Lotte PTA profit jumps 80%

Lotte Pakistan PTA net profit surged 80 per cent to Rs2.18 billion in the first half of the current year.

Lotte PTA profit jumps 80%

The company’s bottom line beat market expectation by 24 per cent as the consensus of two research firms revealed that they expected the company to post a net profit of around Rs1.75 billion.

The company posted earnings per share (EPS) of Rs1.44 compared with Rs0.8 in the same period last year, slightly above the estimated EPS of Rs1.15 to Rs1.25.

Net sales increased by 28.9 per cent to Rs20.8 billion during January to June against Rs16 billion recorded last year, according to a notice sent to the Karachi Stock Exchange on Thursday.

International primary margins are estimated to have increased by eight per cent to around $245 to $250 per ton, according to Topline Securities.

Higher margins inflate profits

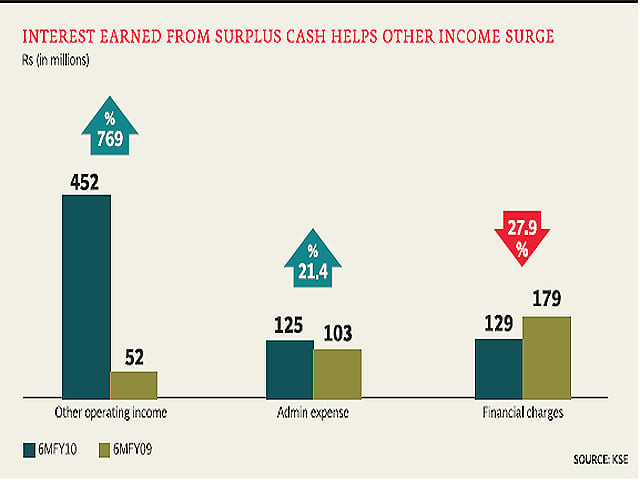

Net margins of the company grew by 330 basis points to 15.7 per cent during the first half of 2010. Apart from improved margins, higher other income also contributed to this growth, said Topline Securities analyst Furqan Punjani in the company research report.

The company’s other operating income increased more than eight times to Rs452 million compared with Rs52 million last year mainly due to interest income earned on surplus cash generated from operations, said Punjani.

Duty reduction to decrease profitability

Higher primary margins along with the duty protection of 7.5 per cent provided enough room for the company to post better earnings, said Punjani.

The government, however, decreased the import duty from 7.5 per cent to 3 per cent in the federal budget for fiscal year 2011.

However, higher cotton prices in addition to greater demand for textile products consuming polyester staple fibre (PSF) are expected to keep demand for PTA intact and cushion the impact of the reduction in import duty, according to BMA Capital analyst Omar Rafiq.

Primary margins of around $30 per ton may also help reduce the impact, said Punjani.

The reduction in import duty will likely result in primary margins declining by 13 per cent from current levels, added Punjani.

Earnings will likely decline in 2011 due to reduction in duty protection but despite this the company can distribute at least Re1 in cash dividend, thus generating a decent dividend yield of 13 per cent, Punjani said.

Published in The Express Tribune, August 27th, 2010.

1724319076-0/Untitled-design-(5)1724319076-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ