1729732218-0/image-(1)1729732218-0.jpg)

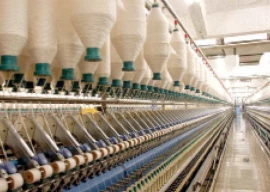

The Special Investment Facilitation Council (SIFC) has directed the Petroleum Division to address the key challenges that hamper work on multibillion-dollar plant upgrading projects of oil refineries.

In that regard, the first issue was the grant of oil import permission to a certain company despite available stocks in the country, which landed in the SIFC. It directed the Oil and Gas Regulatory Authority (Ogra) chairman to ensure that first priority was given to lifting products from local refineries.

Earlier, Ogra allowed an oil company the import of petroleum products, prompting a sharp reaction from refineries. Even, the Oil Companies Advisory Council (OCAC), which represents refineries and oil marketing companies (OMCs), took up the matter with Ogra and the federal government, arguing that a company was importing diesel, though the country had over 40 days of stocks – the highest in history.

Sources revealed that the SIFC held a meeting on refineries' request on Tuesday, chaired by Special Assistant to the PM and SIFC Apex Committee Chairman Dr Jehanzeb Khan, who had earlier been deputy chairman of the Planning Commission.

The meeting was also attended by Ogra chairman, additional secretary of the Petroleum Division and chief tax policy of the Federal Board of Revenue. Refineries were led by Adil Khattak, OCAC Chairman and CEO of Attock Refinery Limited. All other refineries were also represented by their chief executive officers.

During the meeting, four key decisions were taken on issues highlighted by the oil refineries. The SIFC directed the Petroleum Division to resolve the sales tax matter positively by November 12, 2024.

The government had announced some measures in the federal budget for fiscal year 2024-25 regarding exemption from sales tax on petroleum products.

All refineries drew attention of the government to a significant amendment to the Sales Tax Act 1990, proposed through the Finance Bill 2024, to exempt motor spirit (petrol), high-speed diesel, kerosene oil and light diesel oil from sales tax.

These products were previously zero-rated but the new measure effectively restrained refineries from claiming approximately 70% of the input sales tax paid on taxable purchases and services.

Refineries were of the view that the measure would impact their investment plans for upgrading oil processing plants.

Oil smuggling

The other challenge facing the oil industry was increasing oil smuggling from Iran. The wide availability of smuggled products, particularly in border and adjoining areas, poses a serious threat to sales of local refineries and OMCs.

The oil industry has repeatedly taken up the problem of unchecked smuggling with Ogra and the federal government, demanding steps to curb the flood of illegal supplies.

The SIFC directed the Petroleum Division, Ogra and provincial governments to take effective measures, with support from the industry, against the smuggling of petroleum products and to ensure better product quality.

It urged Ogra chairman to ensure and certify that first priority was given to the purchase of local refineries' products and in case of import of deficit products, priority was accorded to Pakistan State Oil (PSO), followed by other OMCs.

The SIFC emphasised that import of only deficit products should be allowed in consultation with the oil industry.

Keeping in view the deadline of October 22, 2024 for signing plant upgrade agreements, the SIFC chairman asked the Petroleum Division to prepare a summary for extension in the time frame, noting that delay in implementation of the Brownfield Refinery Policy had already caused a loss of billions of dollars to the national exchequer.

Earlier, the Cabinet Committee on Energy extended the deadline for inking agreements between Ogra and refineries for six months as two refineries – Pak Arab Refinery Limited (Parco) and Byco – sought more time. According to sources, these refineries are now ready to sign deals.

Parco has planned a long-term investment of over $1 billion for setting up a hydrocracker unit to convert furnace oil into petrol and diesel, which will ensure energy security in the country.

Parco requires a capital injection of $500 million for upgrading its plant, but investors want to make long-term investment rather than providing funds for producing only Euro-5 petroleum products.

All refineries had objections over three issues including sales tax exemption, oil smuggling and import permission despite available stocks in the country.

Sources said that refineries also wrote a letter to the SIFC for removing hurdles standing in the way of pressing ahead with plant upgrade plans.

1721122052-0/stranger-things-(1)1721122052-0-165x106.webp)

1730892765-0/Express-Tribune--(11)1730892765-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ