Foreign aid restricts market losses as KSE-100 closes flat

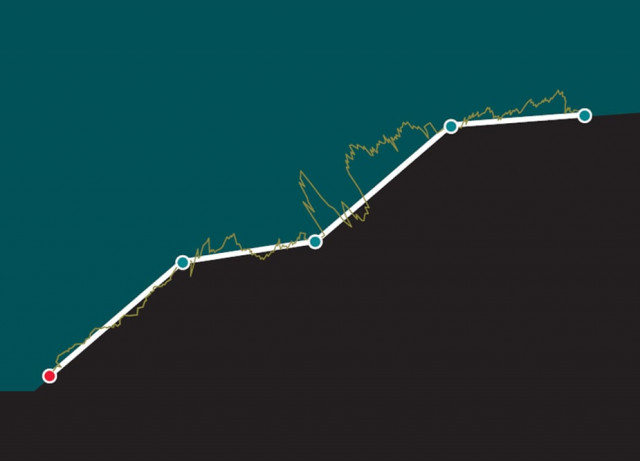

The market remained range-bound and closed almost flat with a slight gain of 0.4 per cent during the week.

The benchmark KSE-100 index fell sharply by nearly 3 per cent on the opening day of the week but clawed back up as nations from around the world pledged aid to the flood-stricken country.

With almost one-fifth of the country affected by the floods and almost 15 million people displacd, the floods have been the worst natural disaster in the country’s history. It is now becoming clearer that the economy is set to take a hit and the gross domestic product (GDP) growth target of 4.5 per cent will not be met.

Officials have opined that losses could amount to as high as 1 to 1.5 per cent of the GDP and it could take years to restore the country’s all-important agriculture sector, which is the primary driver of the GDP.

Bearing that in mind, the week opened on an extremely negative note as the KSE-100 index fell sharply by 2.91 per cent (286 points). The negative sentiments were compounded by rumours that the margin financing product could be cancelled altogether, which forced investors to stay on the sidelines.

But, as the week progressed, the situation started to improve because of announcements of foreign aid and clarification on the margin product issue.

Countries from all around the world stepped up pledges to support flood relief efforts after the visit of the United Nations Secretary General Ban Ki-moon, who had urged the countries to do more for Pakistan.

Furthermore, the Asian Development Bank offered a $2 billion emergency loan to help repair massive damage to infrastructure caused by the floods and the World Bank also offered a $900 million loan for flood relief efforts.

These developments led to improved investor sentiments, who engaged in selective buying in energy and banking sector stocks. Sentiments were also helped by macro economic statistics which revealed that the current account deficit had shrunk by 2 per cent in July year-on-year and that remittances went up by 6 per cent during the same period.

Yet, activity remained sluggish and average daily volumes declined by 2.3 per cent during the week and stood at 58.7 million shares, reflecting investor apprehension. Average daily value also declined by 23.1 per cent as the majority of trading was restricted to second-tier stocks with selective blue-chip buying. Total market capitalisation remained relatively unchanged at Rs2.76 trillion by the end of the week. While foreign buying came down significantly by 54 per cent to $6.1 million, local individuals were sellers of $2.4 million worth of stocks during the week.

What to expect?

Key companies from the banking, auto and telecom sectors are set to make earnings announcements in the coming week and the market is likely to take direction from these results in the absence of any major trigger.

The government is also set to discuss restructuring of loan with the International Monetary Fund in the coming week. Finance Minister Abdul Hafeez Shaikh will visit Washington to seek a delay in the repayment schedule or for a lump sum payment of the remaining $3.3 billion of the $11.3 billion package.

Finally, the KSE board of directors is going to meet on August 26 to discuss the reservations expressed by the board’s chairman, Zubyr Soomro, regarding margin financing product. The outcome of this meeting is likely to determine the possible launch date for the product and will play a major role in the market’s direction for the future.

Published in The Express Tribune, August 22nd, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ