Corporate results: Fauji Cement’s fortunes witness a meteoric turnaround

Higher cement prices, softer coal prices allow the company to post a profit of Rs923m.

The cement industry is expected to have another great year as the demand for cement in Pakistan will continue to grow at the current pace of 7.6%.

On Tuesday, Fauji Cement reported a profit of Rs0.923 billion for the first half of the current fiscal year, switching to black from a loss of Rs0.102 billion in the corresponding half of the preceding year. On a quarter-to-quarter basis, the cement producer’s profits accumulated to Rs0.562 billion in the second quarter of fiscal 2013 against Rs0.361 billion profit in the corresponding previous quarter, up an impressive 56%.

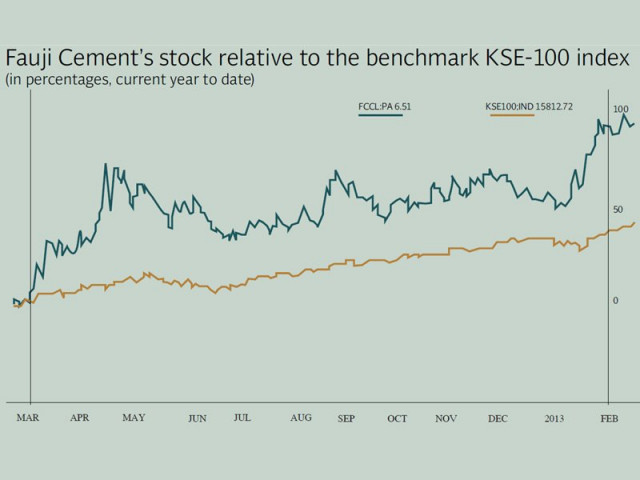

Though exceptional, the results were below market consensus pulling Fauji Cement’s share prices down Rs0.21 to Rs7.84. The stock, however, has outperformed the market by 11.83%, current year to date.

2012 has been really good year for the cement industry in general as higher cement prices and softer coal prices have propelled profits of the highly-leveraged sector. Despite stagnant exports, the industry has more than made up for the losses through higher local dispatches amid higher prices.

Revenues clocked in at Rs7.567 billion in the semi-annual 2012 period, up an astounding 77% compared to Rs4.257 billion in the corresponding half of last year. The astounding boost was solely driven by selling prices which surged 13% to Rs465 per bag in the south zone and 8% to Rs438 in the north.

On a sequential basis, the company posted revenues of Rs4.103 billion in the second quarter against Rs3.464 billion in first quarter of fiscal 2013, up an 18%.

Fauji’s total cement dispatches stood at 662,000 tons in the second quarter, where local dispatches increased 22% to 520,000 tons and exports relatively stable during the quarter, according to a Global Securities’ analyst note.

Gross margin is the number to look at as Fauji Cement managed to boost its margins to 35% during the quarter from 19% in the corresponding quarter of last year, primarily on the back of higher cement prices and falling international coal prices, which declined 27%, and aggressive use of the refuse derived fuel, a cheaper alternative top coal as kilning fuel. Gross margins for the semi-annual period of fiscal 2013 also were at an impressive 32.2%.

On the flipside, the company’s finance cost climbed 15% to Rs0.818 billion despite declining interest rates. Rupee’s depreciation against the dollar contributed to the considerable rise in financial charges as Fauji Cement had secured a foreign denominated loan, which constituted 55% of the company’s total debt. Since the rupee depreciated 2.6% from 94.9 per dollar to 97.4 in the October to November period, Fauji Cement incurred exchange losses of Rs0.168 billion, said Yousuf Rahman, analyst at Global Securities.

Outlook

Going forward, the cement industry is expected to have another great year as the demand for cement in Pakistan will continue to grow at the current pace of 7.6% as government spending is expected to rise due to upcoming elections. Moreover, exports to Afghanistan and African markets will continue to rise in the future.

Furthermore, analysts believe that Fauji Cement’s stock will witness a further upside, despite forward price-earnings of 4.9 times, as the company has an influence on the pricing of the product in the market.

Published in The Express Tribune, February 20th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ