Remittances surge by 13% to $2.38b in Dec 2023

Stability in rupee-dollar parity, crackdown on illegal networks boost numbers

The inflows of workers’ remittances sent home by overseas Pakistanis increased by 13% to $2.38 billion in December 2023, as they dispatched the funds through official channels following the return of stability in the rupee-dollar parity and the crackdown against illegal currency networks.

The improvement in remittances fuelled the ongoing gradual rally in the rupee against the US dollar on Wednesday, strengthening the market view that the balance of the current account would record a surplus for the second consecutive month of December 2023.

The State Bank of Pakistan (SBP) reported that remittances rose by 13% compared to $2.10 billion in the same month of December of the previous year.

Inflows improved by 5.5% in the month compared to $2.26 billion in the prior month of November 2023.

However, workers’ remittances have cumulatively slowed down by 7% in the first half (Jul-Dec) of the current fiscal year 2023-24, amounting to $13.45 billion compared to $14.42 billion in the same period of the previous year, according to the central bank.

Topline Securities, CEO, Muhammad Sohail mentioned that the latest monthly inflows of $2.38 billion are higher than the full-year 2023 average of $2.20 billion a month.

Market talk suggests that the receipts have increased due to the crackdown against foreign currency smugglers, such as hawala-hundi operators and hoarders, since September 2023.

The cleanup operation crushed illicit currency markets, especially in the bordering areas with Afghanistan, and strengthened the hold of official operating networks like commercial banks and authorised exchange companies.

The crackdown not only helped arrest the then freefall in the domestic currency but also assisted it in bouncing back by over 9%, or around Rs26 in the past four months, closing at a 10-week high at Rs281.13 against the US dollar on Wednesday. Earlier, it had hit an all-time low at Rs307.10/$ in the first week of September 2023.

The inflows of workers’ remittances play a pivotal role in the economy, significantly helping finance the twin trade and current account deficits.

The total inflows in the first half of FY24 have, however, slipped by 7% due to high volatility in the currency between July-September 2023, in the wake of the then political and economic instability, according to market talks.

Speaking to The Express Tribune, Maaz Azam, Research Analyst at Optimus Capital Management, projected that the inflows would remain better in the second half of the ongoing fiscal year amid stability in the rupee-dollar exchange rate.

He estimated the average inflows at $2.4 billion a month during January-June 2024, including likely spikes above the average in the months around Ramadan and Eid festivals falling in the second half of FY24.

Read Remittances increase to $2.38 billion in December 2023

He foresaw FY24 full-year workers’ remittances inflows at $28.6 billion, slightly higher compared to the receipts at $27.3 billion recorded in FY23.

He noted that risk factors, which if occur, would disrupt the improved inflows, including the return of political and economic instability after the new political government is formed post the February 2024 general elections and a delay in the acquisition of another IMF programme after the current one of $3 billion completes in March 2024.

“The political instability and delays in the IMF new programme, if they take place, may allow illicit players to re-establish illegal currency markets and mount pressure on the rupee.”

On the flip side, a better-than-estimated increase in economic activities would prompt non-resident Pakistanis to send higher remittances, including for investment purposes. “The inflows would surge along with economic activities.”

He believed that overseas Pakistanis slowed down the dispatch of remittances for investment purposes amid the economic slowdown in the first half of FY24.

Region-wise inflows:

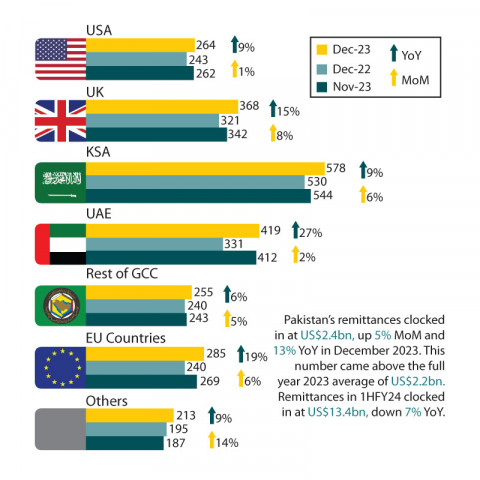

The central bank reported that remittance inflows during December 2023 were mainly sourced from Saudi Arabia at $578 million, increasing by 9% from $530 million received in the same month of the previous year.

Non-resident Pakistanis dispatched $419 million from the United Arab Emirates in the month, which was 27% higher compared to $331 million in the same month of the previous year.

Expatriates sent 15% higher remittances at $368 million from the United Kingdom compared to $321 million.

They dispatched 9% higher remittances at $264 million from the United States of America compared to $243 million.

Inflows from other GCC countries improved 6% to $255 million in the month compared to $240 million.

Pakistanis from European Union countries sent $285 million remittances, which were 19% higher compared to $240 million.

Workers’ remittances surged by 9% to $213 million from other countries around the world in December 2023 compared to $195 million in December 2022.

Published in The Express Tribune, January 11th, 2024.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ