Floods - a watershed moment for NFC

Provinces fail to show capacity to efficiently utilise enlarged financial space

The National Finance Commission (NFC) Award in Pakistan has consistently been at the centre of debates on fiscal federalism, equity, and governance. Enshrined in Article 160 of the Constitution, the NFC Award was envisioned as a tool for ensuring fair distribution of resources between the federation and provinces, thereby strengthening the federal structure and empowering provincial governments to provide essential services such as health care, education, and infrastructure.

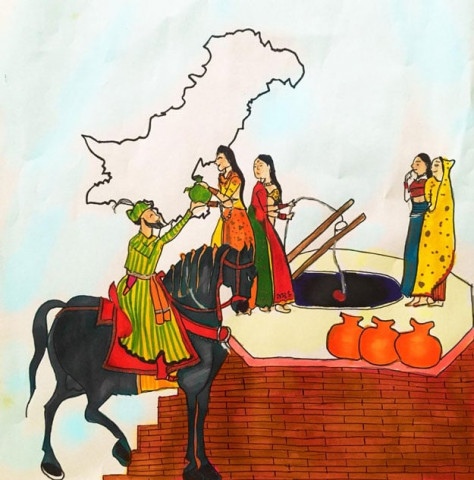

Yet, as Karachiites wade through knee-deep water every monsoon, watching their homes, roads, and businesses drown, they wonder: if so much money flows every year under NFC, why does the country's financial hub look like a disaster zone after every spell of rain?

The most significant transformation in this fiscal arrangement came with the 7th NFC Award in 2010, which dramatically increased the provincial share of divisible pool of taxes from 47.5% to 57.5%. This was coupled with the 18th Amendment, which devolved major responsibilities such as education, health care, and social services to the provinces.

The idea was that by granting provinces a greater share of resources, they would have the financial muscle to provide quality services and reduce regional inequalities. In practice, however, this outcome has not been realised. Provinces have largely failed to demonstrate the institutional and administrative capacity required to efficiently utilise the enlarged financial space.

One of the main criticisms has been the diversion of provincial funds towards politically motivated and short-term projects rather than long-term investments in human development. Reports show that provinces have consistently underspent on development budgets while overspending on current expenditures, particularly bloated wage bills and pensions. This pattern reflects a lack of accountability and vision.

Moreover, instead of strengthening local governments, provincial administrations have centralised decision-making, further weakening service delivery at the grassroots level. As a result, despite increased financial flows, social indicators such as education enrolment, health coverage, and poverty alleviation remain stagnant in many parts of the country.

At the same time, increased transfers to the provinces have left the federal government with shrinking fiscal space. The federation continues to shoulder critical obligations such as debt servicing, defence, large infrastructure projects, and subsidies. With its share of the divisible pool reduced, the federal government has increasingly relied on borrowing, leading to rising debt and macroeconomic instability.

This imbalance between responsibilities and available resources has been one of the unintended consequences of the current NFC framework. Thus, the Award, instead of fostering fiscal harmony, has intensified financial stress at the federal level and created a structural imbalance that undermines Pakistan's economic stability.

Another glaring issue is the lack of provincial initiative to mobilise their own resources. Despite enjoying a larger share of national revenues, provinces have shown little inclination to expand their tax bases. Key areas such as agricultural income tax, property taxation, and sales tax on services remain either underutilised or poorly collected. This dependency on federal transfers creates a "spend without earning" culture, discouraging fiscal discipline and innovation.

Critics argue that genuine fiscal federalism cannot exist unless provinces shoulder the responsibility of revenue generation alongside expenditure. Without this, the NFC Award risks becoming a vehicle for dependency rather than empowerment.

The distribution of resources under the NFC Award is not only a matter of vertical allocation between the centre and provinces but also involves horizontal distribution among the provinces themselves. The current formula, which gives 82% weight to population, has long been criticised for ignoring other equally important factors such as poverty levels, revenue generation capacity, and inverse population density.

While poverty, backwardness, and revenue collection were partially included in the 7th Award, their weight remains minimal. This has perpetuated inequities, as smaller provinces like Balochistan argue that their unique challenges are not adequately addressed.

Moving forward, there is a need to revisit the horizontal distribution formula to ensure that resources are allocated in a manner that reduces disparities rather than widening them. Greater emphasis on poverty, human development indicators, and revenue generation potential would create a more equitable and balanced system.

Reforming the NFC Award does not mean rolling back the principle of decentralisation but strengthening it through accountability and incentives. One approach could be to link part of the provincial transfers with performance indicators.

Provinces that show improvement in health outcomes, education enrolment, poverty reduction, and tax collection could be rewarded with additional funds. Similarly, provinces that fail to utilise development allocations efficiently or show persistent underperformance could face conditionalities in their resource allocation. Such a performance-based system would create pressure on provincial governments to use resources effectively and prioritise public welfare.

At the same time, the federal government must also recalibrate its own expenditure priorities and ensure better coordination with provinces. For example, overlapping responsibilities between federal and provincial departments lead to duplication and wastage of scarce resources. Clear delineation of roles and responsibilities is essential to align expenditure with available fiscal space. Furthermore, empowering local governments within provinces would create an additional layer of accountability, ensuring that resources reach the grassroots level where service delivery actually occurs.

Improving transparency and oversight is another critical aspect of reform. Independent monitoring bodies, public audits, and greater civil society participation in tracking resource utilisation can help reduce leakages and corruption. Currently, the absence of robust accountability mechanisms allows mismanagement to flourish unchecked. A culture of fiscal responsibility needs to be institutionalised at both the federal and provincial levels.

The debate around the NFC Award is not just about numbers and percentages; it is about the future of federalism and economic governance. A balanced approach is needed where both the federation and the provinces have sufficient resources to discharge their responsibilities effectively, while also being held accountable for their performance. The federation cannot remain fiscally strangled, and the provinces cannot be allowed to rely indefinitely on transfers without mobilising their own revenues. Only through a fairer vertical and horizontal distribution formula, linked with incentives for good governance, can the NFC Award fulfill its true purpose.

THE WRITER IS A FINANCIAL MARKET ENTHUSIAST AND IS ASSOCIATED WITH PAKISTAN'S STOCKS, COMMODITIES AND EMERGING TECHNOLOGY.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ