Income tax calculator 2025: How much you can save after budget changes

Monthly savings range from PKR 2,000 and upwards under revised income tax system

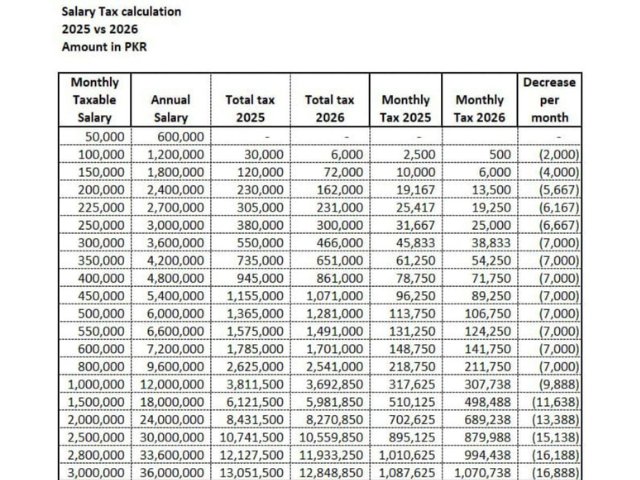

The government of Pakistan has introduced a new income tax structure for 2026, easing the tax burden on salaried individuals. The revised rates provide reductions in monthly and annual taxes across low, middle, and high-income brackets compared to the 2025 regime.

Key Points:

Lowest income bracket (PKR 50,000/month):

- No tax in both 2025 and 2026. No change.

PKR 100,000/month (Annual: PKR 1.2 million):

- Tax in 2025: PKR 30,000 annually

- Tax in 2026: PKR 6,000 annually

- Monthly saving: PKR 2,000

PKR 250,000/month (Annual: PKR 3 million):

- Tax in 2025: PKR 380,000 annually

- Tax in 2026: PKR 300,000 annually

- Monthly saving: PKR 6,667

PKR 500,000/month (Annual: PKR 6 million):

- Tax in 2025: PKR 1,365,000 annually

- Tax in 2026: PKR 1,281,000 annually

- Monthly saving: PKR 7,000

PKR 1 million/month (Annual: PKR 12 million):

- Tax in 2025: PKR 3,911,000 annually

- Tax in 2026: PKR 3,692,850 annually

- Monthly saving: PKR 18,209

Highest income bracket (PKR 3 million/month, Annual: PKR 36 million):

- Tax in 2025: PKR 13,051,500 annually

- Tax in 2026: PKR 12,848,850 annually

- Monthly saving: PKR 16,888

Across-the-board relief:

- Tax savings range from PKR 2,000 to PKR 16,888 per month, depending on income level.

The revised 2026 income tax policy provides uniform relief to salaried taxpayers, reducing financial pressure in the face of persistent inflation. The cuts are expected to boost disposable income and ease the burden on Pakistan’s middle and upper-middle class.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ