Weekly review: Corporate results fail to lift stock market

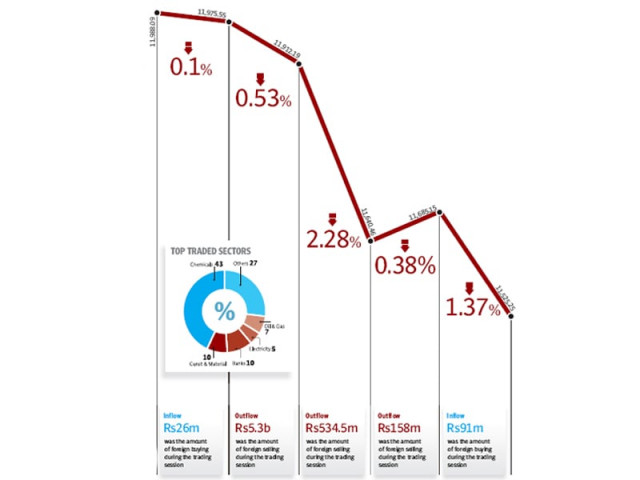

KSE’s benchmark 100-share index sheds 463 points as foreigners continue to sell.

Strong corporate results had little effect on the market as the benchmark KSE-100 index dropped sharply by 3.9 per cent or 463 points during the week.

Concerns about Pakistan’s relationship with the United States and another reduction in fertiliser prices were the primary reasons for the market’s decline. Furthermore, foreigners continued to be net sellers which resulted in panic selling by local investors.

The week saw US Secretary of State Hillary Clinton visit Pakistan during which she pushed the government towards taking action against the Haqqani network, resulting in renewed tensions between the countries.

The fertiliser sector was again at the forefront, after Sui Northern Gas Pipelines Limited cut the supply of gas to fertiliser plants, including Engro’s new Enven plant. As a result, rumours started circulating that Engro will again raise price of urea, which led to heavy buying in the shares of Fauji Fertilizer and Fatima Fertilizer, which are both on the Mari gas network.

However, Engro surprised investors mid-week, with the announcement that it had filed a case in the Sindh High Court against the government and SNGPL, for failing to abide by their agreement of supply of 100 million cubic feet of gas to Enven. The court ordered SNGPL to restore Enven’s supply on an immediate basis.

The announcement triggered rumours of a reduction in the price of urea, which resulted in heavy selling towards the end of the week. Engro Corporation declined 13.7 percent, while Fauji Fertilizer declined 5.4 per cent during the week. Fatima Fertilizer performed the strongest, and gained 5.8 percent following a surge on the last day after the company announced better than expected earnings.

The flow of foreign funds also took centre stage as Xenel Industries of Saudi Arabia offloaded its 12 per cent stake in Hub Power Company which resulted in a one-off outflow of about $60 million on Monday. The massive outflow resulted in broad based selling on Tuesday. Net outflow for the week stood at $67 million.

The week also saw the start of the corporate earnings season, with the Attock Group of companies kicking of proceedings with very strong results. Pakistan Oilfields posted a 55 percent jump in profitability while Attock Refinery also improved its bottom-line by 53 percent. However, the exceptional results failed to drive market interest.

Average daily volumes fell sharply by 31 percent and stood at 86.1 million shares per day. However, average daily value only fell by 12.6 percent, as most of the trading took place in the fertiliser sector. The KSE’s market capitalisation dipped 4 percent to Rs3.08 trillion by the end of the week.

What to expect?

Moving forward, the markets attention will focus on the ongoing earnings season, and stock specific activity can be seen in the coming week. Investors will keep a close eye on the fertiliser sector, as it has again become an attractive buy following the drastic reduction in share price during the current week.

The direction of foreign flows will also continue to affect investor sentiment as the market has been witnessing net outflows for quite a while now, and a change in direction will be more than welcome.

Monday, Oct 17

The stock market ended range-bound on the first trading session of the week as investors seemed to be cautious on the back of mixed triggers. Interest was seen in fertiliser stocks on news that fertiliser plants on Sui Northern Gas Pipelines Limited network will have their gas supply cutoff for an indefinite period.

Tuesday, Oct 18

The stock market fell as investors opted to book profits in key oil and banking stocks. The oil sector’s decline was led by Pakistan Oilfields which dropped 1% to close at Rs362.81 ahead of its result announcement scheduled on Wednesday.

Wednesday, Oct 19

Equities turned up the selling frenzy to such an extent that trading activity reached a 30-week high. Morning trade soon turned negative as news reports of current account deficit widening by 102% in the first quarter of fiscal 2012 along with government borrowing increasing by 20% pushed investors to offload.

Thursday, Oct 20

The stock market rose with the banking sector leading the way. Active buying was witnessed in banking stocks amid rumours of relaxation in forced sale value regulations for commercial banks and development financial institutions.

Friday, Oct 21

The stock market closed at a four-week low on the back of selling by investors and fall in the rates of National Refinery stocks.

Published in The Express Tribune, October 23rd, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ