PSX gains as GSP+ status is extended

Deliberations for privatisation of loss-making SOEs lifted market’s sentiment

The Pakistan Stock Exchange (PSX) remained bullish in the outgoing week, thanks to a range of positive developments such as the rupee’s comprehensive strengthening and the potential easing of inflation.

Deliberations among government circles for the privatisation of loss-making state-owned enterprises (SOEs) also lifted the market’s sentiment.

In addition, news reports stating that the European Parliament had extended Pakistan’s GSP Plus status for four years and the decline in government’s bond yields also aided the KSE-100 index’s advance.

Investors also weighed the next State Bank’s monetary policy, with the rupee standing at 282.69/$ at the end of the eventful week on Friday, and falling government bond yields also vitalised investors’ enthusiasm, leading to bullish activity in the market.

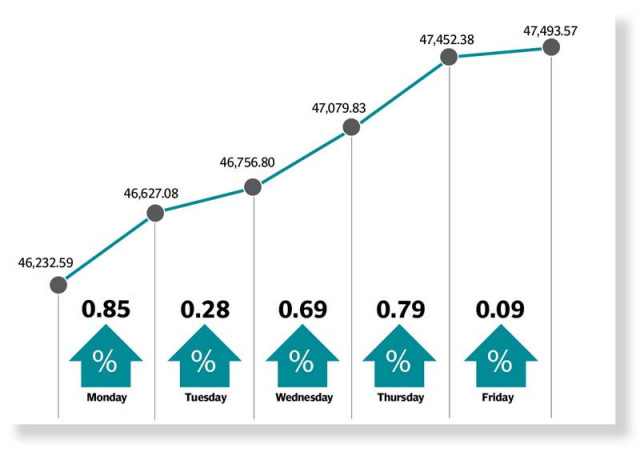

As a result, the benchmark KSE-100 index closed at 47,493.57, with an increase of 41.19 points, or 2.7% week-on-week (WoW).

The bourse started the week on Monday with an impressive bullish rally, driven mainly by a positive economic outlook ahead of the International Monetary Fund (IMF) review meetings before the release of the next loan tranche. The next day, the index maintained its upward march and advanced gradually towards the 47,000 mark, following upbeat data that showed a 48% fall in the trade deficit for September.

On Wednesday, the benchmark KSE-100 index continued its upward trajectory as it breached the crucial 47,000 barrier on a number of positive triggers, which helped maintain the positive momentum.

On the following day, stocks maintained their bullish trend and surged by 0.09% as investors were optimistic ahead of major corporate earnings announcements due next week.

On the last day of the trading week, the PSX rose by around 41.19 points, closing the week with a spectacular performance through five consecutive days.

JS Global analyst Muhammad Waqas Ghani, in his market review, wrote that the KSE-100 index was up by 2.7% WoW this week, closing at 47,493, reporting a positive closing for five consecutive days. Volumes picked up by 44% WoW to 291 million shares.

Foreign investors remained net sellers throughout the week, offloading $12 million worth of equities. Investor sentiment remained positive over declining international oil prices and appreciating PKR against the US dollar, he added.

He highlighted that the government reduced domestic petrol prices by Rs8/litre and Rs11/litre for diesel for the current fortnight in the wake of a drop in international prices, which also added to the stock’s momentum.

Topline Securities, in its weekly commentary, wrote that the KSE 100 Index gained 2.73% on a WoW basis. It attributed the positivity of the market to the decline in international crude oil prices, appreciation of PKR against the US dollar on the back of ongoing action against speculation/hoarding, and Ministry of Finance instruction to ministries to implement all the commitments made with the IMF as the first review under the SBA becomes due.

Topline cited that major developments during the week were September CPI Inflation clocking in at 31.4% YoY, compared to 27.4% in August 2023. Trade deficit for Sep-2023 declined by 31% MoM and 48% YoY to $1.5 billion, which is the lowest level since April-2023. T-Bill auctions in which the government raised Rs.557 billion, where yields declined by 29 basis points and 5 basis points on 3 months and 12 months, respectively.

Average traded volume and value during the outgoing week stood at 290 million shares and Rs.7.39 billion, respectively.

Arif Habib Limited stated in its weekly review that the market commenced on a positive note this week, fuelled by the contraction of the trade deficit by 42% YoY to $5.3 billion in 1QFY24. Moreover, the expectation of robust results for 1QFY24 kept the market participants vested.

The urea and DAP sales witnessed a jump of 11% and 68% YoY, respectively in Sep’23. Furthermore, cement dispatches in 1QFY24 reported a 23% YoY increase.

Moreover, cut-off yields of 3-M T. Bills and 3-Y PIB witnessed a decline of 29 bps and 15 bps, respectively, in the auction held this week. Though inflation climbed up to 31.4% in September 2023, the ongoing decline in international oil prices and consistent appreciation of PKR against the US dollar has eased some investor concerns regarding inflation, as both will provide a much-needed cushion, it added.

The market closed at 47,494 points, gaining 1,261 points, or 2.7% WoW. Sector-wise positive contributions came from Commercial Banks (413 points), Fertiliser (281 points), Cement (176 points), Power (81 points), and Technology (77 points).

On the flip side, sectors that recorded losses include Exploration and Production (48 points), and Miscellaneous (14 points). Average volumes arrived at 291 million shares (up by 44% WoW) while the average value traded settled at $26 million (up by 15% WoW).

Published in The Express Tribune, October 8th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ