Incentives proposed for housing finance

Minister says govt will set up regulatory authority to bridge funding gap

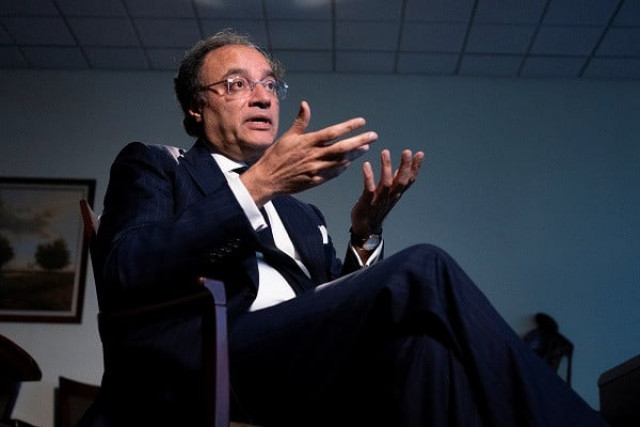

Federal Minister for Finance and Revenue Muhammad Aurangzeb has said that the government will not revert to direct lending to the housing sector and emphasised the importance of providing incentives to facilitate bank-led financing and making it accessible to the public.

"We will not go back to direct lending, which was a wrong thing to do. It creates distortions and has implications for the medium term," the minister said while speaking at the International Affordable, Green & Resilient Housing Conference on Wednesday.

In order to promote housing finance, the government would instead focus on establishing incentive mechanisms, he said. "This approach will encourage banks and microfinance institutions to take the lead in providing housing finance, making it easier for people to get access."

The minister said Pakistan's housing sector was facing two existing problems including population growth and climate change. With population rising at an alarming pace of 2.5%, he pointed out, there were far-reaching consequences, including child stunting, poverty, poor learning outcomes and a significant number of girls being out of school.

Housing plays a critical role in addressing these issues and the government recognises its importance in providing affordable and resilient solutions, he added.

Aurangzeb recalled that the devastating 2022 floods served as a wake-up call, highlighting the need for resilient housing that could withstand the impact of climate change. The Sindh government has taken the first step towards promoting resilient housing by discouraging the construction of homes along water banks.

To address the housing finance gap, the minister said that the government planned to establish a regulatory authority, which would foster access to funding. Furthermore, it aims to introduce foreclosure laws to encourage banks to lend money to the housing sector.

Talking about the state of economy, Aurangzeb said Pakistan had achieved notable milestones in its journey towards sustainable and inclusive growth, with housing emerging as a critical pillar.

Over the past 14 months, the country has witnessed progress across various industries, marked by a reversal of fiscal and current account deficits.

Key indicators of Pakistan's economic health are also showing promising signs as its foreign exchange reserves have increased to 2.5 months of import cover, up from just two weeks previously.

If this trend continues, Pakistan is expected to achieve three months of import cover by the end of current fiscal year, a benchmark considered satisfactory by international standards.

Inflation has been brought under control as it dropped to a 78-month low of 4.9% in November. The State Bank's policy rate is expected to be slashed further while the Karachi Inter-Bank Offered Rate (Kibor) has already gone down.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ