PSX falls slightly as rate hike talk weighs

Benchmark KSE-100 index loses 260 points, or 0.6%, closes at 45,753.52

Pakistan Stock Exchange (PSX) fell slightly in the outgoing week over persistent anxiety over a potential hike of 150-200 basis points in policy rate and unimpressive developments on the economic front.

However, in a highly positive development, Pakistani rupee’s rapid recovery continued against the dollar, which gave a boost to the market’s mood and encouraged investors to buy attractive stocks in the hope of getting handsome returns.

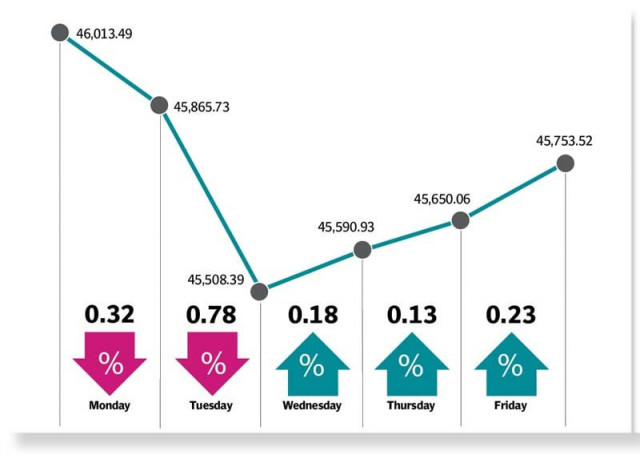

The benchmark KSE-100 index closed the week at 45,753.52, losing 260 points, or 0.6% week-on-week (WoW).

At the beginning of the week, the index dropped nearly 150 points on a potential policy rate hike as it lost the previous week’s momentum over hopes of Saudi crown prince’s visit to Pakistan to discuss $25 billion in investment from Gulf countries under the Special Investment Facilitation Council (SIFC) initiatives.

The index extended losses on Tuesday as it fell by another 357 points despite the government’s crackdown on currency smugglers because the upcoming monetary policy announcement weighed on investors’ mind.

The very next day, the market rebounded in the wake of a significant appreciation of the rupee in the open market. The index rose 83 points. On Thursday, the bourse gained 59 points as the central bank cleared the fog by keeping the policy rate unchanged at 22%. Following this, the market ended the week on a bullish note, gaining 103 points at 45,753.52.

JS Global analyst Muhammad Waqas Ghani wrote in his market review that the KSE-100 index started the week on a dull note as investors chose to divest their holdings due to apprehensions surrounding the key policy rate decision.

During the week, Pakistani rupee continued to gain ground and closed at Rs299.8 vs dollar in the open market, rising 1.7% WoW. On the news front, remittances came in at $2.1 billion for August 2023 (+3% month-on-month, -24% year-on-year), taking 2MFY24 total to $4.1 billion (-22% YoY).

A widening spread between the inter-bank and open market PKR/$ rates, especially in late August 2023, may have contributed to the decline in remittances, the analyst said.

Contrary to market expectations, the State Bank kept its policy rate unchanged at 22% in the monetary policy committee (MPC) meeting held on Thursday. The decision came mainly on expectations of a decline in inflation in the coming months.

Furthermore, forex reserves dipped by $140 million to $7.6 billion on account of debt repayments, the JS analyst added.

Arif Habib Limited (AHL), in its report, commented that the bourse experienced mixed trends during the week under review amid various developments on the economic front.

There was consensus on a potential increase in policy rate, which dampened market sentiment. However, the MPC kept the policy rate unchanged at 22%.

Additionally, Pakistan’s current account deficit shrank by 79% YoY in August 2023, amounting to $160 million, as compared to $774 million in the same period of last year.

Also, in 2MFY24, the inflow of foreign direct investment rose to $234 million against $201 million last year. Pakistani rupee closed at Rs296.85 against the US dollar in inter-bank dealings, gaining Rs6.1, or 2.05% WoW.

Sector-wise, negative contribution came from commercial banks (225 points), fertiliser (100 points), oil and gas exploration companies (65 points), food and personal care products (42 points) and technology and communication (41 points).

Foreigners turned sellers during the week as they sold stocks worth $9.7 million compared to net buying of $0.6 million last week, AHL added.

Published in The Express Tribune, September 17th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ