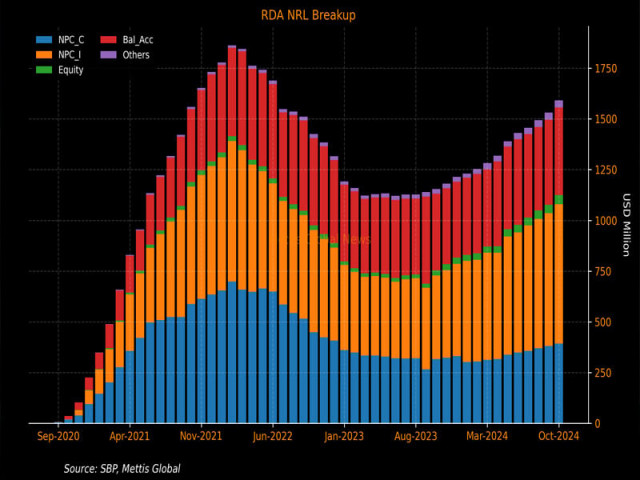

Overseas Pakistanis deposited and invested $204 million in Pakistan through the Roshan Digital Account (RDA) in October 2024, pushing the cumulative gross inflows close to $9 billion over a period of 50 months since the launch of the scheme in September 2020, according to the central bank data released on Monday.

RDA inflows have remained a great support for improving the country's foreign exchange reserves, held by the State Bank of Pakistan (SBP), to two months of import cover at more than $11 billion. Topline Research reported "the injected amount stands significantly higher compared to the last six-month average of $187 million and the average of $179 million since its (RDA) launch in September 2020."

It maintained that net inflows (gross inflows minus funds utilised in the country and withdrawn from Pakistan) stood at $193 million in October versus last six-month average of $173 million and average of $146 million since the launch.

Citing the central bank data, Arif Habib Limited reported that net deposits and investments by non-resident Pakistanis through the RDA reached $1.59 billion against gross inflows of $8.95 billion since the inception.

Giving a breakdown, it said out of the gross inflows, the overseas Pakistanis withdrew $1.67 billion and spent another $5.69 billion in the country.

The research house said out of the $1.67 billion, the expatriate Pakistanis invested $393 million in the Naya Pakistan Certificates (NPCs) and $687 million in Shariah-compliant NPCs.

They invested $45 million at the Pakistan Stock Exchange (PSX) through the Roshan Equity Investment (REI). They have a balance of $431 million in the RDA accounts.

FDI drops

The net foreign direct investment (FDI) in different sectors of Pakistan's economy like energy, banking and telecommunication hit a 15-month low at $133 million in October 2024, the central bank reported.

A senior analyst told The Express Tribune the inflows would have been higher had a foreign holding company not sold its equity worth $150 million.

The company sold stocks of a number of companies after the global indices and analytics provider FTSE recently included and excluded a number of Pakistani companies from its indices.

Cumulatively, the FDI inflows in the first four months of the current fiscal year rose 32% to $904 million compared to $684 million in the same period of last year.

FDI was 18% lower in October 2024 compared to net investment of $163 million in the same month of last year. The inflows were 65% lower compared to the $385 million received in the prior month of September.

Pakistan's power sector received the largest FDI of $414 million in the first four months of the ongoing fiscal year, followed by financial businesses at $190 million.

The oil and gas exploration sector received $104 million while the electronics sector attracted $54 million.

Among different countries, China remained the largest investor in Pakistan, injecting $414 million in the four months. It was followed by Hong Kong which invested $100 million.

The United Kingdom injected $94 million while Switzerland invested $51 million.

REER index rises to 100.86

Pakistan's real effective exchange rate (REER) – the value of domestic currency compared to the basket of currencies of trading partners – appreciated 2.22 percentage points to 100.86 in October, suggesting that the local currency had strengthened, but remained largely near its fair value of 100.

According to the SBP data, the REER stood at 98.64 in the previous month of September.

The improvement primarily came in the wake of downward adjustment in global and local inflation readings. Otherwise, the rupee-dollar exchange rate remained stable at Rs277-278/$ in September-October 2024.

The appreciation in REER has cut the cost of imports, supporting an uptick in the purchase of goods and services from overseas markets. This has, however, made exports slightly expensive, making sales in global markets nominally uncompetitive for Pakistan.

Alpha Beta Core CEO Khurram Schehzad said in comments that REER index at 100.9 meant that Pakistani rupee was around fair levels as of October 2024, or only slightly above its par value at present. "Keeping the index at 95, or slightly below that level, should be the target of the monetary authorities in order to make the country's exports competitive and keep imports in check, thereby containing the trade and current account deficits," he said.

The monetary authorities also needed to keep a check on smuggling while fiscal, tax and trade authorities should keep import tariffs low, so smuggling could be discouraged while local players remained competitive at the global level, he added. On Monday, the Pakistani currency depreciated Rs0.19 against the US dollar in the inter-bank market on an uptick in demand for the greenback, reversing the uptrend seen in the previous three days.

COMMENTS (1)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ