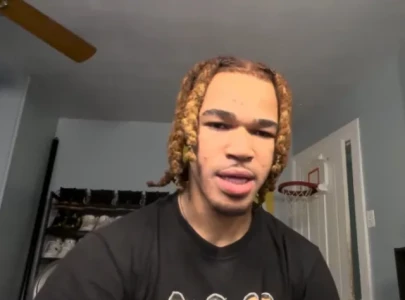

Federation of Pakistan Chambers of Commerce and Industry (FPCCI) President Atif Ikram Sheikh has made it clear that the business community opposes any heavy-handed approach to increasing tax collection.

Sheikh lamented that the FPCCI has repeatedly insisted that the only effective way to enhance tax revenue is through a meaningful consultative process with key stakeholders. He reiterated FPCCI's stance that the Federal Board of Revenue's (FBR) revised tax collection target of Rs12.91 trillion for the fiscal year 2024-25 is not only unrealistic but also regressive and anti-business. He explained that in the current economic environment, with limited opportunities for business expansion, the FBR's shortfall in tax collection will continue to worsen. The shortfall for JulyAugust 2025 is already Rs99 billion, and the deficit for September 2024 is expected to be between Rs100150 billion, he added. He further elaborated that the Ministry of Finance and the FBR need to investigate the root causes of the missed tax collection targets.

1729080111-0/BeFunky-collage-(63)1729080111-0-165x106.webp)

1730838202-0/Trump-(1)1730838202-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ