Textile millers come up with charter of demands

Urge govt to take policy rate into single digit, remove unreasonable taxes

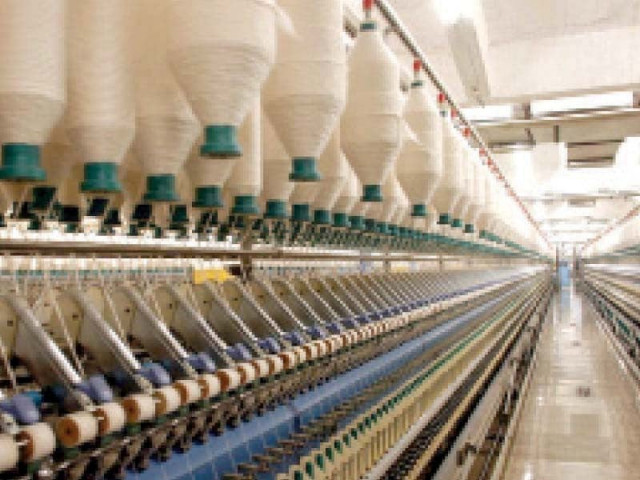

Leaders of the All Pakistan Textile Mills Association (Aptma) Central and Southern Zone have presented a charter of demands to run the industry in a seamless manner and without any disruption.

Talking to media persons at a press conference on Thursday, they emphasised the importance of the textile sector, saying it was the backbone of the national economy and was contributing around 55% to the overall export earnings.

Aptma Central Vice Chairman Naveed Ahmed urged the government to reduce interest rate to 6-7% from 19.5%, supply electricity at 8-9 cents per kilowatt-hour (kWh) instead of 14 cents and remove all unreasonable taxes on imports, exports and earnings to enable the industry to run its manufacturing units properly.

Aptma Chairman Southern Zone Zahid Mazhar and other leaders pointed out that the export-oriented textile industries of Sindh and Balochistan were confronting severe problems in the wake of inconsistent supply of both gas and electricity.

They called the expensive energy unacceptable and disastrous as it was causing the closure of industrial units.

Capacity payments to the independent power producers (IPPs) are the main factor behind the high industrial electricity tariff, though most of the IPPs are underutilised and running below 30% of production capacity.

The total installed electricity production capacity in Pakistan is 43,400 megawatts. However, the distribution capacity is only 22,000MW, out of which 13,000MW is used, according to the millers.

Fuel cost is Rs10 per unit and capacity payment is Rs24/unit. The high capacity payments to the IPPs have jeopardised the entire economy, therefore the government must review and revoke the unnecessary contracts and also carry out forensic audits of the IPPs, which have received Rs1.95 trillion in capacity payments, the millers said.

Commenting on the issues affecting growth and viability of the textile industry, they said that due to the inadequate supply of electricity, the industry was compelled to install gas-based power generating units for consistent and stable supply of electricity, but the government was making it difficult for them to run the power plants on gas and was forcing them to shift to grid electricity.

They decried that the measures taken in budget were anti-industry and anti-exports, which would trigger a wave of de-industrialisation.

They termed the high tax collection target a burden on the existing taxpayers, adding that the increase in tax rates from 1% (final tax) to 29% on profits and 2% advance tax on export proceeds were the major discouraging factors. Furthermore, the incidence of tax on the salaried class in Pakistan is three times higher than in India.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ