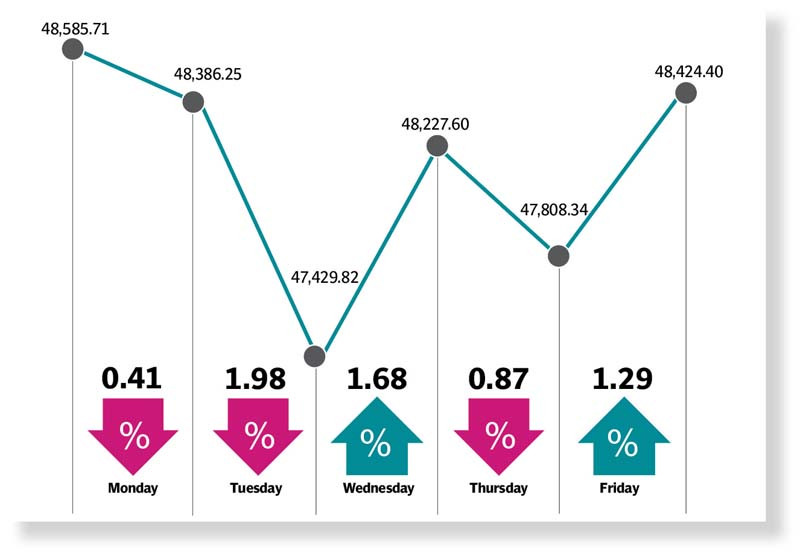

The Pakistan Stock Exchange (PSX) had a turbulent trading week, with the benchmark KSE-100 index swinging on both sides of the fence due to a combination of buying enthusiasm and selling pressure, driven by several developments on political and economic fronts.

The bourse opened the week on a negative note with the first two sessions closing in the red.

The KSE-100 declined on Monday ahead of the much-awaited approval of a new refinery policy and as investors weighed mounting concerns over a potential delay in Pakistan’s general elections.

Bears tightened their stranglehold on Tuesday as the PSX plunged over 950 points over political uncertainty ahead of transition of power to a caretaker setup and rupee depreciation against the US dollar, which shattered investor spirits and triggered profit-taking. Furthermore, uncertainty about the release of Rs415 billion for settling the gas sector circular debt kept the market under pressure.

Bulls staged a comeback on Wednesday when investors cheered the recovery of Pakistani rupee against the US dollar and a favourable trade data, which boosted the positive sentiment and offset the previous day’s losses. Investor sentiment flipped again on Thursday in the absence of positive triggers and the prevailing political and economic instability in the country, fuelling bearish trading. Delay in approval of the circular debt management plan by the International Monetary Fund (IMF) kept investors on sidelines.

In a major turnaround on the last day of trading week, the index recovered over 600 points following a highly positive MSCI’s quarterly review of the Frontier Market Index where scores of Pakistani companies were added. By the end of the outgoing week, the KSE-100 index shed 161 points, or 0.3%, compared to the previous week, settling at 48,424.

According to JS Global analyst Muhammad Waqas Ghani, the week started on a dull note but investor optimism grew as it progressed.

On the news front, the potential postponement of elections added to investor worries. During the week, the prime minister took steps to hand over power to an interim government. However, discussions on the caretaker premier could not result in a consensus on any candidate.

On the other hand, in a noteworthy development, the IMF hinted at considering collaboration with the caretaker administration in order to conclude the ongoing standby arrangement. In other news, according to the State Bank, total borrowing of the banking sector came in around Rs10 trillion (+36% year-on-year). It constituted 25% of the sector’s assets being financed through borrowing, which was 20% a year ago and 15% two years ago.

Meanwhile, the Cabinet Committee on Energy finally approved a policy for upgrading the local refineries and producing cleaner fuels. Furthermore, the government revisited the debt solution for the gas sector with plans to release Rs414 billion, which was lower than the previous Rs543 billion, the JS analyst added.

Arif Habib Limited, in its report, said that the bourse experienced a mixed trend during the outgoing week.

The expected resolution of gas sector circular debt problem through the injection of state-owned enterprises’ dividends and approval of the new refinery policy kept sentiment positive in the market. Moreover, there was an upward revision in Pakistan’s weight in the MSCI Frontier Market Index, which went up from 0.6% to 2.7%.

Furthermore, Pakistani rupee depreciated against the US dollar during the week, closing at Rs288.49 with a loss of Rs1.53, or 0.5% week-on-week. Foreigners were once again net buyers at the PSX, who bought shares worth $2.9 million as compared to net buying of $5.3 million last week.

In terms of sectors, positive contribution came from fertiliser (264 points) and banks (153 points). Negative contribution came from technology (157 points), exploration and production (116 points), oil marketing companies (87 points), refineries (73 points) and chemical (56 points).

Published in The Express Tribune, August 13th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1722237119-0/unepmployment-(1)1722237119-0-270x192.webp)

1722236723-0/sukuk445-(1)1722236723-0-270x192.webp)

1722244248-0/tlprrt-(1)1722244248-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ