Corporate results: Fauji Fertilizer Bin Qasim profitability down three-fifths

The largest fertiliser producer in the country announces a 22.5% cash payout .

Urea manufacturing has been highly disturbed this year, marred by low gas supply and lost markets due the availability of cheaper imported urea.

Fauji Fertilizer Bin Qasim (FFBL) – Pakistan’s largest manufacturer of di-ammonium phosphate (DAP) and granular urea – posted a profit of Rs4.338 billion for the year ended December 31, 2012, impressive, but a whopping downfall of 60% from Rs10.767 billion a year ago.

According to a copy of the results sent to the Karachi Stock Exchange, the fertiliser producer’s board announced a cash payout of Rs2.25 per share, taking the full-year cumulative payout of the company to Rs4.5.

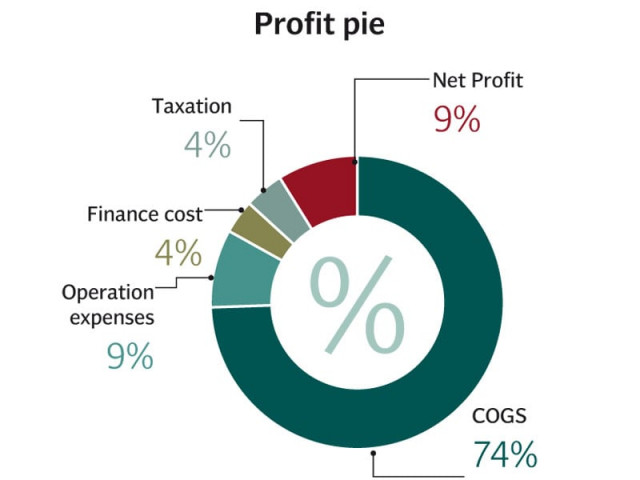

Analysts say that the major factor which dragged the earnings down was a massive decline in revenue, which plunged by Rs8 billion (14%) to Rs47.9 billion during the year from Rs55.9 billion in the preceding year.

Urea manufacturing has been highly disturbed this year, marred by low gas supply and lost markets due the availability of cheaper imported urea.

Shajar Capital’s analayst Raza Hamdani blamed decline in DAP and urea off-takes for restricting the company’s sales from its true potential, as DAP off-take declined 9% whereas urea sales dived 42%. Gas curtailment hampered fertiliser production by 36%.

On the other hand, gross margins were squeezed 12 percentage points to 24% due to a 19% cutback in DAP margins. “Further imposition of the gas infrastructure development cess (GIDC) effective from January 2012 also affected urea and DAP margins,” said Zeeshan Afzal, associated with Topline Securities.

FFBL’s other income was also lower by 37% compared to last year, and stood at Rs1.045 billion due to losses in Pakistan Maroc Phosphore – a subsidiary in which the company holds a 25% stake.

The final blow to profitability was given by gigantic financial charges during the year, which jumped 67% to Rs1.82 billion in 2012 against Rs1.08 billion because of higher short term loans, resulting in further pressure on the bottom line.

The only silver lining for the company was that it made a comeback in the fourth quarter of the year, where earnings jumped 48% over the previous quarter containing the otherwise adverse situation, buoyed by a 4.6 percentage point expansion in margins to 26.9% on the back of higher urea sales.

Outlook

Going forward, analysts expect higher DAP margins and lower urea imports to swell earnings for FFBL, while its investments in the meat export business and likely participation in acquisition of Askari Bank is expected to engage investor interest in the scrip.

The Fauji Group is interested in acquiring a 51% stake in Askari Bank, and the transaction is estimated to range between Rs13.5 billion and Rs14.7 billion. Assuming 25% contribution of FFBL in the takeover, fertiliser producer’s cash outlay can range from Rs3.4 billion to Rs3.7 billion, which may affect future payouts.

The fertiliser company’s market capitalisation as of January 11, 2013 stood at Rs35.97 billion at the Karachi Stock Exchange and the stock closed at Rs38.51 during yesterday’s trading session.

Published in The Express Tribune, January 12th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ